Stocks Rise, Dollar Dips on Bernanke Comments

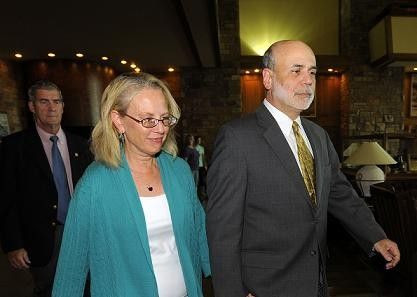

World stocks rose 1 percent and the dollar fell on Friday as Federal Reserve Chairman Ben Bernanke left the door open for future U.S. economic stimulus.

Speaking at the Fed's annual retreat in Jackson Hole, Wyoming, Bernanke did not offer new measures to boost the economy but said it was critical for the economy's health to reduce long-term joblessness.

U.S. stocks ended more than 1 percent higher, reversing losses of as much as 2 percent just after Bernanke started speaking, while Treasuries, whose yields are at near-historic lows, ended higher but well off earlier gains.

Bernanke said the central bank's policy panel would meet for two days in September instead of one to discuss additional monetary stimulus, offering some hope to investors.

He didn't give the market the green light for QE3 -- he also didn't give the market the red light for QE3, said Kevin Caron, market strategist at Stifel, Nicolaus in Florham Park, New Jersey, referring to the Fed's quantitative easing program.

By implying that inflation is viewed as not a concern, it leaves the possibility for something down the road, he added.

The speech follows several turbulent weeks for markets, with investors facing concerns about another U.S. recession and escalating euro zone debt troubles, as well as a downgrade of the top-tier U.S. credit rating.

Analysts said the very choppy trade in many markets after Bernanke spoke reflected the concern about the U.S. economy, as well as a realization that U.S. interest rates will stay at record lows for years to come.

World stocks as measured by the MSCI world equity index .MIWD00000PUS were up 0.7 percent, but are down 11.1 percent since the start of the month, while ICE Brent for October delivery settled at $111.36 a barrel, gaining 74 cents.

Bernanke's speech last year laid the groundwork for the Fed's $600 billion bond-buying program to revive the economy under the rubric QE2 for the Fed's second round of stimulus, or quantitative easing.

The stimulus plan was the basis for a sharp rally in stocks last fall.

The dollar gained on the euro after the speech but later shed those gains, with the euro last up 0.8 percent at $1.4489, near a session peak of $1.4502 set on trading platform

EBS.

The dollar .DXY was down 0.7 percent against a basket of currencies.

An increase of money supply, such as the QE2 program, tends to erode the value of the dollar relative to other currencies. It also depresses Treasury yields and encourages investors to seek higher returns elsewhere.

I would say that longer term, the Fed is keeping their powder dry, said Andrew Busch, senior currency strategist at BMO Capital Markets in Chicago. But the fact is that the Fed has the easiest monetary policy on the planet, and that will eventually force the dollar to go lower.

At the close, the Dow Jones industrial average .DJI was up 134.72 points, or 1.21 percent, at 11,284.54. The Standard & Poor's 500 Index .SPX was up 17.53 points, or 1.51 percent, at 1,176.80. The Nasdaq Composite Index .IXIC was up 60.22 points, or 2.49 percent, at 2,479.85.

The FTSEurofirst 300 .FTEU3 ended the day down 0.7 percent at 919.03.

WALL ST PREPARES FOR IRENE

As Hurricane Irene bore down on North Carolina, tens of thousands of people evacuated and East Coast cities, including New York, braced for a weekend hit from the powerful storm.

Wall Street scrambled to raise cash in case the storm causes major disruption in trading for thousands of traders who live in the New York metro area.

The repurchase market, a major source of cash for Wall Street to fund trades and operations, showed an increase in interest rates on loans that mature on Monday, a sign markets are worried there could be disruptions - however temporary - as a result of the hurricane.

Interest rates on loans backed by Treasury bonds that expire on Monday rose by several hundredths of a percentage point from late Thursday to about 0.08 percent in the $1.6 trillion repurchase market.

U.S. Treasuries prices clung to slight gains, even as volume petered out.

Benchmark 10-year Treasury notes last traded up 12/32 in price to yield 2.19 percent, down from Thursday but up 12 basis points on the week. They posted a full-point gain immediately after Bernanke started speaking.

Gold rose after days of liquidation pushed bullion down from record highs this week. Spot gold was up 2.2 percent at $1,808.60 an ounce.

On the New York Mercantile Exchange, crude for October delivery rose for a second day and settled at $85.37 a barrel, gaining 7.00 cents. Traders positioned ahead of the arrival of Irene, as oil terminals, refineries, pipelines and other energy infrastructure prepared for the stormy weekend.

© Copyright Thomson Reuters 2024. All rights reserved.