Stock futures rebound from plunge, all eyes on Fed

Stock index futures rose on Tuesday, indicating a partial rebound from the previous session's nosedive, as investors looked to a Federal Reserve statement for clues on how it may combat the growing perception the nation was headed for recession.

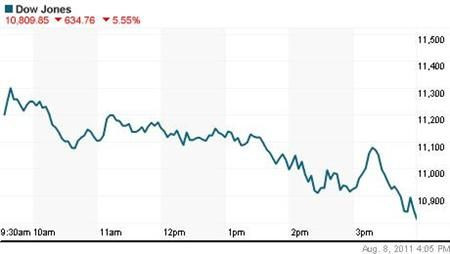

Equities suffered a massive slide on Monday as the S&P recorded its worst loss since December 2008 and approached bear market territory.

Both the S&P and Nasdaq dropped more than 6 percent and the Dow fell more than 5 on the heaviest trading volume since the "flash crash" in May 2010. The CBOE Volatility Index jumped 50 percent.

Standard & Poor's downgrade of the U.S. credit rating late Friday, removing its triple-A designation for the first time in history, sparked the decline and underlined fears a recession was inevitable, given increasing signs of slowing growth and more turmoil in the euro zone.

Fed policymakers meet on Tuesday, and a Fed statement, due at 2:15 p.m EDT, will be closely scrutinized. While the central bank isn't expected to debut any massive new program to help asset prices, investors may return to selling if there's no indication that help is on the way.

S&P 500 futures rose 23.8 points and were above fair value, a formula that evaluates pricing by taking into account interest rates, dividends and time to expiration on the contract. Dow Jones industrial average futures added 194 points, and Nasdaq 100 futures rose 40.75 points.

Overseas, the FTSEurofirst 300 index of top European shares fell 1.8 percent, while Hong Kong shares slumped to their lowest since June 2010.

September crude futures lost 2 percent to $79.67. Gold, seen as a safe haven for assets, soared to another record of $1,778 an ounce.

Adding to global concerns, China's annual inflation quickened to a higher-than-expected 6.5 percent in July, putting its central bank in a bind as it tries to keep prices in check without dragging down an economy facing increasing threats from abroad.

Even though fear remained a dominant emotion in the markets, analysts said stocks could be nearing a bottom. They noted the S&P was now more technically oversold than at any other time in the last ten years. Its 14-day relative strength index was at 16.5 percent. Generally a level below 20 attracts buyers.

Bank of America Corp, the S&P's biggest decliner on Monday, edged 1.4 percent higher to $6.60 in premarket trading.

Dow component Walt Disney Co is scheduled to report quarterly results later Tuesday, with investors watching for an outlook on its theme park business in the midst of economic uncertainty.

Also due are Sempra Energy and Scripps Networks Interactive Inc.

Every S&P 500 component ended in negative territory in Monday's selloff, with all ten S&P sectors losing more than 3.5 percent. At its low, the Dow fell under 11,000 for the first time since November.

© Copyright Thomson Reuters 2024. All rights reserved.