RIM Layoffs Not Long-Term Solution

Analysis: Research in Motion is Cutting Jobs, But Company Needs Innovation

Blackberry maker Research in Motion's plan to lay off 10 percent of the company's workforce shines fresh light on desperation within the company to keep up with fierce smartphone competition eroding its market share.

Research in Motion said Monday the company plans to lay off 2,000 employees.

The Canadian-based company has seen its stock share plummet over the course of last year as its main source of revenue, BlackBerry phones, have been beaten up by Apple iPhones and Google Android phones.

This workforce reduction might save RIM a decent chunk of money, but it does nothing to address the long-term issues that have shareholders and analysts greatly worried about the future of the company.

Some analysts, including Morgan Keegan's Tavis McCourt, see the company's deflated stock price as a discount, believing the company could see a major rebound in the upcoming year.

That's possible, but this layoff announcement shows the company doesn't see an immediate Blackberry turnaround forthcoming.

Industry analysts and observers say RIM needs to focus on innovation to make its smartphone competitive again, but the company apparently feels the best way to deal with its financial problems is to cut expenses in the face of declining revenue -- similar to putting a Band-Aid on a major, gaping wound.

For RIM to succeed, the company still needs to start at the top, making some major management changes and designing and manufacturing products that are unique, in order to try to combat the ever-growing horde of Apple's product offerings.

Shareholders have grown louder in their calls for the company to break up its current dual CEO set-up, but RIM's job cuts announcement made no mention of going forward with just one CEO.

Instead, it looks like the company will continue its unique, if not bizarre trend by having multiple people replace outgoing Chief Operating Officer Don Morrison. Instead of consolidating the position to one person, the company has now broken it down into three positions, giving each person a specific area to focus on.

Generally, specialization can be a good thing, but RIM continues to have too many cooks in the proverbial kitchen, which can make decision-making complicated at a time when the company needs decisiveness and nimbleness to gain a competitive foothold.

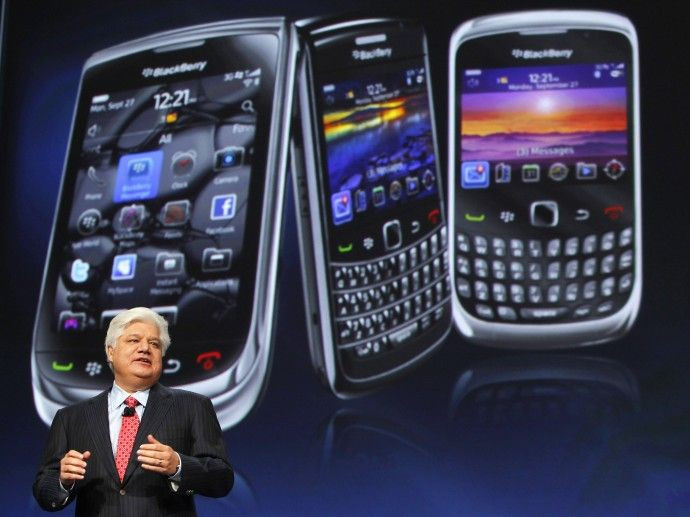

No one at the top will ever publicly admit it, but there seems to be a power struggle going on between Jim Balsillie and Mike Lazaridis, causing the company to be hesitant, inefficient, and easily lapped by competitors while in-fighting continues to weigh heavily against RIM.

If the company wants to survive, something that's in question right now, RIM must focus on the long-term and not just stopgaps to barely appease shareholders. It's invested a lot of money in its QNX operating system, but has seen delay after delay in actually getting a QNX-backed smartphone out to the market.

RIM's only released QNX product to date is the disappointing PlayBook tablet, though the company did just receive government approval for it. The attempt to enter the tablet market made sense, especially considering Apple sold an astonishing five million iPads last quarter, but it was behind the curve.

Apple had already taken a large scale of the market, and the only chance RIM had to actually make a major mark was for the product to be incredibly good, which it just isn't.

The company has not only been late to the party, but also hasn't put out a lot of products. Last year RIM released only one new handset, the BlackBerry Torch, and one tablet computer, the PlayBook. It's a risk to release so few products a year when having the latest and greatest means everything.

One thing RIM can do is to start producing more smartphones to try to build a buzz around the company again.

Peter Misek, an analyst for Jeffries & Co., would like to see six new QNX-backed smartphones over the course of the next year. A nice mix of touch screen and QWERTY-based smartphones could bring in new customers. But again, the products must be good.

RIM doesn't have the competitive advantages that Apple has, thus it has to work harder, and faster to get back in the game. Currently, with a wide mix of strong products, including the iPhone and iPad, as well as actual retail stores, Apple is able to get customers to buy products across different platforms.

RIM really doesn't have that ability, at least not yet. The company would be wise to look into partnership deals with other companies. Misek suggests Amazon, to make its products more readily available. RIM doesn't have retail stores either and instead relies on service provider stores, but that can be easily changed.

At the very least, looking at alternative revenue streams that can quickly be developed should be a priority.

As it stands now, RIM is on the path to a long, slow death of irrelevancy, cutting back to buy more time without providing meaningful marketplace solutions. RIM has lost its market share, new studies suggest that consumers really don't want BlackBerrys anymore, and the company's share price has plummeted as a result.

Cutting 2,000 jobs may help slow the bleeding at RIM, but it doesn't heal the wound.

Only new, distinct products will do that, and that's what everybody is waiting to see if RIM can acheive.

© Copyright IBTimes 2024. All rights reserved.