Spain, Greece Spur Fear, Boosting US Dollar, Bonds: Daily Markets Wrap

European stocks lost big Thursday as the European Central Bank cut Greek banks loose and Spain's borrowing costs kept skyrocketing. That European losses weighed on U.S. equities.

The head of the International Monetary Fund, Christine Lagarde, also warned of the extremely expensive consequences of Greece leaving the currency bloc. Concern over the health of Spanish banks grew as Bankia SA's liquidity troubles and reports, denied by officials who have every reason to allay worries, that depositors were withdrawing their funds was the main red flag.

In the U.S., the Philadelphia Fed Business Index report for May, which gauges manufacturing activity in the Mid-Atlantic region, showed an unexpected decline this month. The U.S. Labor Department said jobless applications last week were unchanged, suggesting a slowdown in hiring. On a more positive note, Federal Reserve Bank of St. Louis Chairman James Bullard made optimistic comments about the state of the U.S. economy, suggesting benchmark interest rate increases could come next year.

Stocks. Responding to the downbeat Philadelphia Fed report and the lack of momentum on jobs last week, U.S. stocks traded down with half of the Dow Jones Industrial Average components closing in the red, led by a 4.47 percent loss by Caterpillar Inc. (NYSE: CAT). The Dow leader was Wal-Mart Stores Inc. (NYSE: WMT), which rose 5 percent after it reported a 10 percent rise in first-quarter income. JPMorgan Chase & Co. (NYSE: JPM) fell 4.12 percent as it continues to struggle with fallout from last week's announcement regarding its risky betting from its London unit.

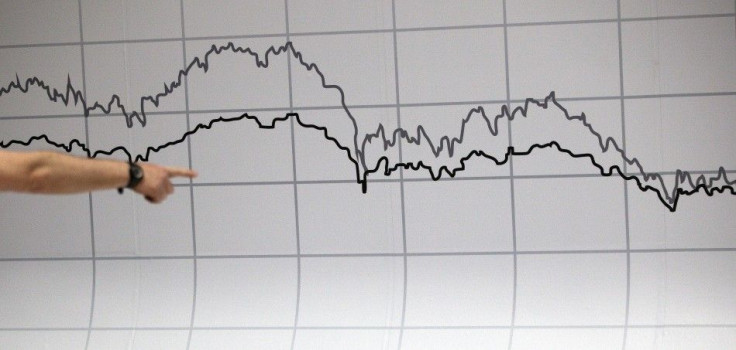

Bonds. Spanish 10-year bond yields have now risen by a third since April as investors fret over Spain's high debt and what would happen to its economy if Greece leaves the euro. The U.S. benchmark 10-year note yield closed at 1.70 percent, putting it closer to the record low of 1.67 percent struck in September.

Currencies. Europe's bust has been the dollar's bounty. The greenback rally entered its 14th session, the longest in at least 27 years. The euro dipped below $1.27, but managed to rebound to keep from closing at a four-month low.

Commodities. Many commodities that have been losing as traders ran for safety bounced back. Gold for June delivery rose 2.3 percent after a World Gold Council report said demand for the metal in China is growing and that the nation may surpass India to become the largest consumer of the precious metal. Silver for June followed gold to close over 3 percent higher. Oil is the major exception: Light crude for June delivery stayed below $94 a barrel; it has lost over 10 percent of its value in the past month.

© Copyright IBTimes 2024. All rights reserved.