Stock Market 2014 Outlook: S&P Capital IQ Forecasts Correction Without New Bear Market

It has been a great year for the U.S. stock market thus far, with major indices hitting strings of closing records. The phenomenal rally begs the question: How much gas is left in the tank?

“We believe a correction is not only possible, but is also probable in the year ahead,” said Sam Stovall, chief equity strategist at S&P Capital IQ, in a note. “However we don’t think a new bear market will ensue.”

While there remains a number of headwinds, past behavior at least suggests “good years tend to follow great years.”

Year to date through the end of November, the S&P 500 (INDEXSP:.INX) was up 26.6 percent in price. In addition, all 10 sectors in the index were higher, led by consumer discretionary, health care, industrials and financials.

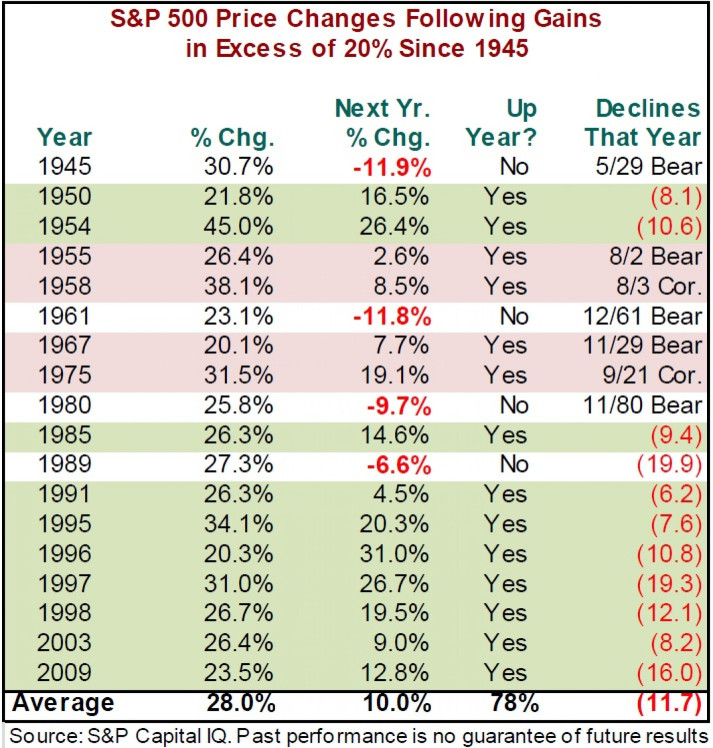

Since 1945, there have been 21 times that the S&P 500 gained more than 20 percent, according to historical data compiled by S&P Capital IQ.

In the following year, the S&P 500 recorded an average increase of 10 percent, versus an average price gain of 8.7 percent for all years since WWII.

This subsequent “good” year was not achieved without challenges, however. Each one had to ride out at least one intra-year decline in excess of 6 percent, and some years -- such as 1950, 1986 and 2010 -- suffered through more than one.

During 10 of these 21 “good” years, the S&P 500 declined a minimum of 6.2 percent and as much as 19.3 percent, while still registering a positive performance for the entire year.

Correction Ahead

S&P strategists see the U.S. market moving higher, with the benchmark index at 1,895 in 12 months -- a level that implies a 5 percent price gain from the end of November’s level.

“We also believe 2014 could be one of those years in which the S&P 500 is up for the entire year, but has to suffer through a pullback of at least 5 percent to 10 percent, and more likely a correction of 10 percent to 20 percent, before ending the year higher than where it started,” Stovall said.

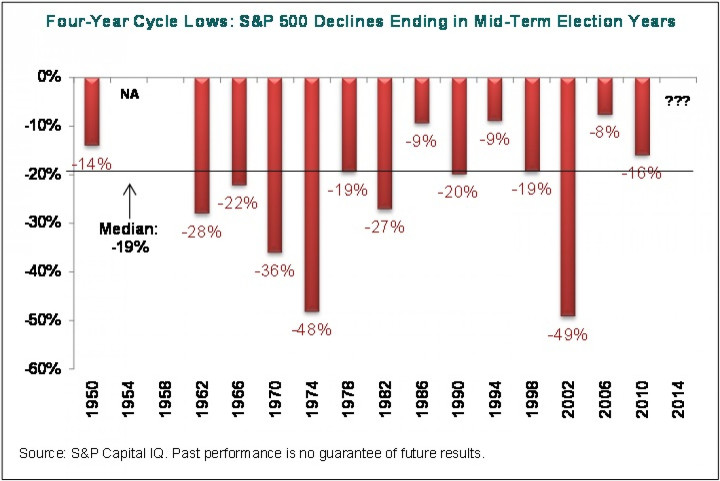

One reason is that the S&P 500 has elapsed 26 months without slipping into a correction, versus the average of 18 months (and median of 12 months) between declines of 10 percent or more since 1945. “And since we believe stock market corrections have not been repealed, but are often times delayed, we think another correction will occur within the coming calendar year,” Stovall added.

In addition, 2014 is a mid-term election year, which falls into the cycle of the four-year low. Since WWII, the S&P 500 has endured 12 bear markets, with seven of them occurring in a mid-term election year (1962, 1966, 1970, 1974, 1982, 1990 and 2002), according to S&P strategists.

But Won’t Slip Into Bear Market

One reason S&P strategists don’t think the S&P 500 will slip into a new bear market in 2014 is that they don’t foresee a recession.

The firm forecasts U.S. GDP will climb 2.5 percent in 2014, compared with an advance of only 1.6 percent seen for this year, slowed primarily by the sequestration. The unemployment rate is seen averaging 7.0 percent for all of 2014, but is expected to break below that threshold in the third quarter of next year.

Another reason they don’t expect a new bear market is that they do not believe the U.S. equity markets are in the midst of an inflating bubble. “While we agree that the S&P 500’s valuations are no longer compelling, they are not stretched and in need of justification as they were in the late 1990s,” S&P strategists said.

© Copyright IBTimes 2024. All rights reserved.