Is Slack In Trouble? SEC Reportedly Looking Into How IPO Handled

KEY POINTS

- Slack closed at $21.52 Friday, nearly half of its peak price

- SEC reportedly is investigating how its debut as a public firm was handled

- The Wall Street Journal said it could not determine the target of the SEC probe

The Securities and Exchange Commission reportedly is investigating recent initial public offerings of unicorns and other companies that achieved high valuations while still in private hands to determine whether any misconduct was involved.

The Wall Street Journal reported Slack Technologies (WORK) is among the companies whose IPOs are being scrutinized. The SEC sent letters seeking information from electronic-trading firm Citadel Securities LLC, which also managed Uber’s (UBER) listing, on how it opened Slack trading on June 20, the Journal said, quoting people familiar with the situation.

The report said the SEC has contacted at least one other firm in addition to Citadel Securities, asking for messages and email sent just before trading opened. It also wants to examine the companies’ policies for following New York Stock Exchange rules.

The investigation reportedly extends back several years but there was no word of any irregularities.

Slack’s IPO went off at $38.50 in a direct listing, topping its $26 reference price and producing a $25 billion valuation. The stock, which soared as high as $42, closed at $21.52 Friday. It has not seen a single rally since its debut, and after third-quarter earnings were released, the company’s valuation was reduced to $11.7 billion.

The Journal said it was unable to determine the target of the investigation.

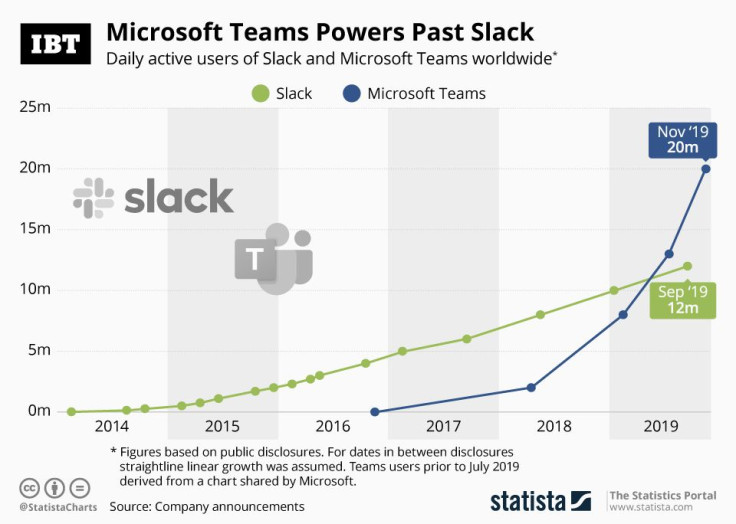

Slack lost as much as 45% of its market value post-IPO, partly because it’s still losing money and billings are heading lower, Seeking Alpha said. Competition in the interoffice messaging field also is growing from the likes of Microsoft (MSFT) and Facebook (FB). As such, the company is not attractive to mainstream investors.

Venture capital firms like direct listings because they avoid some of the restrictions and costs of traditional offerings involving investment banks.

© Copyright IBTimes 2024. All rights reserved.