SEC Drops Investigation Into Ethereum, But Hints It's Not The End

KEY POINTS

- Consensys said the decision means the SEC will no longer allege that ETH sales are securities transactions

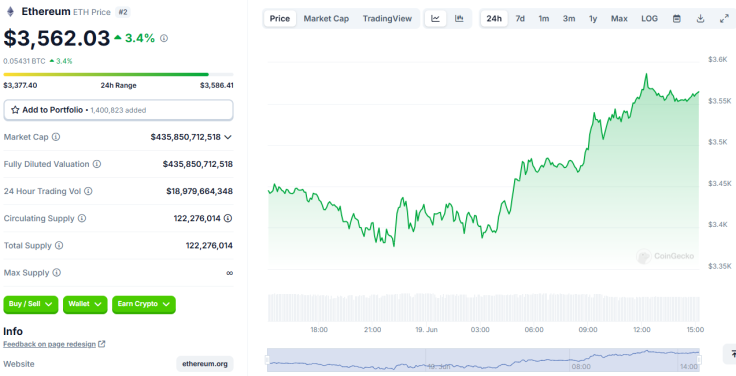

- Ether's price spiked from $3,400 to $3,500 early on Wednesday following the news

- Consensys sued SEC in April, alleging the regulator deemed ETH a security since last year

Blockchain technology firm Consensys, which revealed in a legal filing in April that the U.S. Securities and Exchange Commission (SEC) had deemed Ether (ETH) a security since March last year, said Tuesday that the regulatory agency has closed its investigation into the Ethereum blockchain.

Consensys called the development a "major win for Ethereum developers, technology providers, and industry participants." As per Consensys, the closure of the SEC Enforcement Division's probe into the Ethereum network "means that the SEC will not bring charges alleging that sales of ETH are securities transactions."

ETHEREUM SURVIVES THE SEC.

— Consensys (@Consensys) June 19, 2024

Today we’re happy to announce a major win for Ethereum developers, technology providers, and industry participants: the Enforcement Division of the SEC has notified us that it is closing its investigation into Ethereum 2.0.

This means that the SEC…

The blockchain firm said the SEC's notification came after Consensys sent a letter to the regulatory agency on June 7, asking it to confirm that the partial approval of spot Ethereum exchange-traded funds (ETFs) meant that the agency will close its investigation.

Consensys senior counsel Laura Brookover shared a link to the SEC's notice that revealed the regulator no longer intends to recommend an enforcement action.

Following Consensys' announcement, Ether's price spiked from ending Tuesday at around $3,400 to over $3,500 early on Wednesday, as per CoinGecko data. The world's second-largest digital asset by market cap has also been up by 3.4% in the last 24 hours.

Prominent names in the cryptocurrency industry have hailed the development, including well-known Bitcoin investor Lark Davis, who said it is a "big W" for the Ether community.

𝗝𝗨𝗦𝗧 𝗜𝗡: The SEC permanently suspends its investigation into Ethereum.

— Lark Davis (@TheCryptoLark) June 19, 2024

Big W for $ETH. pic.twitter.com/L8mz04aeOB

Crypto trader Jimie said the development suggests that the Wall Street regulator is "losing" its anti-crypto battles, adding that the community can now expect "higher highs after this mid cycle dip." Many other crypto users on X (formerly Twitter) said the SEC's decision now makes spot Ether ETFs imminent.

However, the notice from SEC stated that it "must in no way be construed as indicating that the party has been exonerated or that no action may ultimately result from the staff's investigation."

Meanwhile, Consensys said its fight for Ethereum continues. "It should not take a lawsuit to provide the much-needed regulatory clarity to allow an industry that serves as the backbone to countless new technologies and innovations to thrive," it said.

Our fight continues. In our lawsuit, we also seek a declaration that offering the user interface software MetaMask Swaps and Staking does not violate the securities laws. It should not take a lawsuit to provide the much-needed regulatory clarity to allow an industry that serves…

— Consensys (@Consensys) June 19, 2024

The company filed a lawsuit against the SEC in April, alleging that the regulator already deemed ETH a security in March, a few weeks before SEC Chair Gary Gensler appeared before Congress and refused to clarify the digital asset's status as a security or a commodity. The crypto community erupted upon learning of the news, and some lawmakers also questioned Gensler's "regulatory dishonesty."

The SEC has yet to definitively declare that Ether is a commodity even as it has approved the 19b-4 filings of exchanges to launch Ether ETFs.

© Copyright IBTimes 2024. All rights reserved.