Southeast Asian Office Rents Soar As Tiger Economies Roar

The steamy, tropical corner of Asia between China and Australia is seeing commercial real estate rents jump, spurred by fast-growing economies and city dwellers' rising incomes. According to a report released Tuesday by Chicago-based global real estate services firm Jones Lang LaSalle Inc. (NYSE:JLL), the price of office space in the biggest economies of Southeast Asia is a clear indication of the region's growing economic importance.

“While economic growth drives corporate activity across Southeast Asia, businesses are making changes to accommodate growing workforces and modernized office spaces in new, emerging markets,” the company said in a report on the eve of the World Economic Forum on East Asia 2013, to be held this week in Myanmar. “While existing companies seek space to accommodate expansion and new businesses and industries demand a share in the markets, demand for offices will spike and vacancy levels are forecasted to reach historic lows by 2014.”

Jones Lang LaSalle cites several reasons why five of the 10 members of the Association of Southeast Asian Nations (ASEAN) are ripe for investment in expanding commercial real estate:

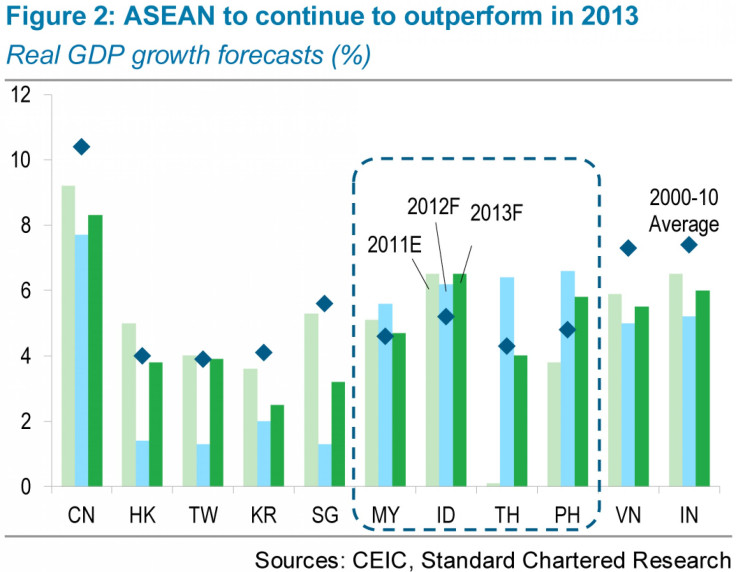

Indonesia, which will lead the region in economic expansion this year, has seen demand for office space more than double in the past four years; it grew 7.4 percent in the first quarter of this year alone. Indonesia’s bustling, traffic-congested capital of over 10 million inhabitants, Jakarta, is the current ASEAN center of the retail real estate boom, with commercial rents rising 4.9 percent year-over-year in the first quarter.

The Philippines, with the second-fastest-growing ASEAN economy, has seen office rents rise 3 percent in the first quarter of the year compared to the same period last year.

Meanwhile, the economies of Thailand, Malaysia and Vietnam are expected to expand between 4.5 percent and 5.5 percent. Thailand’s real estate market has been recovering briskly from the last global economic meltdown, with office-space prices rising 15.2 percent year-over-year in the first quarter. Retail rents in Bangkok went up nearly 5 percent in the first three months of the year compared to last year, thanks to rising consumer confidence. Office rents are up between 1 percent and 4 percent in major Southeast Asian cities, such as Kuala Lumpur.

Jones Lang LaSalle's 2012 Global Real Estate Transparency Index shows these countries have improving conditions that make their real estate markets more trustworthy but notes they have to do more to boost transparency. They rank fairly low on the trust scale, meaning investors have to be careful about the data provided to them and may encounter corruption and bids for under-the-table payments to close deals. The one exception is Singapore. It's the only Southeast Asian economy whose real estate market ranks up with European markets -- between Denmark and Germany on the transparency index. (Hong Kong ranks higher, but it also has the world’s highest prices for office space.)

Of the five other major Southeast Asian economies, Malaysia has the most "trustworthy" real estate market, followed by the Philippines, Indonesia, Thailand and Vietnam.

© Copyright IBTimes 2024. All rights reserved.