Spain Property Market Outlook 2014: Home Price May Fall By Another 15%

After five years of double-dip recession, Spain’s economy seems to have stopped sinking. But the recovery will be a prolonged one. Despite having fallen almost 40 percent since the housing bubble burst in late 2007, home prices in the euro zone’s fourth-largest economy are expected to drop by another 10 percent to 15 percent before they stabilize.

“Recovery in the housing sector in Spain hinges on an improvement in employment and access to credit, both of which are prey to uncertainty,” Souheir Asba, an analyst at Societe Generale, said in a note.

Here are the reasons why Asba thinks Spain’s property market has yet to hit the bottom.

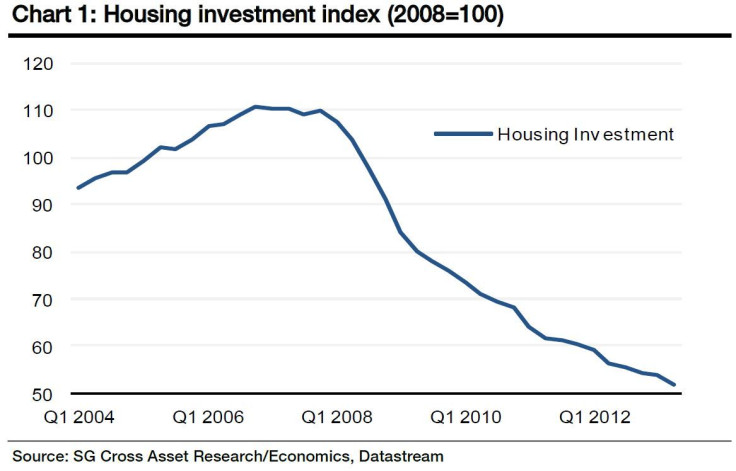

1. No significant investment in housing.

While a recent trend indicates an improved appetite for distressed Spanish real estate assets, it’s not significant enough to call for a revival of the market.

2. Flat household income prospects despite GDP growth.

Spain has finally overcome a slump triggered by the end of the real estate boom. The country emerged from recession in the third quarter of last year and its economy expanded 0.3 percent in the final three months of 2013, the fastest rate of quarterly growth in almost six years.

The Spanish government expects gross domestic product to grow by about 0.7 percent this year, and for job growth to resume in the second or third quarter.

The fact that investors are once again buying up Spanish government bonds is a big vote of confidence. As a result, the government is now paying much lower interest rates to borrow money. Yields on 10-year treasury bonds are down to 2006 levels.

On Jan. 23, Spain became the second euro zone country to exit its international bailout program, after Ireland.

Spain saw a meaningful pickup in exports last year, but the housing and construction sectors are still lagging behind.

For one, Asba pointed out that the unemployment rate is still too high, at 26 percent, to call for an impact on household income. Real wages are not expected to grow substantially in the short term either.

Moreover, the credit crunch that the country is experiencing has an impact on both corporates (specifically SMEs) and households. “This has limited expansion in internal consumption and narrows the benefits of improved financial conditions to mainly large corporates,” Asba said.

3. Widening supply and demand gap. This gap in the housing market has been widening for the last five years.

Asba noted that 2012 residential and non-residential construction permits represent a tenth of the 2006 levels due to both the lack of demand and the difficulties construction companies and real estate developers are now facing in starting new projects.

Meanwhile, the total housing stock stood at 25.3 million dwellings by the end of 2012, of which around 700,000 new dwellings are still unsold.

4. Mortgage market is nowhere near rebounding.

“The deleveraging process is ongoing among Spanish financial institutions, and we observe a transmission of this trend to households, although the transfer has not been very rapid,” Asba said.

By November 2013, the number of mortgages granted fell by 26.6 percent year-over-year, which corresponds to 970 million euros and approximately 84 percent since the end of 2007.

5. Prices likely to drop further.

A report prepared by one of the major real estate portals in Spain (idealista.com) notes that of a sample of 0.5 million bids since 2010, the prices offered were 24 percent lower than the bids (as of August 2013). “As anecdotal as this might sound, the key message behind the statistic is that Spanish households are indeed waiting for a correction in prices,” Asba said.

© Copyright IBTimes 2024. All rights reserved.