Stock, Bonds Groggy After Rout; Eyes Peeled On Fed

Global stocks and bonds gyrated in choppy trade on Tuesday after the prior day's market rout, while investors braced for a U.S. interest rate rise this week that could be the largest in 28 years.

Surprisingly strong U.S. inflation data released last Friday has fueled bets that the Federal Reserve must tighten monetary policy more aggressively to tame soaring prices. Fears that the tightening could bring on a recession walloped global equities and government bonds on Monday.

Investors are now betting with near certainty that the Fed will announce a 75-basis-point rate increase - the largest since November 1994 - at the end of its two-day policy meeting on Wednesday.

"It's the meeting everyone has on their radar. ... And the market will be hanging off every word Fed Chair Jerome Powell has to say," said Chris Weston, head of research at Pepperstone Group Ltd, a currency broker in Australia. "The market wants answers on its commitment to smash inflation."

By early afternoon in New York, the Dow Jones Industrial Average was flat, the S&P 500 was up 0.21%, and the Nasdaq Composite rose 0.9%.

MSCI's gauge of stocks around the world dropped 0.25% to levels last seen in November 2020, while a pan-European equity index slumped 1.26% to March 2020 lows.

Underscoring expectations of rising U.S. rates, two-year Treasury yields rose as high as 3.430%, the highest level since November 2007, while 10-year Treasury yields struck an 11-year high of 3.4620%. [US/]

Markets now see the Fed's rate hike cycle peaking around 4%, rather than the 3% seen last month.

Euro zone government bond yields also hit multi-year highs, as spreads between core and periphery widened amid concerns about accelerated central bank monetary tightening. [GVD/EUR]

Investors' repricing of higher rates has pummeled assets that benefited from rock-bottom interest rates, including stocks, crypto, junk-rated bonds and emerging markets.

Monday's sell-off pushed the S&P 500 index into a bear market, with the index falling more than 20% from its Jan. 3 record closing high.

(Graphic: Fed terminal rate-

)

"Quite simply, when we see monetary tightening the order of what we are seeing globally, something is going to break," said Timothy Graf, head of EMEA macro strategy at State Street.

"Stock markets are reflecting the reality of the first-order effect of tighter financial conditions," Graf said, predicting that with U.S. stock valuations still above COVID-era lows, there is more pain to come.

"I think there are other shoes to drop," he said.

MSCI's broadest index of Asia-Pacific shares outside Japan closed 0.59% lower, tracking Wall Street's losses, while Japan's Nikkei lost 1.32%.

Crypto markets, where bitcoin and ether hovered near 18-month lows, have also been drubbed by interest rate expectations and crypto lender Celsius Network's decision to freeze withdrawals.

Bitcoin, which fell as low as $20,816, recovered to $22,599 on Tuesday.

Brent crude futures rose 0.2% to $122.5 a barrel, supported by expectations that supply will stay tight. [O/R]

State Street's Graf did not see recession as inevitable, but said that "monetary tightening and the squeeze on real incomes from commodity prices mean the probability has gone up."

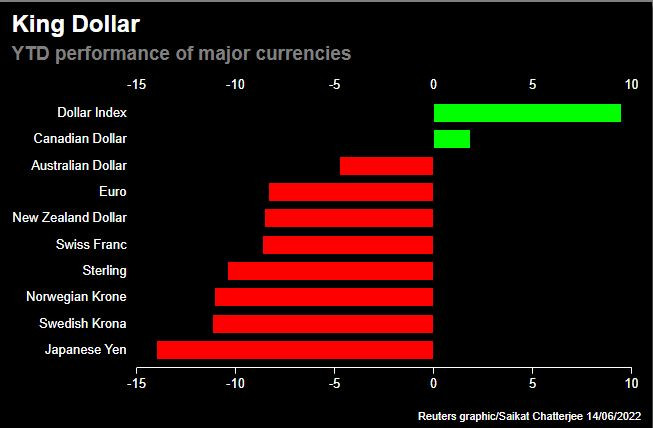

Rising yields and the flight from risk helped the dollar surge to a 20-year high against a basket of currencies.

The dollar index, which measures the greenback against a basket of six major currencies, was up 0.2% after hitting a high of 105.46.

A strong dollar pinned the euro near a one-month low at $1.04225, and pressured the yen, which languished near a 24-year low at 134.94 against the dollar. [USD/]

With the Bank of Japan expanding bond purchases on Tuesday and unlikely to budge from its ultra-low rates policy at its Friday meeting, a respite for the yen looks unlikely.

"Given Wednesday may see the Fed go 75 bps and flag more, while the BOJ on Friday will only flag more bond buying, the yen is not going to stay at these levels for long. It's going to get much, much worse," Rabobank strategist Michael Every said.

A strong dollar and rising yields weighed on gold. Spot gold slipped 0.4% to 1,811.40 an ounce. [GOL/]

(Graphic: King dollar-

)

© Copyright Thomson Reuters 2024. All rights reserved.