Stocks Mixed After Putin Sees 'Positive Shifts' In Ukraine Talks

Wall Street and European stocks were mixed, while gold dropped on Friday after Russian President Vladimir Putin said there had been some progress in Moscow's talks with Ukraine.

Putin did not provide any details and recent talks between the two countries have made little headway.

U.S. President Joe Biden on Friday said the United States will revoke Russia's "permanent normal trade relations" status, a change Biden said would pave the way for the U.S. to impose tariffs on a wide range of Russian goods.

The war in Ukraine, now in its third week, and the prospect of central banks tightening monetary policy to tame inflation just as the global economy begins to slow has sent financial markets swinging wildly up and -- mostly -- down.

Data on Thursday showed U.S. inflation at a four-decade high, prompting traders to raise their bets on interest rate hikes from the Federal Reserve beginning next week and sparking a sell-off in the prior trading session.

The Bank of England is expected to tighten next week, especially after January's economic growth numbers came in stronger than expected on Friday. A more hawkish than expected European Central Bank this week added to the sense policymakers will not be deterred by the uncertainty wrought by the war in Ukraine and will tighten.

But after another bruising week and with commodity prices down from recent highs, traders looked for reasons to buy back into riskier assets, including stocks.

"Overall, central banks now have less flexibility to cushion shocks to equity markets, as they have succeeded in doing over recent years," said Mark Haefele, chief investment officer, global wealth management, at UBS.

But he said simply selling out of stocks was not advisable.

"Our view remains that simply selling risk assets is not the best response to the war in Ukraine," he said, advising investors to reduce equity exposure.

At 10:45 a.m. EST (1545 GMT), the Dow Jones Industrial Average rose 174.28 points, or 0.53%, the S&P 500 gained 3.99 points, or 0.09%, and the Nasdaq Composite dropped 51.72 points, or 0.39%, to 13,078.24.

The pan-European STOXX 600 index rose 1.22% and MSCI's gauge of stocks across the globe shed 0.23%.

Emerging market stocks lost 1.40%. MSCI's broadest index of Asia-Pacific shares outside Japan closed 1.56% lower, while Japan's Nikkei lost 2.05%.

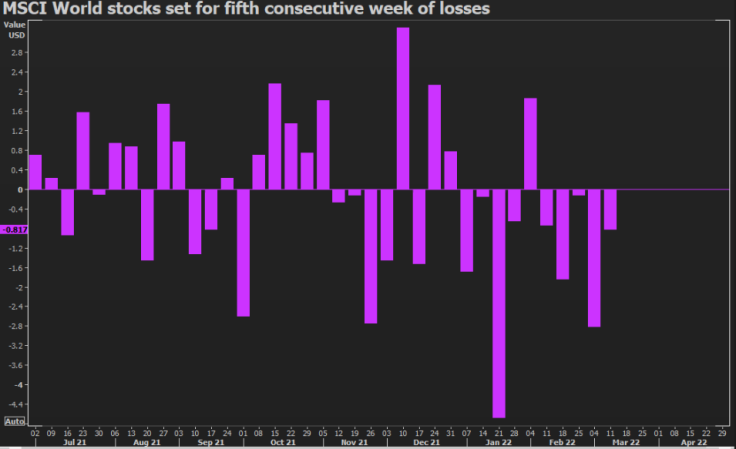

Graphic: MSCI World Index:

Spot gold dropped 1.0% to $1,975.40 an ounce, after traded as high as $2,070 on Tuesday. [GOL/]

EURO FALLS

The ECB's more hawkish tone had failed to boost momentum for the single currency substantially as investors continued to fret about the impact of the war in Ukraine on the euro zone economy. [FRX/]

The euro was last down 0.31% at $1.0949.

"On another day -- i.e. prewar -- EUR/USD might have enjoyed lasting gains on ECB hawkishness," said Chris Turner, global head of markets at ING.

"Yet it looks unlikely that an ECB, barely matching (Fed) tightening, can generate a stronger euro in the face of heavy terms of trade losses."

The yen weakened 0.69% versus the greenback to 116.92 per dollar, a more than five-year low.

The dollar index was last up 0.435% at 98.762, below a more than 1-1/2-year high of 99.418 hit on Monday.

In commodity markets, oil prices rose but were way off the multiyear highs reached earlier in the week. U.S. crude recently rose 2.4% to $108.56 per barrel and Brent was at $111.49, up 1.98% on the day.

© Copyright Thomson Reuters 2024. All rights reserved.