Restaurant Recession Looms With Coming Wave Of Minimum Wage Hikes

As if the restaurant industry doesn't already face enough headwinds, come January 1 it will face a tsunami of hikes to minimum wage rates. Some 24 states and the District of Columbia will increase the base rate in 2020, just as restaurants will likely be entering a recession.

The industry is already slowing to a near crawl, and though comparable-store sales rose over the last two months, it's all been based on higher prices and a better product mix; guest traffic is still falling. The profit picture for many chains may turn very ugly soon.

Pricing workers out of the market

While the Fight for $15 movement to double the federal minimum wage to $15 per hour has not been successful in Congress, despite the House of Representatives passing the Raise the Wage Act this past summer, activists have had better luck at the state and local levels.

This comes after a number of restaurant chains, like McDonald's (NYSE:MCD) and Shake Shack (NYSE:SHAK), previously raised their minimum starting pay on their own in the New Year.

The affected states won't necessarily be hitting $15 per hour this year (though D.C. will), and a number simply keep pace with inflation, but in many states they are rising toward that level. New York City already imposed a $15-per-hour wage law last December.

Rising wage pressure

Only five states have no state-level minimum wage law -- Alabama, Louisiana, Mississippi, South Carolina, and Tennessee. That means the federal minimum rate, $7.25 per hour, prevails. Another seven states peg increases to the Consumer Price Index or to the rate of inflation. It's the other 17 states and D.C. that have laws in place that increase wages above the federal minimum or inflation.

Some of the increases are nominal. Alaska, for example, will be increasing the base rate from $9.89 per hour to $10.19 per hour, but that's due to inflation. Michigan is going from $9.45 to $9.65 per hour. Other increases are more substantial, rising by $1 or more per hour.

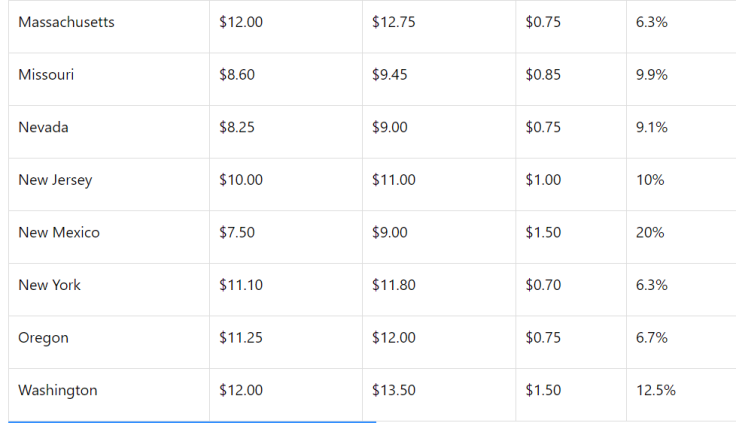

Below are the minimum wage rates for the coming year for each of the relevant 17 states and D.C., and just how substantial the hikes are.

Most state increases are averaging around 9%, though there are a few outliers, like New Mexico, which is hiking wages by 20% this year, followed by another 17% in 2021 and 9% the year after.

New Jersey's 10% wage hike seems in line with other states, except it started 2018 at $8.85 per hour, hiked it 13% on July 1 to the current $10 wage, and is hiking it again on January 1, so employers are experiencing a 24% increase within 12 months. It will then continue increasing the minimum wage by $1 per year until it hits $15 per hour at the start of 2024.

Restaurant industry recession on the horizon

The problem, of course, is that these laws imposing ever-higher wages are a burden for restaurants as business slows.

Black Box Intelligence data from TDn2K shows same-store sales grew just 0.1% in October, but restaurant traffic was down over 3% and has averaged a decline of 3.2% for seven consecutive months.

There are some other factors besides wages affecting these results, such as more carryout orders and the growth of third-party delivery apps. Yum! Brands' (NYSE:YUM) Pizza Hut chain, for example, is in the midst of a vast conversion of its operations from sitdown restaurants to a carryout/delivery model.

Restaurants are also introducing more technology to do jobs workers used to do, such as the robots McDonald's is testing to dunk fries and chicken nuggets in oil for cooking, and the self-ordering kiosks it and Wendy's (NASDAQ:WEN) have introduced.

Ripple effect growing

The inexorable rise in base pay is also contributing to high turnover rates in restaurant management. Although they're often able to pay waitstaff lower rates if they accept tips, as those wages rise, they push the the rates of the positions above them higher, too. Or if they don't, employees tend to leave, which the TDn2K data reflects: manager turnover is growing as pay has stagnated.

Restaurants have limited options. Raise prices, cut hours, cut jobs, or all three, assuming they don't just close their doors. That's what's occurring in New York City after the $15 rate was imposed. The New York City Hospitality Alliance found over three-quarters of survey respondents cut staff hours and 36% eliminated jobs.

A chain of 35 upscale restaurants in Seattle ended up declaring bankruptcy, citing in its filing higher wage rates in the Pacific Northwest, such as Seattle's $16-per-hour law.

Pay to play

The tight labor market was already pushing wage rates higher, but by artificially boosting them further beyond what the market can bear, at a time when restaurants are currently suffering a significant slowdown that's poised to turn into a recession, the rising tide of states raising their minimum wages could push the industry over the edge.

This article originally appeared in the Motley Fool.

Rich Duprey has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.