Starbucks (SBUX) Bets On Food, China And Innovation For 2014

The Starbucks Corporation (NASDAQ:SBUX) is betting big on food, China and new products to maintain its strong pace of growth in 2014, according to remarks that were made at a presentation on Tuesday.

Food sales provide some of the biggest potential upside for the Seattle-based coffee retailer. The company rolled out only half of the number of planned bakery products under its acquired La Boulange brand, with some food items appearing for the first time last year.

“Food is probably the biggest near-term opportunity that we can see,” Chief Financial Officer Scott Maw told investors at a conference in New York. “We continue to say: ‘It’s early days.’”

About 30 million U.S. Starbucks sales transactions each week don’t include food at all, according to the company. That’s even after the food as a share of sales doubled in the past decade. Starbucks has yet to push its food offerings in a big way internationally, and it is first experimenting it in the U.S.

Both food and new drinks have usually added one to two points of comparable sales growth each quarter, for the past several quarters, company executives told investors. They expect that steady but small contribution to continue.

In the summer of 2014, the U.S. Sun Belt states, which include Texas, Alabama and Florida, among others, will see new Starbucks’ handcrafted sodas. That will hit a third of Starbucks’ U.S. stores and has already been tested in Atlanta, Austin, Texas, and Japan, before a planned national rollout in 2015.

Fresh products have helped Starbucks drive sales growth even as consumers in developed markets suffered from stagnant wages and the financial crisis. Starbucks is among U.S. companies that have bested older household names, such as McDonald’s Corporation (NYSE:MCD) or Wal-Mart Stores, Inc. (NYSE:WMT) on pure sales growth.

The U.S. is still Starbucks' largest single market. The Americas region drove almost 75 percent of Starbucks’ revenue last year, compared to 6 percent for China and the Asia-Pacific region and 8 percent for Europe, the Middle East and Africa (EMEA) combined.

Starbucks plans 1,500 new stores in fiscal 2014, with the 750 slated for China and the Asia Pacific region. Those stores deliver the greatest return on investment, at 63 percent relative to a 22 percent return on EMEA stores. Starbucks has not been as popular in Europe.

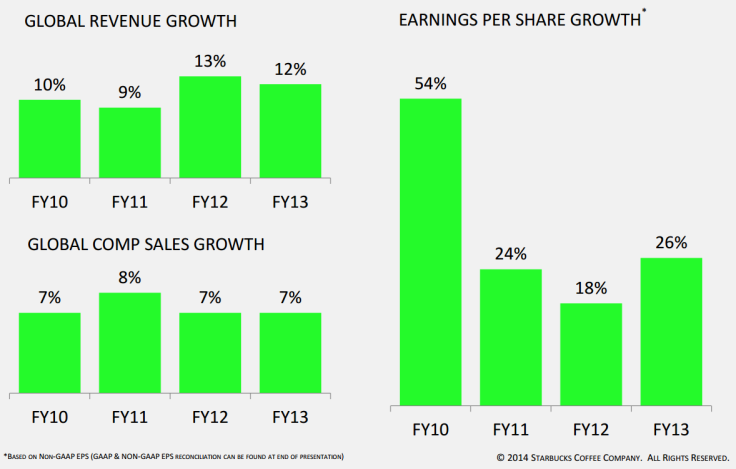

The company will aim for revenue growth of 10 percent or more in 2014, though it will plan for only about five percent in global store sales growth, according to its latest outlook from late January. That outlook remained unchanged as of Tuesday and includes capital spending of $1.2 billion.

Starbucks also calls itself the largest mobile payments retailer in the U.S. It plans to allow customers to order in advance before even entering its stores, so that rushed coffee-drinkers can save time. An express system for people who need to skip queues may also be in the works. Advance-ordering technology will launch in a major market this year, Chief Operating Officer Troy Alstead said.

“We’re not overly concerned with what’s happening with coffee costs today, as it impacts our business,” Alstead said during the presentation. Volatile coffee prices, driven by forecast oversupplies and unfavorable weather in Brazil, are on the radar for some analysts and investors lately. The company lost $206 million in operating income in fiscal 2012 due to high coffee prices.

Not all analysts agree with Starbucks’ case for growth, however. Belus Capital Advisors downgraded the company from Buy to Hold in early January, before earnings came out.

“There are operating issues in the store that have to be addressed, suggesting it could take more time to deliver on the strong growth anticipated by the market,” Belus Chief Equities Strategist Brian Sozzi wrote on Feb. 4. “With Starbucks, it’s about delivering to the high standards the Street has come to demand.”

Executing its ambitious agenda, which also emphasizes tea, digital platforms and K-cup sales, could be tricky and a key business risk, according to investment advisor Morningstar.

Starbucks is the world’s largest coffee shop chain. It operates more than 20,000 stores in more than 64 countries.

© Copyright IBTimes 2024. All rights reserved.