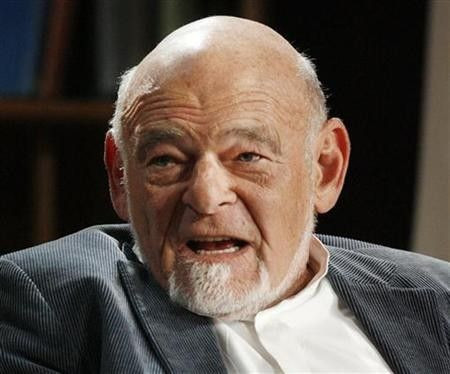

Sam Zell, Blackstone Raise Cash For Buildings, Potentially Stabilizing Markets

Analysis

Two of real estate's biggest landlords are gearing up for more acquisitions in moves that could help stabilize local housing markets.

Sam Zell, the Chicago-based mogul who controls Equity Residential (NYSE: EQR), the largest public residential landlord, is seeking $1 billion for a new private equity fund, according to Bloomberg News. The entity, Zell Opportunities Fund II LP, will target distressed properties and troubled companies.

Zell is sticking to his long-time strategy of targeting what he believes are undervalued assets, and he's putting in $100 million of his own cash. In 2009, his firm invested $666 million in properties including Blockbuster LLC, Domino's Pizza Inc. (NYSE: DPZ), Hilton Hotels Holdings Corp. (NYSE: HIL) and Marriott International Inc. (NYSE: MAR), and it was generating a 16 percent net return in March, according to Bloomberg.

Meanwhile, the Blackstone Group LP (NYSE:BX) is raising $13 billion in the largest private equity fund ever, according to Bloomberg. The financial giant has been the biggest buyer of office and retail buildings since the recession began, but more recently it has entered the hot rental market, new territory for the firm.

Blackstone has spent over $250 million on foreclosed single-family homes, including 1,500 units around Phoenix and Southern California. It partnered with Arizona-based Treehouse Group LLC and Dallas-based Riverstone Residential Group to fix up the properties, and it could potentially take the holdings public or sell them at a later date.

Zell and Blackstone's moves are a testament to investors' beliefs in real estate's opportunities. The investments, particularly by Blackstone, to convert rentals, could also help to create demand for depressed markets. While investors won't be able to turn the housing market around by themselves, these moves could instill more confidence in the sector.

© Copyright IBTimes 2024. All rights reserved.