Zambia's economy is expected to grow 6.5 percent this year and 6.6 percent next year on the back of a rally in copper prices and improvements in agriculture, a Reuters poll of 12 economists showed on Thursday.

Asian stocks were broadly steady On Tuesday after traders took China's closely-watched inflation data in their stride, while the euro regained some ground after hitting a three-week low the previous day.

Asian stocks rose slightly on Tuesday after China's closely-watched inflation data failed to surprise markets, while the euro regained some ground after hitting a three-week low the previous day.

The debts assumed by the Western democracies will overwhelm their economies and lead to the end of our current Dollar-denominated, global currency regime. This has profound implications for Americans' standard of living and our empire's role in the world.

The companies whose shares are moving in pre-market trade on Monday are: Nvidia, Expedia, Freeport-McMoRan, Netflix, Nokia, GameStop, Clorox and Wal-Mart Stores.

China's trade surplus fell to its lowest in nine months in January after imports surged, supporting the government's case ahead of a G20 meeting that it is doing enough to spur domestic demand without speeding up currency appreciation.

Newcrest Mining , Australia's top gold miner, almost doubled underlying first-half profits on Friday due to higher gold production, beating some forecasts, and appointed a new chief executive.

World stock markets fell hard on Thursday, with Hong Kong shares losing 2% and London's FTSE100 dropping 0.9% by lunchtime. Indian stock markets have lost more than $20 million per minute so far in 2011, the Economic Times reports, with billionaire Anil Ambani blaming vicious and illegal rumors.

Zambia expects its power generation capacity to rise to over 3,000 megawatts by 2016 and plans to export the surplus electricity to its neighbours, the chairman of state power firm Zesco told Reuters on Wednesday.

Resource-rich African governments risk unrest if they hold back the benefits of soaring global commodity prices from their own people, delegates to a major mining conference were told on Wednesday.

Gold rose more than 1 percent on Tuesday to $1,367.60 an ounce as traders covering short positions in the New York futures market pushed spot prices through key resistance at the metal's 100-day moving average.

World stocks and oil prices ebbed from recent highs on Tuesday after China raised interest rates for the second time in just over a month, spurring worries of the hike's impact on global economic demand.

Gold inched higher on Tuesday as equities fell, the euro picked up and flows of metal out of exchange-traded funds stabilized, although a rise in Chinese benchmark rates limited gains.

China central bank raised interest rates for the second time in just over a month on Tuesday in a bid to rein in inflation as inflation stayed above 4 percent for a third month.

Miner Xstrata Plc reported a surge in profit for the full year on stronger commodity prices, and proposed a final dividend of 20 cents a share, reflecting a return to pre-financial crisis levels.

World stocks rose on Monday, hovering near a 29-month high on further signs of global economic recovery, and copper rallied to a record high while U.S. 10-year Treasury yields hit their highest since May.

World stocks rose on Monday, hovering near a 29-month high on further signs of global economic recovery, and copper rallied to a record high while U.S. 10-year Treasury yields hit their highest in 10 months.

Australians voiced relief and surprise after one of the world's most powerful cyclones spared the nation's northeast coast from expected devastation on Thursday, with no reported deaths despite winds tearing off roofs and toppling trees.

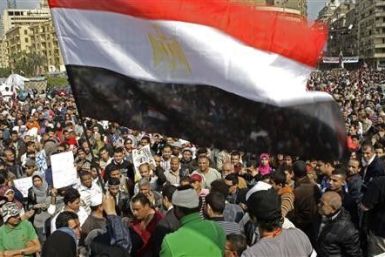

Spot gold was bid at $1,328.05 an ounce at 1300 GMT, against $1,336.00 late in New York on Wednesday. U.S. gold futures for April delivery fell $3.90 to $1,328.20. Concerns over the fallout from unrest in Egypt, where six people were killed after supporters of president Hosni Mubarak opened fire on protestors overnight, have underpinned prices, but have not sparked fresh investment, analysts said.

One of the most powerful cyclones on record slammed into Australia's coast on Thursday, uprooting trees, tearing roofs off buildings and raising the danger of deadly storm surges.

The category-five storm, Cyclone Yasi, that has struck Queensland in northeastern Australia (already reeling from deadly floods last month) is likely to hammer global commodity markets, according to media reports.

Gold prices eased a touch in Europe on Wednesday after well received U.S. economic data and a spate of upbeat corporate earnings deflected interest away from bullion on to higher-risk, higher-yielding assets.