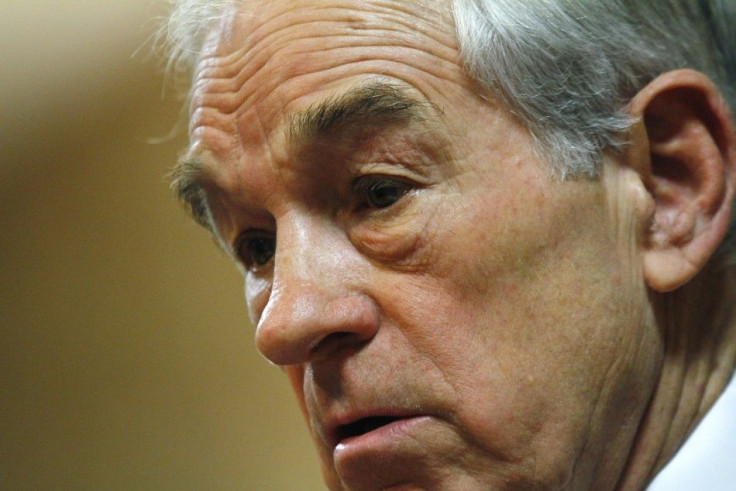

Ron Paul 2012: Should We Hand Him the Economy?

OPINION

The number one issue for the 2012 presidential race is the economy. Republican candidate Ron Paul's position on it, like his position on almost everything else, is radically different from President Barack Obama and Paul's GOP rivals.

Paul, in short, supports drastically cutting government spending, drastically cutting taxes and pursuing drastically tighter monetary policy. Most so-called experts, however, dismiss Paul's economic positions as horrible and unrealistic.

But consider that most so-called experts completely botched their prediction of the economy and financial markets four years ago.

The chairman of the Federal Reserve and the treasury secretary are supposed to be the country's foremost authorities on the economy and financial markets.

Yet in 2006, Fed Chairman Ben Bernanke famously predicted that housing prices will probably continue to rise. Later, he claimed the U.S. real estate market would not significantly affect the U.S. economy and financial markets.

In 2007, then-Treasury Secretary Hank Paulson predicted a bottom in housing prices and was upbeat on the U.S. economy.

The U.S. economy and financial markets, of course, were brought to ruin by the real estate bubble in 2008 and 2009.

In April 2011, current Treasury Secretary Tim Geithner said there is no risk the U.S. would lose its AAA credit rating. Just four month later, the U.S. lost its AAA credit rating.

In a 2009 interview with Bloomberg Businessweek, legendary investor Jim Rogers, who has been right about a lot of things, claimed Geithner has been wrong about just about everything for 15 years.

Obama himself recently admitted that he did not know how bad the economic crisis was. His economic record as a president has also been abysmal.

The Washington establishment has a poor grasp of how the economy and financial markets actually work. It completely missed the financial crisis, misjudged it when everything came crashing down and devised wrong solutions to address it.

Now, four years after the financial crisis first hit, the economy remains extraordinarily weak. In short, the Washington establishment has failed in its stewardship of the U.S. economy and financial markets.

Back in 2009, financial philosopher Nassim Taleb lamented that people who saw the crisis coming are not in power, which was a key reason he was bearish on the economy.

The economics establishment (universities, regulators, central bankers, government officials, various organizations staffed with economists) lost its legitimacy with the failure of the system. It is irresponsible and foolish to put our trust in the ability of such experts to get us out of this mess. Instead, find the smart people whose hands are clean, wrote Taleb.

One politician who is smart and has clean hands, by Taleb's definition, is Ron Paul.

In 2002, Paul warned about a painful crash in the housing market. What is more, he actually recommended repealing the special privileges granted to the government sponsored enterprises in the housing market, which by 2010 became widely understood as key contributors to the real estate bubble and ensuing financial crisis.

In 2004, he warned about loose monetary policy creating financial bubbles. After the U.S. housing and overall asset bubble burst in 2008, loose monetary policy, too, has been widely blamed for causing the problem.

Paul even demonstrates an uncanny understanding of the financial markets, something which Bernanke clearly does not have.

The Wall Street Journal reported that Paul's personal portfolio is unlike that of any other congressman its Total Return blog has reviewed.

His 2010 financial disclosure filing indicated he held 64 percent of his assets in gold and silver-related assets. He has held many of his positions since at least 2002.

Since that time, the prices of gold and gold-related assets have handily outperformed the broad stock market, which most congressmen heavily invested in.

Paul's extraordinarily prescient calls on the financial markets and economy are not the only reason one should consider handing him the powers the presidency has over the economy.

A major reason the Washington establishment failed the economy is its inconsistency and corruption. An active government regime that intervenes often (something Paul is against), for example, can produce economic prosperity if the intervention is done consistently and in the best interest of the country.

However, it, and any other form of government, will not work if it is guided by bribery, as is the case with the current Washington establishment.

Washington is run by lobbying money. Most of Congress is bought. Legislative decisions are glaringly inconsistent and driven by which lobbyist is willing to dish out the most money.

For example, studies have shown that tariffs on intermediate goods are persistently lower than tariffs on final goods.

If the U.S. government had a consistent tariff policy, this would not be the case. However, because companies importing intermediary goods lobby for lower tariffs while no one with deep pockets lobbies for lowered tariffs on final goods, lobbyists for U.S. companies that make final goods are able to drive their tariffs higher compared to those on intermediate goods.

Paul has shown that he will not succumb to such inconsistencies; his voting record and rhetoric has for decades reflected his small government philosophy. Moreover, numerous accounts from his personal life attest to his unwavering virtue and commitment to principles.

Paul stands out in the 2012 presidential race as the only candidate outside the Washington establishment. All other leading candidates - Mitt Romney, Newt Gingrich and Barack Obama - belong to the establishment and bear blame for its failure.

It is time to consider a vote against the establishment, especially if it is to someone who has been as right about the economy and financial markets as Paul has been.

© Copyright IBTimes 2024. All rights reserved.