Stocks Cling To Week's Gains, Biden Talks Russia With Beijing

Global stocks were just below water on Friday with most of their strong gains for the week still intact but the mix of rising interest rates, high oil prices and war in Ukraine kept risk-taking at bay.

U.S. stocks were also set for a pause, with trading on Wall Street likely to be bumpy due to "triple witching" as investors unwind positions in futures and options contracts before expiry.

S&P 500 futures eased 0.6%, with little in the way of major data or corporate news ahead of Wall Street's opening bell to distract investors from headlines about the war in Ukraine or ease underlying concerns over high inflation.

U.S. President Joe Biden talks with his Chinese counterpart Xi Jinping at 1300 GMT, with the White House expected to deliver a warning that Beijing will pay a price if it supports Russia's war effort.

The MSCI world stock index was down 0.2% at 694 points, still up more than 5% for the week but well below its lifetime high of 761.21 from Jan. 4.

Tom O'Hara, portfolio manager at Janus Henderson, said markets were twitchy, with investors terrified they will miss out on any further rebound in stocks, or that the economy is heading for stagflation.

"Whichever way I look at it, the situation challenges the growth narrative we had for the past 10 years. We didn't have inflation so it hits an environment which most funds have not navigated in a long time," O'Hara said.

In Europe, the STOXX index of 600 leading companies was down 0.4% at 449 points, still heading for its best week since November 2020, though about 9% below its early January lifetime high.

"Sentiment is still pretty cautious, it's looking for some reason to rally but it's struggling to find something which it has strong conviction in," said Seema Shah, chief strategist at Principal Global Investors.

After the U.S. Federal Reserve on Wednesday finally embarked on a series of interest rate hikes, from here on it was a question of watching how the economy evolves and how high inflation rises before peaking, Shah said.

Oil prices remained above $100 a barrel after slim progress in peace talks between Russia and Ukraine raised the spectre of tighter sanctions and a prolonged disruption to crude supply.

There was also relief after Russia paid $117 million in interest due on two sovereign dollar bonds, easing doubts about its ability to honour external debt after harsh sanctions imposed by the West.

In Asia, MSCI's broadest index of Asia-Pacific shares outside Japan was down 0.17% and Hong Kong's Hang Seng steadied following a furious two-day surge. Japan's Nikkei rose 0.6%.

The impact on inflation of port and supply chain disruption in China due to a spike in COVID-19 infections risks being massively overlooked by markets, said Michael Hewson, chief markets analyst at CMC Markets.

"That is going to be a headwind for valuations and while we are getting a fairly decent rebound at the moment, I really struggle to see whether or not we can move above the highs we have seen this year," Hewson said.

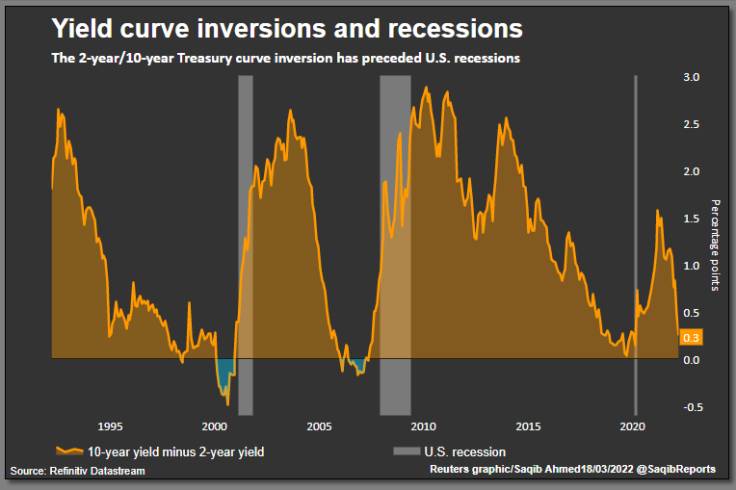

Graphic: Yield inversion:

YIELD INVERSION ALERT

Problems faced by policymakers whose economies are suffering surging inflation and sagging growth were underscored during a series of central bank meetings this week.

The Fed raised rates for the first time in more than three years on Wednesday and surprised traders with a more hawkish than expected outlook. The Bank of England also hiked but the surprise there was a dovish outlook that drove a rally in gilts.

The Bank of Japan offered no surprises on Friday, leaving policy ultra easy, which has kept heavy pressure on the yen.

Meanwhile the gap between two- and 10-year U.S. Treasury yields is near its tightest since March 2020, when economies were slammed by the start of COVID lockdowns.

That leaves the yield curve not far from inverting, long a reliable indicator of a likely recession in the following one or two years.

The benchmark 10-year Treasury yield was last at 2.1548%.

Oil, which had crumbled some 30% from last week's peak, has bounced again as traders fret that hope for peace in Ukraine is misplaced. Brent crude futures were off 0.4% at $106 a barrel.

Wheat and corn futures, which are sensitive to Black Sea supply disruptions, have also risen sharply. [GRA/]

Japan's currency hit a six-year low this week and last traded at 119 per dollar. "The next multi-session target may well be the 120.00 psychological level," said Terence Wu, a strategist at OCBC Bank in Singapore. [FRX/]

The euro hovered at $1.103, down 0.55% on the day

Spot gold was at $1,938, down 0.2%, and bitcoin was clinging on above $40,000, down 1.2%.

© Copyright Thomson Reuters 2024. All rights reserved.