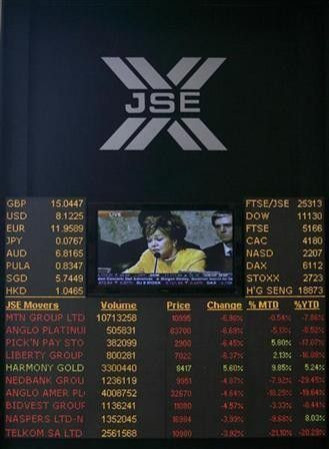

S.Africa's volatile rand ends firmer, stocks rally

South African stocks added more than 3 percent on Thursday, the biggest daily percentage increase in 15 months, boosted by sentiment generated by better-than-expected U.S. labour market data.

The rand recouped earlier losses against the dollar, largely tracking a firmer euro, but remained vulnerable to market volatility linked to global financial worries which have cast a pall on the outlook for the domestic economy.

Government bonds fell, giving back some of the previous day's strong gains which were prompted by traders pushing out their expectations of interest rates rises to mid next year on signs growth is stalling in Africa's biggest economy.

At the bourse, the benchmark Top-40 index added 3.3 percent to 26,297.69, the highest daily increase since May 2010. It has fallen nearly 6 percent this month. The broad-based All Share index added 2.9 percent to 29,490.20 on Thursday.

The banking index surged more than 4 percent and Standard Bank, Africa's biggest lender by assets, gained 4.4 percent to 94.50 rand after reporting a surprise 11 percent rise in half-year earnings.

Resource firms such as Kumba Iron also benefited from the rally. It ended nearly 6 percent up at 499.00 rand.

Gold miner Gold Fields surged 4.9 percent to 118.00 rand, riding on record bullion prices and after reporting second quarter profits jumped 15 percent.

"We are definitely seeing a turn in sentiment," said Devin Schutte, a trader at Newstrading, but warned that trading would still be driven by news flow out of Europe.

Whispers that France and Italy could ban short selling would be negative for the markets, he said.

There has been speculation that Europe could ban short-selling after Greece banned the practice for a period of two months earlier this week.

The Johannesburg bourse's volatility index -- a measure of investor fear similar to the CBOE Volatility Index in the United States -- has spiked 24 percent since the beginning of the month.

RAND STABLE, BONDS CORRECT

The rand was at 7.24 to the dollar by 1537 GMT, up 0.28 percent on Wednesday's close in New York and off Thursday's low of 7.3438.

Traders said the rand had been cheered by a stronger euro and a firmer open on Wall Street on a better-than-expected U.S labour market report and a rebound in financial shares.

"Euro is up from 1.4130 to 1.4280 so the rand is just coming down from that mid 7.30's area. Things seem to be settling down a bit, I think we can stay at these ranges unless the Dow comes under pressure overnight," RMB trader Jim Bryson said.

But Bryson cautioned: "I think there's still potential for volatility over the next 24 hours."

Government bond yields climbed higher on Thursday in what traders was a technical correction from Wednesday's slide to multi-month lows.

The yield on the benchmark four year note closed eight basis points higher at 7.0 percent and the 15-year issue jumped 10 basis points to 8.325 percent.

Traders are bracing for another volatile session after very choppy trade on Wednesday as investors attempt to figure out where best to put their money during the global rout.

"The rand is firming on the euro/dollar bounce and positive stock futures, but expect it to remain volatile and swing with wider market flows," said emerging market analyst Christopher Shiells of Informa Global Markets.

Expectations that foreigners will keep buying South African bonds with cheap U.S. dollars is supportive of the rand and helped cap losses overnight, IGM's Shiells said.

The local forward rate agreements market -- contracts used to gauge interest rate expectations -- is pricing in a slight chance that the Reserve Bank will cut interest rates sooner than raising them.

© Copyright Thomson Reuters 2024. All rights reserved.