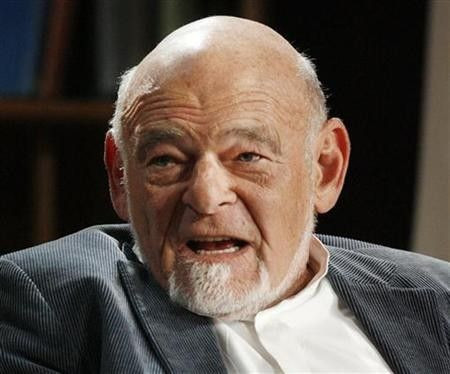

Sam Zell's Equity Residential Leads With $2.5 Billion Archstone Bid

Real estate mogul Sam Zell's Equity Residential is the lead bidder to buy 53 percent of rival company Archstone for over $2.5 billion, the Wall Street Journal reported.

Bank of America and Barclays control the majority stake in Archstone, owner of 77,000 apartment units, while the estate of Lehman Brothers owns the rest.

The Equity Residential bid would value Archstone at around $16 billion, according to the Journal, and be one of the largest real estate deals since the downturn began. The valuation includes Archstone's $11 billion in debt to Fannie Mae and Freddie Mac.

AvalonBay Communities, the Blackstone Group and Brookfield Asset Management have also submitted bids for the company. In June, Reuters reported that the Steve Roth's Vornado Realty Trust had also been approached to take over the company.

Lehman's estate still has the right of first refusal for the transaction, and it may block Equity's bid because it could lead to the two entities squabbling over management and direction of the company, according to the Journal.

Zell has developed a reputation of a grave dancer, stepping in to take over distressed assets with an eye for future profits, although his most recent acquisition of the Tribune Company, which publishes the Chicago Tribune and Los Angeles Times, has led to a difficult ownership.

In February 2007, Zell sold Equity Office Properties Trust to the Blackstone Group for $23 billion, and recent years have seen him focus on residential properties. His first ground-up development in New York, Ten23, a 111-unit rental at 500 West 23rd Street, opened for leasing last month, with move-ins scheduled for January.

Zell has also touted the merits of investing in Brazil, where he has stakes in local malls. The country's booming population and growth has led directly to surging retail, he said.

Shares of Equity Residential were trading around $57.30 mid-Wednesday.

© Copyright IBTimes 2024. All rights reserved.