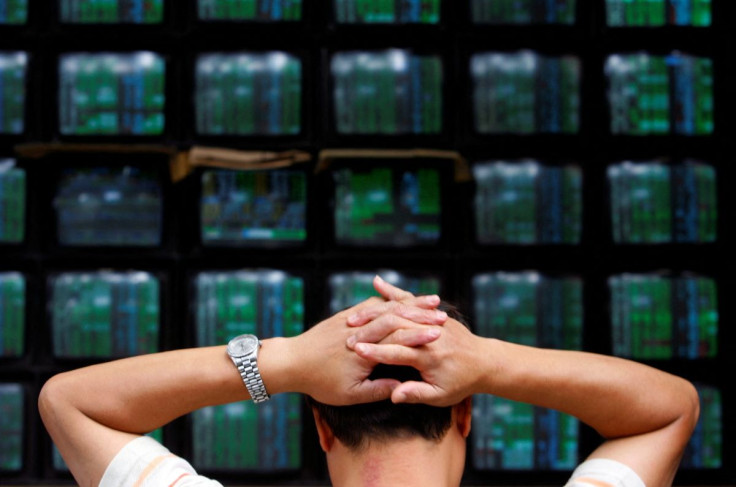

Stocks Slump On Fresh Inflation, China COVID Worries

Asian stocks sank on Monday and bond yields ticked higher as red-hot inflation reignited worries about even more aggressive U.S. interest rate increases while new mass COVID-19 testing in China sparked concerns of more crippling lockdowns.

The heightened expectations about Federal Reserve rate hikes drove the Japanese yen to a more than two-decade low against the dollar, prompting more concern from authorities about the sharp moves down.

MSCI's benchmark Asia-Pacific equity index slumped 2.66%.

The stock weakness was expected to extend into U.S. and European trading with futures pointing to a 1.67% drop for the S&P 500, a 1.4% retreat for Germany's DAX and a 0.77% slide for Britain's FTSE.

"It is turning into a Black Monday in Asia," Jeffrey Halley, senior market analyst at OANDA, wrote in a client note.

"The R-word (is) now on everyone's lips" amid "a scramble to reassess Fed hiking expectations," he wrote.

Focus in Asia was on the risk of fresh COVID-19 lockdowns with Beijing's most populous district of Chaoyang announcing three rounds of mass testing to quell a "ferocious" COVID-19 outbreak that emerged at a bar.

Shanghai conducted mass testing to contain a jump in cases tied to a hair salon.

Chinese blue chips dropped 1.42% and Hong Kong's Hang Seng suffered a 3.29% slide.

Japan's Nikkei slumped 3.03% and South Korea's Kospi declined 3.27%. Australian markets were closed for a holiday.

"Anyone trying to pick the bottom in China's growth and equity markets on the basis that China was 'one and done' on lockdowns is naive," OANDA's Halley said.

China's Growth shares sagged, with tech giants listed in Hong Kong slumping 4.45%. Index heavyweights Alibaba, Tencent and Meituan were each down between 4% and 6%.

INFLATION WORRIES

In currency markets, the dollar climbed as high as 135.22 yen, its highest since October 1998, buoyed by a rise in Treasury yields that continued into Tokyo trading.

The 10-year reached a more than one-month peak of 3.202%, putting it just a tenth of a basis point from the highest since November 2018.

That put upward pressure of Japanese government bond yields, with the 10-year pushing to a six-year high of 0.255%, half a basis point above the Bank of Japan's 0.25% tolerance limit under its yield curve control policy. That's even amid the BOJ's standing offer to buy unlimited amounts of the 10-year note since April.

The breach of its ceiling spurred the central bank to announce an additional, unscheduled purchase operation.

The U.S. consumer price index increased a bigger-than-expected 8.6% last month, the largest year-on-year increase since December 1981, data showed on Friday.

That dashed hopes that inflation had peaked and instead put markets on alert that the Fed may tighten policy for too long and cause a sharp economic slowdown. The next policy decision is on Wednesday.

"The inflation data are game changers that force the Fed to switch to a higher gear, front-loading policy tightening," Jefferies strategist Aneta Markowska wrote in a research note, lifting a call for this week's decision to a 75 basis point hike.

Markets currently price 80% odds of a half point increase, and 20% odds for 75 basis points.

Two-year Treasury yields, which are very sensitive to policy expectations, leapt as high as 3.194% in Tokyo on Monday, a first since December 2007.

The U.S. dollar index, which measures the currency against six major peers including the yen, ticked as high as 104.58 for the first time in almost a month.

The euro slid as low as $1.04755 for the first time since May 19.

Leading cryptocurrency bitcoin slumped to the lowest since December 2020 at $24,888.88.

Meanwhile, crude oil dropped, with Brent crude futures down $1.81, or 1.48%, to $120.20 a barrel and U.S. West Texas Intermediate crude at $118.81 a barrel, down $1.86, or 1.54%.

© Copyright Thomson Reuters 2024. All rights reserved.