Sovereign Bond Yields Not Yet Reached A Summit - Reuters Poll

The latest turmoil in major sovereign debt markets is far from over as bond strategists in a Reuters poll expected yields to stay elevated well into next year, with risks firmly skewed towards their moving higher than currently predicted.

More than a decade of rock-bottom sovereign bond yields came to an abrupt end earlier this year as major central banks, which kept them artificially subdued, dumped pandemic-era policies in pursuit of price stability which so far has remained elusive.

With inflation now running multiple times higher than major central bank targets, bond yields, along with policy rates, are unlikely to drop significantly in the short- to medium-term.

The Sept. 12-19 Reuters poll of over 40 fixed income strategists and economists showed major sovereign bond yields trading near current levels in one, three, six and 12 months from now.

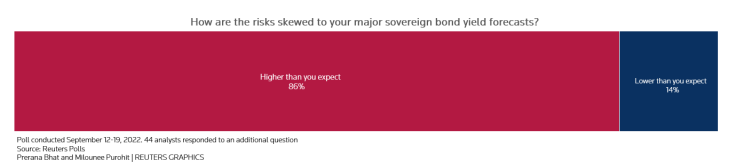

However, given the backdrop of stubbornly high inflation, the bias was clearly for yields to move higher. An overwhelming 86% of strategists, 38 of 44, said that was the risk to their forecasts.

The U.S. Federal Reserve, which sets the rate for the cost of capital globally by default, was forecast to go for a third consecutive jumbo 75 basis point hike on Wednesday, with a one in five chance of a bigger 100 basis point hike. [ECILT/US]

"A hawkish Fed keeps our core rates strategy unchanged: stay underweight front-end and lean, long back-end with increased risks of a hard landing," noted Mark Cabana, head of U.S. rates strategy at Bank of America Securities.

While bond yields were forecast to remain high, much of the rise was expected to come from shorter duration securities, which are the most sensitive to central bank rate hikes. That is set to continue given the Fed is not yet close to being done.

"If clients are looking to take an outright duration long, we still recommend waiting until the Fed delivers the last hike. For now, the curve is still biased flatter with a hawkish Fed," Cabana wrote.

There is no real consensus yet - but plenty of worry - about how far central banks need to go and how active they will be offloading their bloated balance sheets while raising rates.

Yields on U.S, German and UK two-year notes were trading at levels not seen for at least a decade as markets and economists expect the Fed, the European Central Bank and the Bank of England to continue raising interest rates.

"In the near-term the risks are to higher yields than we are currently forecasting," said James Knightley, chief international economist at ING.

GRAPHIC: Reuters Poll- Major sovereign bond market outlook

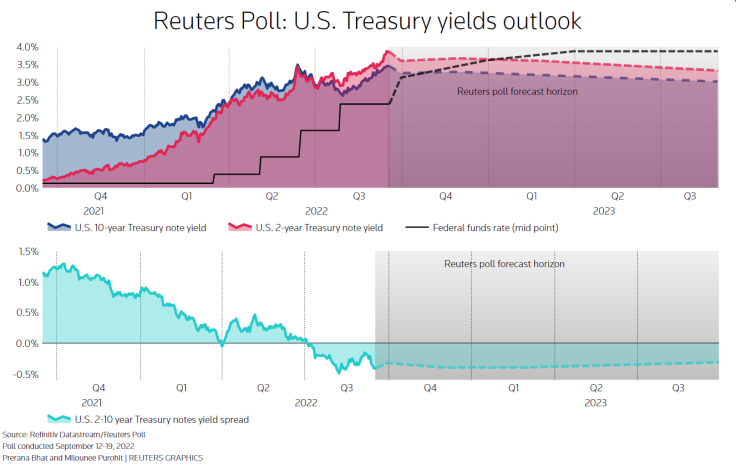

Poll medians showed U.S. Treasury two-year notes were expected to yield in a 3.6%-3.7% range over the next six months and then dip slightly to 3.3% in a year.

The story was similar on the other side of the Atlantic, with the German two-year note forecast to yield 1.51% and 1.75% in the next three to six months respectively. UK two-year gilts were forecast to yield around 3.0% over the next six months.

A sharp rise in short-term borrowing costs is likely to restrict economic activity and so also prevent yields on longer-term maturities from rising too much.

Benchmark 10-year bond yields for the U.S. and the UK were expected to dip below two-year notes in the next 12 months, inverting the yield curve, which in the past has forecast a recession was coming in the next 12-24 months.

GRAPHIC: Reuters poll-U.S. treasury yield outlook

In the euro zone, the yield curve was expected to be at its flattest since the beginning of the global financial crisis back in 2007.

"The recent significant rise in rates has been global in nature and has been a function of central bank hiking expectations as well as rising term premiums," noted Priya Misra, head of global rates strategy at TD Securities.

"We would argue that a faster pace of hikes by central banks and a higher terminal rate have been more dominant as evidenced by the flattening of the global sovereign curves."

(For other stories on major government bond yields and money market rates:)

© Copyright Thomson Reuters 2024. All rights reserved.