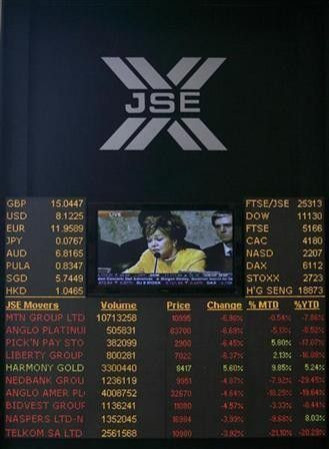

S.Africa assets follow global rout to multi-month lows

S.Africa's rand and stocks fell to multi-month lows on Monday as investors dumping risk hammered everything from resource firms to banks after the downgrade of the U.S. credit rating prompted a sell-off.

The rand broke through key support to trade at its weakest level in five months, while stocks fell three percent to their lowest in 11 months.

Government bonds reversed some losses in a very volatile session as the local debt market was bought and sold in reaction to global sentiment and rand moves.

The central bank and Treasury said in the session they saw no reason to make significant changes to the composition of foreign currency reserves, and forecasts for economic growth were unchanged by the global developments.

Other central banks such as Nigeria and Mauritius announced plans to diversify their own holdings away from an over reliance on the dollar.

South African markets will be closed for a national holiday on Tuesday.

The rand lost 2.6 percent to the dollar to 7.1000 during the session, piercing through support at the psychologically important 7.0/dollar mark. It closed at 6.9175 in New York on Friday.

"We've seeing a lot of uncertainty in these markets around what's happened over the weekend with the downgrade of the U.S," said Brigid Taylor, currency trader at Nedbank.

"That being said there's been a lot of risk taken off book, with offshore players remaining relatively risk averse, which means that the rand has become less of a serious appetite currency," she added.

By 1612 GMT the rand was the biggest loser among a basket of emerging market currencies monitored by Reuters.

"We're so correlated to equity markets. Its really just negative sentiment around wealth destruction and people concerned about growth which has to capitulate into weaker commodity prices," said Garth Klintworth, head of fixed income commodities and currencies at Absa Capital.

Government bonds had a very volatile session, jumping 10 to 15 basis points on the benchmarks. Yields opened higher but had come back somewhat by the end of trade to close little changed from Friday.

The yield on the 2015 note was down 1.5 basis points to 7.14 percent and the 2026 yield was up 8 basis points to 8.285 percent.

"We opened up very weak with the global problems and soon we were trading 13 points above Friday's close with hedge funds selling early," said a local trader.

"Then we saw some profit taking and London buying it again (the 2015 note) which brought it back down to 7.13 but now with the rand looking a bit weaker we're closing at about 7.15."

"If you look at a daily close it looks like we haven't done much but intraday its been quite volatile," he added.

STOCKS ALSO HAMMERED

Stocks fell to finish at an 11-month low but the index of gold producers escaped the attack to gain 1 percent. AngloGold Ashanti, Africa's biggest gold miner, added 2.4 percent to 301.89 rand.

Gold, which is enjoying safe haven trades, is up a whopping 20 percent this year.

The Top-40 blue chip index was down 3.13 percent at 25,180.59, its lowest close since September 2010. The broader All-Share index was down nearly 3 percent at 28,391.18.

"Despite the fact that we are still seeing very good results, the sentiment is spreading to all sectors," said Ferdi Heyneke, portfolio manager at Afrifocus Securities.

"Where we will see support coming through is not easy to say right now. Until the overseas situation starts to see some resolve, we are going to see some more volatility," Heyneke added.

Johannesburg's index of market volatility -- a so-called "fear gauge" similar to Wall Street's VIX -- hit its highest since March on Friday, and was likely to see a further rise after Monday's sharp downturn.

Mining firms were hardest hit with diversified miner African Rainbow Mineral losing over 7 percent, the biggest percentage loser among blue chips, to 160.01 rand.

Banks lost 3.4 percent and general retailers fell nearly 3 percent.

© Copyright Thomson Reuters {{Year}}. All rights reserved.