Sprint May Launch 3G iPhone 5 in Mid-October

Apple's tight-lipped approach towards its iPhone 5 release date has fueled several rumors, and the latest is that U.S. carrier Sprint will carry it along with Verizon and AT&T.

The rumors of iPhone 5 coming to Sprint have been making the rounds for some time. But the new twist in the tale is that Sprint would launch only a 3G version of iPhone 5, not 4G.

From recent discussions with industry contacts, we believe Sprint and Apple are moving forward toward a launch of the iPhone 5 concurrent with the refresh that next occurs with AT&T and Verizon. We believe this phone would be 3G, but not 4G, capable, RBC Capital Markets analyst Jonathan Atkin wrote in a note to clients.

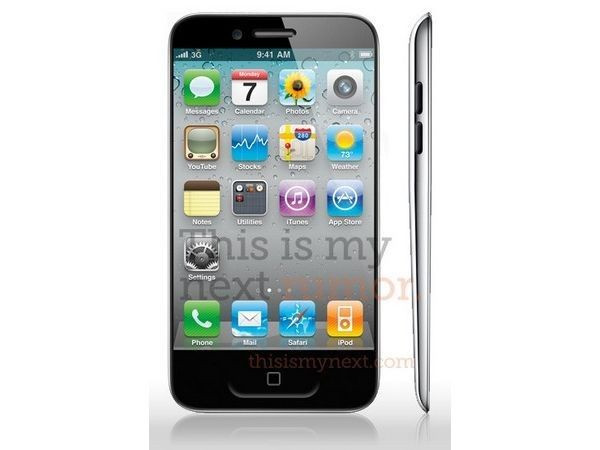

The Wall Street Journal reported that Sprint will begin selling the iPhone 5 in mid-October. According to people familiar with the matter, the new iPhone will be similar to the iPhone 4, but thinner and lighter with an improved digital camera and a new more sophisticated operating system.

If iPhone 5 comes to Sprint, it will significantly boost the carrier's prospects. While Verizon and AT&T have banked on the high-end smartphone sector to boost sales, Sprint has so far been left out of the race. This can change now, and investors are weighing in on the prospects.

The analyst said the iPhone 5 could augment postpaid subscriber momentum starting in fourth quarter 2011 as a result of increased share gains and reduced churn. Sprint is already seeing favorable postpaid trends in the third quarter.

Atkin's base case suggests that Sprint would generate positive postpaid net additions and see an approximately 20 bps improvement in churn following an iPhone launch, but would experience cumulative EBITDA dilution of $493 million in 2012 until seeing EBITDA accretion in the second quarter of 2013.

Our base case assumes iPhone activations of 1.6M and 6.0M in 4Q11 and 2012, respectively, with 5% y/y growth in 2013 and 2014, and we estimate that 20% of the iPhone activations are new to Sprint. The base-case churn improvement of 20 bps results in 721K and 707K reductions in disconnects in 2012 and 2013, respectively, versus our current Sprint model, Atkin wrote.

For every 10 basis points improvement in churn, postpaid net additions would improve by approximately 380K annually, the analyst said.

In our base assumption, postpaid service revenue increases by $715 million and $884 million in 2012 and 2013, respectively, through increases in the postpaid subscriber base and higher ARPU generation. As the iPhone would accelerate the smartphone adoption at Sprint, in our opinion, the number of subscribers paying the $10 add-on fee for smartphone subscribers would increase faster postpaid ARPU growth, said Atkin, who has an outperform rating on the stock.

© Copyright IBTimes 2024. All rights reserved.