S.Africa's bond market consolidates, stocks up

South Africa's government bonds took a breather on Monday, with yields coming off record lows as some dealers cashed in their holdings after a strong rally last week.

Weekly offshore buying of South African debt was at its highest in more than a year last week, pushing yields to record lows. But yields have bounced, particularly in the long end of the curve.

Stocks edged higher on bargain-hunting after last week's sharp decline while lingering worries about the health of the global economy boosted gold shares.

The rand softened against the dollar and was expected to remain vulnerable given elevated levels of aversion to risky assets.

It was trading at 7.22 to the dollar at 1528 GMT, 0.35 percent weaker than Friday's New York close of 7.1956.

After last week's wide gyrations, Monday's moves were relatively mild as dealers were looking to this week's annual meeting of the U.S. Federal Reserve for direction.

On the bond market, the yield on the 2015 bond ended at 6.56, seven basis points lower than Friday's close and off a session low of 6.46 percent. The 2026 bond yield went up eight basis points to 7.945 percent.

The market is trying to find more suitable levels after the overbought levels we saw earlier but I don't think the (bullish) trend changes , said Ian Scott, a dealer at Stanlib.

Increasing expectations that the South African Reserve Bank could cut the repo rate towards year-end from the current 5.5 percent have in part driven bond market gains.

Rates on the FRA (forward rate agreements) market have pointed to a 50-50 chance of such a scenario, with the 3x6 contract falling to 5.4 percent.

But the market may be running ahead of itself with that expectation and the bond market could see more losses this week, said Ion de Vleeschauwer, chief dealer at Bidvest Bank.

We would need to see a substantial decline in growth.

The Reserve Bank's mandate is still inflation targeting and I can't see them cutting rates with inflation still above five percent. We are going to have a stable rates environment for some time, he added.

Inflation data later this week will give the market some direction. July's consumer inflation data on Wednesday is expected to come it at 5.2 percent year-on-year up from 5.0 percent in June.

A higher-than-expected reading should see the market curb monetary loosening forecasts, to add to the 650 basis points worth of rate decreases between December 2008 and end-2010.

GOLD SHARES SHINE ON BOURSE

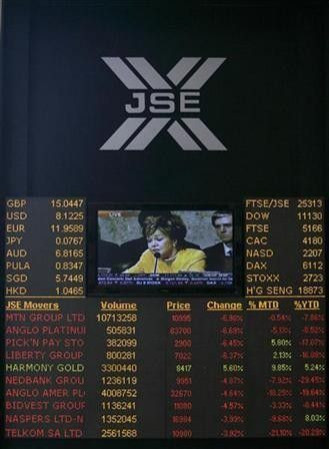

The JSE Top-40 blue-chip index was up 0.17 percent at 26,188.71 and the broader All-share index gained 0.19 percent to 29,433.12.

A lot of these stocks have reached levels where investors see some value, Ferdi Heyneke, a portfolio manager at Afrifocus Securities said. But the mood is still fragile and it should remain volatile in the coming sessions.

Among the equity movers, Harmony jumped 4.63 percent to 90.92 rand after the gold miner said its operations in Papua New Guinea were not threatened by plans to shift mineral ownership there to local communities from the state.

Rivals Gold Fields added 3.36 percent to 124.65 rand and AngloGold Ashanti improved 2.55 percent to 333 rand.

Gold prices retreated from record highs near $1,900 an ounce on Monday but they remain elevated due to lingering economic worries.

Grindrod booked its biggest daily gain nearly three months after shipping firm said it was considering taking a 2 billion rand cash injection from a potential strategic partner. Shares in the company rallied 6.06 percent to 14 rand.

© Copyright Thomson Reuters 2024. All rights reserved.