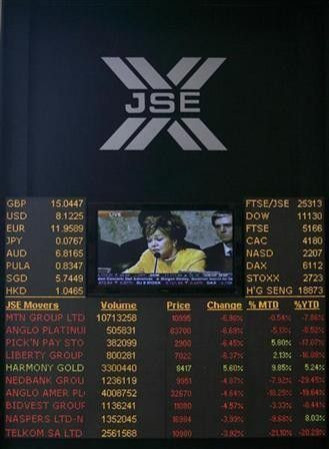

S.Africa's rand steadies, stocks rise

South Africa's rand steadied against the dollar on Friday but faced further losses after a turbulent week in which it hit its weakest levels in more than a year as investors spooked by debt woes in the U.S. and Europe fled to safer havens like the yen.

Government bonds also took a breather after demand rose sharply earlier in the week as market players pushed out their expectations for a domestic rate rise to mid-2012 on a dimmer outlook for the global and South African economy.

South Africa's broad-based stocks index rose over 1 percent on Friday, led by retailers such as Mr. Price, which were bolstered by U.S. retail sales' biggest gain in three months in July.

The rand was at 7.18 to the dollar by 1550 GMT, off its weakest level of the day of 7.29 and up 0.21 percent from Thursday's close.

The currency was set to close the week about 4 percent weaker than the greenback after a heavy global sell-off triggered by S&P's downgrade of U.S. debt.

"For next week, a lot still depends on what's going to happen in the U.S. and Europe," said Paul Chakaduka, a trader at Global Trader.

"What's worrying at the moment is that gold has pulled back a long way from its highs and that doesn't bode well for the rand. But at the same time we're seeing equity markets pushing higher ... and that should have a positive impact on the currency. I would say it could trade from around 7.25 to 7.00."

Government bonds edged lower after strong gains at the start of the week, and yields climbed higher in tandem, with the benchmark four-year issue closing up a basis point at 7.01 percent.

The yield on the longer-dated 2026 bond tacked on 1.5 basis points to 8.39 percent.

"I think it's just a bit of cutting of positions more than anything else," a bond trader said of Friday's slight sell-off.

"We're also hearing rumours that guys are speculating the National Health Insurance plan may increase issuance but it's too premature."

South Africa's government is mulling a health insurance scheme to give greater access to healthcare for the country's poor, which would require 125 billion rand in 2012, according to a government policy paper released on Thursday.

RETAILERS LEAD GAINERS

Johannesburg's index of general retailers gained 2.4 percent, with all but one firm rising. Furniture retailer Lewis Group fell 1 percent to 79.59 rand after saying debtor costs rose in the first quarter.

Mr. Price added 5 percent to 73 rand.

The Top-40, Johannesburg's index of blue chips, climbed 1.25 percent to 26,626.27, while the broader All-Share index rose 1.14 percent to 29,826.40.

"At this stage shares are looking so cheap, our markets are looking so depressed, (news) like that is definitely going to spur some buying," said Byron Lotter, portfolio manager at Vestact.

"The reason our market is up 1.1 percent is because of the catch up it is playing from the U.S. yesterday."

The retailers' has outperformed the All-Share, banks, and the general mining sector indices year-to-date.

Spot gold prices weighed on Johannesburg-listed bullion miners as the precious metal lost some of its lustre as a safe haven commodity with the return of some risk appetite.

Spot gold backtracked to $1,728.49 an ounce at 1539GMT from record highs in previous sessions.

Harmony Gold was the biggest percentage loser of gold miners. It shed 2.9 percent to 99 rand.

News that British insurer Old Mutual was still very intent on getting rid of its stake in Nedbank helped boost South Africa's fourth-largest lender by a total 2.8 percent, to 135.24 rand.

© Copyright Thomson Reuters 2024. All rights reserved.