From Satoshi to SegWit2x: Japan’s Role In The Future of Bitcoin

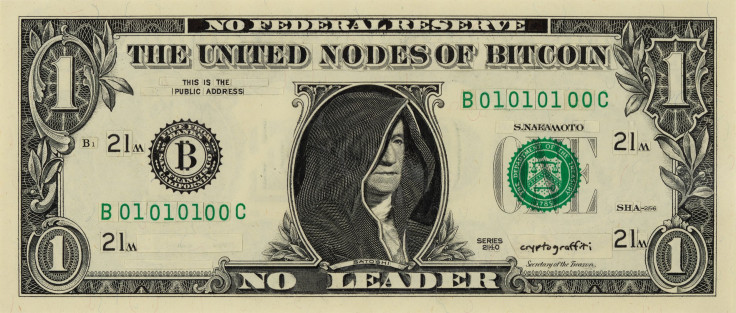

When future history books name the greatest modern technologists and economists, the Japanese alias Satoshi Nakamoto will probably be among the most mysterious inventors. Satoshi Nakamoto is an unknown person, or persons, who wrote the original bitcoin white paper. It proposed a new distributed way of storing and securing data, blockchain technology, could build a purely peer-to-peer version of electronic cash. The key was decentralization.

Bitcoin allows online payments to be sent directly from one party to another without going through any traditional institution. It gives individuals financial sovereignty, enabling them to transact without banks or governments. The bitcoin community attracted diverse traders, developers and investors who turned this white paper into a vibrant network. Bitcoin is more than an investment for some people: It’s a philosophical movement.

Some cryptocurrency users, such as the citizens of Bitnation and members of Estonia’s token-friendly e-residency program, imagine blockchain technology could create a variety of global citizenships.

Bitcoin was invented less than a decade ago. Its technology has already inspired the creation of more than 2,000 different cryptocurrencies with an estimated global market cap worth more than $207 billion. China and Russia have both announced efforts to create their own national cryptocurrencies, which will be easier to regulate than the peer-led bitcoin network. Regardless, bitcoin is still the most valuable and widely used cryptocurrency.

Ayako Miyaguchi, managing director of the cryptocurrency exchange market Kraken in Japan, told Newsweek Media Group that institutional bitcoin adoption is much more progressive in Japan, especially compared to the American market. “Regulations are a lot better than the U.S.,” she said. “Financial institutions are already ready to work with bitcoin companies. It’s getting to the point where big companies in Japan are starting to work with bitcoin...the whole world started to see Japan as very welcoming to cryptocurrency.”

Bitcoin’s grassroots governance was put to the test in November when controversial network forks sparked heated debate. Bitcoin Gold already proved the community can have a relatively friendly split. Bitcoin Gold did not try to use bitcoin’s core brand. Instead, it focused on one proposed solution for curbing the overwhelming influence of Chinese bitcoin mining operations, which are quickly spreading on an industrial scale. Bitcoin Gold supporters want it to be easier for small miners to participate.

One the other hand, the SegWit2x fork leveraged support from some of the cryptocurrency industry's wealthiest players, including the venture capital firm Digital Currency Group and the cryptocurrency company ShapeShift, which offers everything from hardware wallets to a platform where users swap bitcoin for alternative coins like monero and ether.

“Alternative coins probably have more potential in the Japanese market,” Miyaguchi said. “Japan has huge potential for consumer-level people...We have industry groups who work really well with regulators.” The Japanese have a less rigid approach to decentralized technology than the Russians or Chinese, plus a faster legislative system than the Americans.

There are already several active bitcoin debit card services in Japan. This year, Japan became one of the few countries with an established licensing structure for cryptocurrency exchanges. Miyaguchi herself worked with Japan Authority of Digital Asset, one of the organizations promoting cooperation across the white collar blockchain industry. She believes bitcoin could be Japan’s gateway into a whole new world.

Despite bitcoin’s rising popularity and official recognition, the movement is facing a fundamental dilemma: How will bitcoin’s growing community work together without any official leadership?

In order to boost global capacity, which is what most people want, developers need to update and maintain the open source bitcoin network. Plus, any decentralized cryptocurrency network needs diverse miners and node hosts to power the ecosystem. Blockchain technology works without a president or CEO because it’s an open source network run by contributors. The community also relies on businesses, such as wallet providers and exchanges, to support updates harmoniously as the community builds bitcoin into a bigger, faster global highway for secure transactions.

“It’s impossible to get everyone to upgrade exactly on cue. You even see this with, for example, your phone,” Eric Lombrozo, Bitcoin Core contributor and CEO of Ciphrex Corp, told Newsweek Media Group. “Whenever you have to update the software on your phone, it’s impossible for Google or for Apple or Microsoft or whoever to get everyone to upgrade exactly when they want to. Even now, they support older versions of the operating systems that they released years ago...Now we’re talking about a decentralized [bitcoin] network with people all over the world, who have different incentives at play. Try convincing all of them to make an upgrade, right?”

Last but not least, bitcoin needs users in order to have any real value as a global currency. According to ShapeShift CEO Erik Voorhees, the average bitcoin transaction fee is around $10.17, a highly prohibitive cost for small or high volume transactions. SegWit2x supporters wanted bigger blocks to help curb fees. But the reality is, this wasn’t a debate over technical updates or lowering fees. Most SegWit2x critics would also love lower fees, just on a different timeline. Bitcoin communities from Hong Kong to Korea, Brazil, Argentina, Israel and Italy, just to name a few, repeatedly rejected the SegWit2x plan.

“The main challenge here was not about block size whatsoever. The real challenge was about the way that consensus rules get changed and trying to do a referendum on governance,” Lombrozo said. “The problem with SegWit2x, and the way it was being pushed, is the idea was not only to change the rules and push the new network with those rules, but to try and destroy the old network, to force everyone on the old network to move to the new network rather than it being voluntary.”

Coinbase, a popular cryptocurrency exchange with a $1.6 billion valuation, announced it would eventually call “the chain with the most accumulated difficulty Bitcoin” after the (now defunct) SegWit2x fork. Many critics disagreed with this approach. Beyond offense at the idea that companies might use bitcoin’s original symbolism for a new chain, they argued “bitcoin” should be measured by its adherence to decentralization and cooperative development to prioritize the strength of the code. Tallying more transactions and fee reductions aren’t the only way to measure bitcoin’s value.

“The community is learning how to reach human consensus without voting,” venture capitalist Bill Tai, an advisor to several blockchain startups, told Newsweek Media Group. “Over the next 12 months, I think we’ll have clarity. Bitcoin is now the default store of value, the record store of value, for the entire ecosystem. I do not see that changing.”

The bitcoin community weathered several forks this year, yet the original network remains more vibrant and valuable than ever. On Nov. 8, institutional SegWit2x supporters finally canceled plans for this unpopular fork. “We hope the community will come together and find a solution, possibly with a blocksize increase,” BitGo CEO Mike Belshe wrote in an email. “Until then, we are suspending our plans for the upcoming 2MB upgrade.”

Bitcoin’s greatest weakness isn’t security risks or logistics. Blockchain technology is generally considered extremely secure and almost impossible to hack. Cryptocurrency networks are evolving so fast that most network issues are more a question of “how” or “when” to implement solutions as opposed to “if.” The more the bitcoin network grows, the more participants are incentivized to contribute to a healthy ecosystem.

“Most of the bitcoin developers I know work on it for more philosophical reasons,” Lombrozo said. “Unless someone comes out with a groundbreaking new idea that revolutionizes bitcoin and adds features to it that improve its immutability and its resistance to being taken over...I just don’t see them [forks] as viable competitors.”

Bitcoin’s core technology will still need updates and changes to solve this crucial scalability issue. Even on its best day, the current bitcoin network can handle less than 10 transactions per second. Each transaction requires the same amount of electricity it would take to power an average American household for a whole week. The Japanese city of Kazuno is experimenting with using renewable energy sources for bitcoin mining, but that is only the start. The bitcoin community will continue to face the same governance challenges as the technology matures.

Tai believes the way inevitable forks and changes are implemented will define bitcoin’s social and cultural potential, regardless of each blockchain network’s profitability after the dust settles. “In the future, everything will be based on cryptocurrency techniques,” Tai said.

Most cryptocurrency experts believe the broader industry will continue to grow. It’s impossible to say whether the market will be dominated by centralized technologies, such as the approaches China and Russia appear to favor, decentralized grassroots governance models like the monero community, or hybrid businesses consortiums similar to the thwarted SegWit2x proposal. Some countries, such as Ecuador, have banned bitcoin outright.

So far, Japan’s model falls somewhere in the middle. It is cautiously yet steadily beefing up the legal framework for working with decentralized technology. Earlier this year, Japan became one of the first countries to officially recognize cryptocurrency as a legal method of payment. Many Japanese bitcoin users aren’t as focused on the political aspects as they are on usability and long-term investments. Whatever happens to the global bitcoin community, its foundational technology is still in its infancy.

Developers around the world are now using blockchain technologies to create new types of digital assets.

“Going forward, what I think we’ll be seeing is forks that do try to offer other stuff, or altcoins that offer other stuff,” Lombrozo said. “More futures, derivatives markets or cross-chain atomic swap protocols, stuff like that, to allow people to move their wealth over to whatever technology appears to be the most promising at that time.”

This diversification is already starting. One of SegWit2x’s leading developers, entrepreneur Jeff Garzik, recently announced his startup Bloq will make a new cross-blockchain cryptocurrency that can move value across chains. Meanwhile, CME Group Inc., one of the world’s leading derivatives markets, plans to start offering bitcoin futures before 2018. Regardless of what happens to bitcoin itself, the bitcoin community will continue engaging with the global cryptocurrency movement it sparked.

“I think the token ecosystem will have mushroomed and come back,” Tai predicts will happen over the next year. “Someday, there will be multiple government cryptocurrencies and there will be something like gold that’s international. Some countries are going to mandate: legally, you can only do this. But the ownership of gold has been outlawed before, and confiscated. Yet people still had it. You can’t make this go away."

© Copyright IBTimes 2025. All rights reserved.