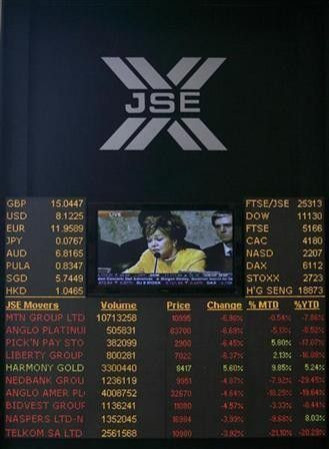

S.Africa stocks book biggest drop in 7 weeks

South African stocks posted their biggest one-day drop in seven weeks on Monday, tumbling 2.5 percent as concerns about debt burdens in the United States and Europe sparked a sell-off in resources firms and others sensitive to global growth.

Shares of Telkom SA briefly hit a three-year low after the fixed-line operator reported a 36 percent drop in first-half profit, hurt by tough competition and burdensome costs from its new mobile business.

Global investors were jittery as a U.S. congressional super committee was expected to concede defeat in its bid to lower the deficit, while ratings agency Moodys warned that France could have its ratings cut.

There's a lot of risk aversion taking place, said Mitchell Gannaway, a trader at Thebe Stockbroking.

The rand and anything to do with emerging markets are getting hammered, despite the fact that it's the developed world that is experiencing all this.

Johannesburg's Top-40 index fell 2.46 percent to 27,732.14, booking its biggest one-day decline since early October, and its lowest close in a month.

The broader All-Share index fell 2.2 percent to 31,116.01.

Equity investors also shrugged off the sell-off in the rand, which dropped more than 1.5 percent against the U.S. dollar at one point on Monday.

A weaker rand is usually seen as a positive for South African companies, as it increases profits when overseas earnings are brought home.

Sasol Ltd, the petrochemical company that is the world's top maker of motor fuel from coal, fell 4.2 percent to 362 rand, becoming the top percentage decliner on the Top-40 index.

Diversified miner Exxaro Resources slid 3.5 percent to 172 rand.

Shares of African Bank Investments, a mass-market lender, fell 2.3 percent to 33.50 rand. The company on Monday came short of analysts' expectations, posting a 24 percent increase in full-year earnings.

Trade was relatively active, with 173.7 million shares changing hands, according to preliminary data available from the Johannesburg exchange.

Decliners outnumbered advancers by a ratio of more than 3 to 1, with 80 shares unchanged.

© Copyright Thomson Reuters 2024. All rights reserved.