Stocks Sink On Fears For Global Economy, Capping Worst H1 On Record

Stocks sank on Thursday to extend what is the worst first half of a year for global share prices on record, as investors fret that the latest show of central bank determination to tame inflation will slow economies rapidly.

Central bank chiefs from the U.S. Federal Reserve, the European Central Bank and the Bank of England met in Portugal this week and voiced their renewed commitment to control inflation no matter what pain it caused.

While there was little new in the messaging, it was another warning that the era of cheap cash which had turbocharged share prices for years is coming to an end.

Traders are now focused on data on U.S. core prices due at 1230 GMT that are expected to underline the extent of the inflation challenge.

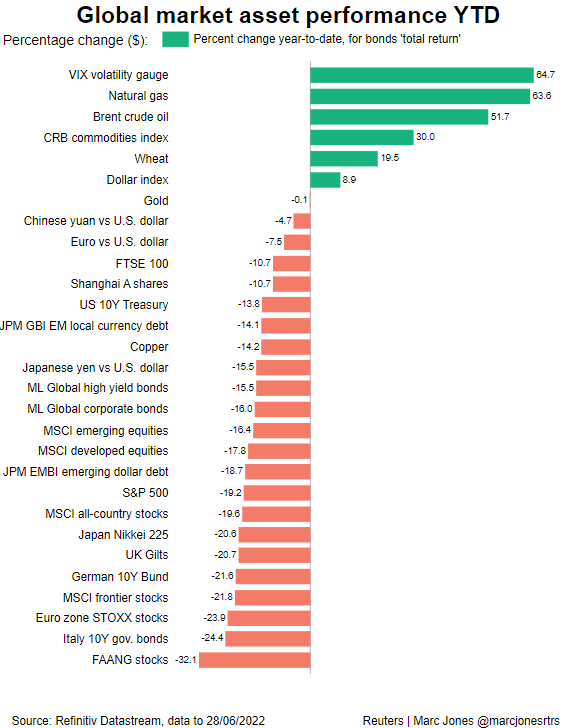

The MSCI World Equity Index was last down 0.67%, with its year-to-date losses down more than 20% -- the worst fall since the index's creation. The falls have wiped $13 trillion off stock values.

On Thursday, the Euro STOXX extended earlier falls in the European mid-session to drop 2.15%, while the German DAX weakened 2.45%. Britain's FTSE 100 was off 1.98%.

U.S. futures fell sharply, with little sign yet that the new quarter will bring in brave bargain hunters. This year's dramatic slide in asset prices has been led by tech-heavy indexes and stocks more sensitive to rising interest rates.

The S&P 500 has lost 20%, its worst first-half of a year since 1970, and its worst performance during two quarters since the 2008 financial crisis.

"Fed Chair (Jerome) Powell and the FOMC (Federal Open Market Committee) don't want to get this one wrong. They want to be 90% sure that inflation is on the way down, not evenly balanced," said Steve Englander, Standard Chartered's head of global G10 FX research.

"So the signals they send become increasingly hawkish when they see the market as possibly prematurely pricing in victory over inflation."

(Graphics:

)

Sweden's Riksbank became the latest to jack up borrowing costs, pushing its key rate to 0.75% from 0.25% as expected and flagging further sharp tightening to try and control price growth.

The Hungarian central bank also hiked, raising rates by 0.5% to 7.75%.

MSCI's broadest index of Asia-Pacific shares outside Japan eased 1.25%.

Japan's Nikkei fell 1.54%, though its drop this quarter has been a relatively modest 5% thanks to a weak yen and the Bank of Japan's dogged commitment to super-easy policies.

Chinese blue chips added 1.44%, helped by a survey showing a marked pick up in services activity.

With investors so fearful of a sharp global economic slowdown caused by central banks tightening policy, some analysts are willing to call for a second-half rebound.

"It is not that we think that the world and economies are in great shape, but just that an average investor expects an economic disaster, and if that does not materialize risky asset classes could recover most of their losses from the first half," JPMorgan wrote in a research note.

DOLLAR REIGNS SUPREME

The risk of recession has been enough to bring U.S. 10-year yields back to 3.06% from their recent peak at 3.498%, though that is still up 73 basis points for the quarter and nearly 160 bps for the year.

The Fed's hawkishness and an investor desire for liquidity in difficult times has gifted the U.S. dollar its best quarter since late 2016. The dollar index on Thursday rose 0.3% to 105.34, putting it a whisker off its recent two-decade peak of 105.79.

The Swedish crown fell, with the Riksbank rate hike priced in -- the euro was last up 0.3% at 10.719 crowns.

Sterling showed little reaction to data showing the UK balance of payments deficit hit a record 8.3% of GDP. The statistics office cautioned that the data was subject to more uncertainty than usual.

The euro weakened 0.3% to $1.0407, having shed 6% for the quarter and 8.4% for the year. It dropped to a new 7-1/2-year low versus the Swiss franc at 0.9963 francs.

The Japanese yen is in even worse shape, with the dollar having gained more than 12% this quarter and 18% this year to 137, its highest since 1998.

Oil prices, which have soared in 2022 along with most commodity prices, edged lower on Thursday amid concerns about an unseasonable slowdown in U.S. gasoline demand. [O/R]

OPEC and OPEC+ end two days of meetings on Thursday with little expectation they will be able to pump much more oil despite U.S. pressure to expand quotas.

Brent slipped 0.5% to $115.63 a barrel, while U.S. crude declined 0.46% to $109.29.

Bitcoin slipped 5%, and was briefly below $19,000.

© Copyright Thomson Reuters 2024. All rights reserved.