Exclusive: Missouri Attorney General Investigates Morningstar Over ESG Ratings

Missouri Attorney General Eric Schmitt has launched an investigation into whether Morningstar Inc violated a state consumer-protection law through its evaluations of environmental, social and governance (ESG) issues, his office told Reuters.

In West Virginia, Banks Cite Green Criticism As Red State Credential

Looking to keep doing business in West Virginia amid a review of energy lending policies, several top U.S.

Shareholder ESG Support Down But Not Out, Researchers Say

Average support for shareholder resolutions on environmental, social and governance (ESG) topics at U.S.

Green Investors To Step Up Pressure On U.S. Utilities After Court Ruling

Activist investment leaders who have urged U.S. companies to cut carbon emissions said on Friday they expect more such efforts following a milestone U.S.

U.S. Sustainable Funds Mark Rare Outflow In May

Investors in May pulled $3.5 billion from U.S. mutual funds using environmental, social and governance (ESG) factors, researcher Morningstar Inc said on Thursday, a break with years of net new deposits.

Engine No. 1 Rushes To Back ESG Disclosures At Top Companies

Sustainability-focused hedge fund Engine No. 1 has backed 83% of shareholder resolutions on environmental, social and governance (ESG) topics at top U.S.

Investors Call For Human Rights Report At Gunmaker Sturm Ruger

A majority of shareholders of gunmaker Sturm Ruger & Co voted in favor of a shareholder resolution calling for a human rights impact report, executives said on Wednesday.

Tesla Investor Streur Says Carmaker Still Believes In ESG

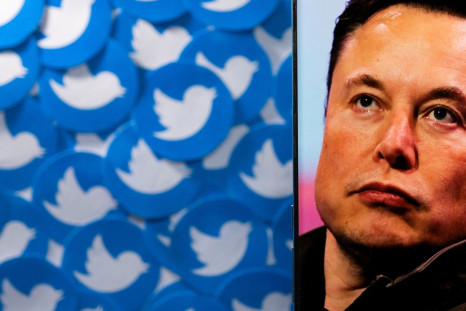

Tesla Inc CEO Elon Musk may have denounced business use of environmental, social and governance (ESG) factors as a "scam" last week but one sustainable investing pioneer thinks the electric carmaker still believes in the cause.

Citing Shootings, NY Fund Urges Votes Against Twitter And Meta Directors

New York State Comptroller Thomas DiNapoli is calling for votes against directors at Twitter Inc and at Facebook parent Meta Platforms Inc at their upcoming annual meetings, saying both companies failed to enforce their standards against harmful content including from a mass shooting in Buffalo, N.Y.

BlackRock, JPMorgan, Others Tell Texas They Don't Boycott Energy Companies

BlackRock Inc, JPMorgan Chase & Co and other top financial firms have told a Texas official they are not boycotting energy companies, responding to a request for information that could determine if they are able to continue to manage state funds.

Tesla Removed From S&P 500 ESG Index, Prompting Musk Pushback

S&P Dow Jones Indices has removed electric carmaker Tesla Inc from its widely-followed S&P 500 ESG Index, citing issues including racial discrimination claims and crashes linked to its autopilot vehicles, a move that prompted critical tweets from Tesla CEO Elon Musk on Wednesday.

Top Wall Street Firms, Ford To Disclose Directors' Race And Gender

Four top Wall Street firms and Ford Motor Co will start to disclose the race and gender of individual directors under deals reached with New York City pension officials, the city's comptroller, Brad Lander, said on Thursday, while a utility company has pushed back on the idea.

BlackRock Says It Has More Than $800 Million For New Impact Fund

Top asset manager BlackRock Inc said on Wednesday it has more than $800 million in commitments for a new impact fund, part of a growing investor focus on diversity and equity themes.

U.S. Poll Finds Bipartisan Concern Over High CEO Pay

Bipartisan majorities of U.S. adults think CEO pay is too high, a new poll found, presenting a challenge for corporate boards looking to balance compensation for leaders and workers.

Reformer Pitches Musk Trendy "public Benefit" Structure For Twitter

A prominent corporate reformer is pitching a trendy idea to Elon Musk as he takes control of Twitter Inc: turn the social-media platform into a "public benefit corporation" to work for the benefit of all stakeholders, not just investors.

U.S. Regulator Asks Companies About Exposure To Russia's Invasion

The top U.S. securities regulator on Tuesday told companies they may have to disclose the impact Russia's invasion of Ukraine could have on their business, such as on operations or employee bases in either country, or if their assets were nationalized.

WHO Says Pandemic Justifies Leader's Pitch At Moderna Meeting

The head of the World Health Organization will present a shareholder resolution at the annual meeting of Moderna Inc on Thursday, a rare step into investor advocacy by the United Nations agency.

WHO-backed Vaccine Resolution Wins 24% Support At Moderna

A shareholder proposal calling on Moderna Inc to study transferring production of COVID-19 vaccines to less-developed countries won 24% support from investors on Thursday after it received a rare endorsement from the World Health Organization.

NYC Pension Leaders To Urge Fossil Fuel Lending Curbs, Late Boost For Activists

New York City pension leaders said the $262 billion system will mostly favor calls for sharp limits on fossil fuel lending at top banks this week, giving a late boost to activists who have gained little backing from proxy advisers.

U.S. CEO Pay Soars 31% On Stock And Cash Awards, Study Finds

Median pay for top U.S. CEOs rose 31% last year to a record $20 million, a new study found, surging after a slight decline during the COVID-19 pandemic, as companies showered leaders with stock awards and cash bonuses.

ISS Says Wells Fargo Pay Reforms Insufficient To Justify Support

Top proxy adviser Institutional Shareholder Services on Tuesday recommended investors cast proxy votes against the pay of Wells Fargo & Co Chief Executive Charles Scharf and other leaders, citing concerns about the discretion used to award the pay and lack of disclosures.

New York Pension Leaders Back Calls For Less Fossil Fuel Financing

New York pension officials on Monday said they will support shareholder resolutions filed at major banks seeking quick cuts to financing of new fossil fuel development, pushing climate issues to the fore of another springtime shareholder meeting season.

Fidelity Investments Longtime Leader Edward C 'Ned' Johnson 3d Dies At 91

Edward C. "Ned" Johnson 3d, an American billionaire investor and philanthropist who as chairman of Fidelity Investments propelled the family business to a dominant place in finance for decades, died on Wednesday at age 91, the company said.

Fidelity's Edward C 'Ned' Johnson 3d, Who Built Fund Giant, Dies At 91

Edward C. "Ned" Johnson 3d, an American billionaire investor and philanthropist who as chairman of Fidelity Investments propelled the family business to a dominant place in finance for decades, died on Wednesday at age 91, the company said.

Exclusive-Goldman Sachs Pushes Directors For More Climate Data

Goldman Sachs' big asset-management arm will take a harder line in voting on directors at companies that do not disclose enough about their greenhouse gas emissions, an executive said on Thursday, adding to the pressure on business leaders to provide more climate-impact data.

Investors Say U.S. SEC Climate Disclosure Rule To Clarify 'Mixed Bag' Of Data

Investors, including several who run environmentally focused funds, welcomed the U.S.

U.S. ESG Shareholder Resolutions Up 22% To Record Level For 2022, Study Finds

U.S. corporations face an unprecedented wave of shareholder resolutions focused on ESG themes for 2022, a new review shows, as activists look to build on favorable regulatory changes and more executives seem willing to make deals.

Texas Official Quizzes Financial Companies On Fossil Fuel Investments

Texas Comptroller Glenn Hegar has questioned 19 financial companies to clarify their investment policies on fossil fuels, his office said on Wednesday, showing the breadth of a review that could see firms losing state pension mandates.

BlackRock Russia Exposure Down $17 Billion Since February, Company Data Shows

BlackRock Inc's total client exposure to Russia has declined to less than $1 billion from $18 billion a month ago, before Moscow's invasion of Ukraine led to Western sanctions and the closure of the Russian stock market, according to figures supplied by the asset manager on Friday.

Mutual Fund Manager Vanguard Works To Further Cut Russia Exposure

Vanguard Group on Monday said it has moved swiftly to implement international sanctions imposed against Russian banks, entities and individuals in the wake of Moscow's invasion of Ukraine, and is working to further reduce its exposure to Russia and exit positions across its index funds.