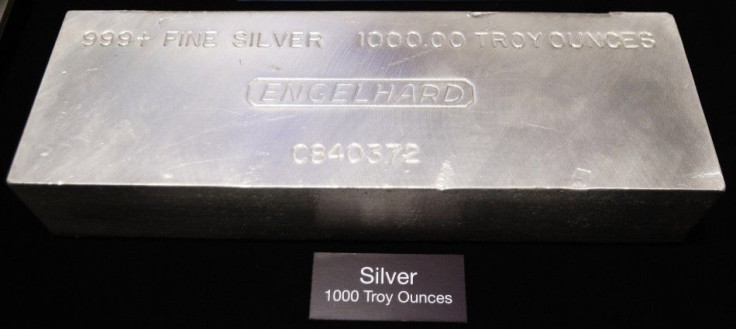

Silver investing returns to mainstream as prices hover near 30-year high

Silver has surged within striking distance of new 30-years highs. The March silver contract on the Comex division of the New York Mercantile Exchange is trading around $30.805, about 47 cents from the January high, Kitco News reported.

The precious metal has far outshined gold in recent months even as alternative investment options were in the focus ever since the financial crisis weakened conventional investment positions.

The gold to silver ratio, the number of silver ounces needed to buy an ounce of gold, dropped to just above 45:1 last week, signifying the relative advance made by silver over gold, Resource Investing News has reported. The change in the ratio marked silver's highest value relative to gold in the past five-years.

And more investors are flocking to silver, sensing an opportunity. Mark Thomas of the Silver Shortage Report wrote on Tuesday that Soros Fund management has made an investment in Pan American Silver (PAAS). The purchase itself was small for only 19,900 shares of stock which is only $700,000 as of Dec. 31, 2010. However after the first of the year they probably added to their position, he said.

A very nice development for silver investors in general! I hope you have already made your purchases of physical silver, silver ETF's and silver mining companies. If you haven't you might want to continue buying all three, said Thomas.

He observed that other hedge funds and institutional investors will now follow suit and that silver investment is back in the mainstream. We are on the cusp of stage two of the three stage process of silver investing becoming mainstream.

Last month, Silver Shortage had reported that silver prices could hit an incredible $120 in just three years, propelled by a physical shortage in the silver market and further momentum in economic recovery.

Silver is currently priced in US dollars at $30 but could explode in price to $120 in just the next three years. That would be an incredible 300 percent gain on your investment, it had said.

Commodities like gold and silver witnessed a surge in demand last year as financial markets remained roiled and future looked uncertain. Investors flocked to the precious metals, seen as safe haven investments, as global currencies became too volatile for comfort. Silver scored over the yellow metal because of its increased demand as an industrial metal while gold has very few industrial applications.

Now is a great time to consider silver and gold. Request your free investor kit from Goldline.

© Copyright IBTimes 2024. All rights reserved.