Struggling With Credit Card Debt? There's An App For That

With credit card debt climbing toward new post-recession peaks, a study published this week pointed to a possible answer — for millennials, anyway.

Personal finance app users, particularly those between the ages of 18 and 36, are less likely to cough up overdraft fees and short-term debt interest payments, according to the paper, which was published in the National Bureau of Economic Research this week. That ease of information access came with a catch, however, as the youngest app users were also more likely to turn to credit cards and unnecessary expenditures, according to the authors, from the University of California Los Angeles’ Anderson School of Management, the Columbia Business School and the Copenhagen Business School.

Studying the behavior of close to 14,000 Icelanders in the two years after they were introduced to a European fintech software company app that helps users keep tabs on their financial transactions, the researchers found that — surprise! — millennials adopted it at a much higher rate, 52 percent, than members of Generation X, with 41 percent, and Baby Boomers, with 27 percent. Both millennials and Gen Xers were also more likely to reap the benefits of keeping an eye on their finances, reducing their monthly bank fees by and average of, respectively, $2.48 and $2.81 per login, compared to just 32 cents for Baby Boomers.

But use of the app also correlated with increased adoption of a financial tool millennials have so far been collectively reluctant to embrace: credit cards. More specifically, the youngest members of the study’s population boosted their credit card usage by about 30 percent, three times the 10 percent average growth in credit-card use across all three generations. And, unlike the age group ahead of them, who tended to “remain more austere,” they were more likely to use their extra savings for discretionary, non-necessary spending. While the authors cautioned that lifestyle differences were likely the predominant reason, other recent findings point to relatively indulgent tendencies among millennials, who regret a quarter of their purchases.

Arna Olafsson, an assistant professor at the Copenhagen Business School and one of the study’s authors, said millennials’ increased discretionary spending was not an issue, as money spent on unneeded things is better than money spent paying back bank fees.

“It is possible that individuals would use this to spend more on discretionary entertainment, but that is welfare improvement,” she said. She added that the experiment, while leaning on population data from Iceland, was broadly applicable to the financially developed world, and that she “would not be surprised to see the same effect” in the U.S.

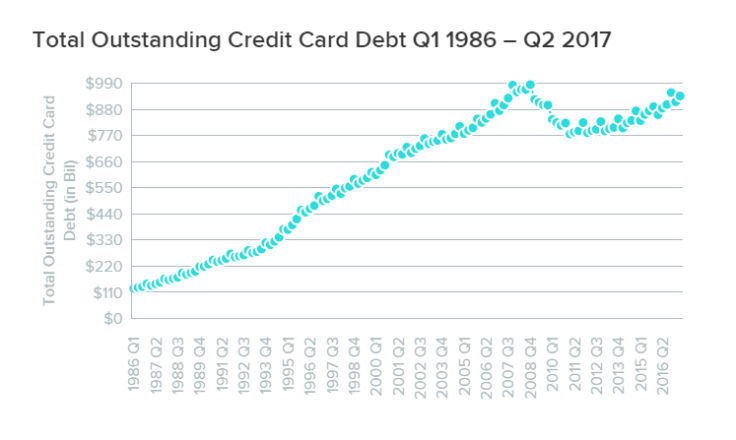

That’s good news for Americans, as U.S. consumer credit card debt reached its second-highest level since 2008 during the second quarter of 2017, when the U.S. took on $33 billion in new debt, bringing the total to $936.1 billion, according to a new report from WalletHub.

Aggregate consumer debt — including not just credit card balances but mortgages, auto loans and student loans — has followed a similar trajectory, like a cross-section of a volcano: rising almost exponentially since the mid-century to a 2008 peak, then dipping slightly before growing to roughly that pre-crisis level. Americans’ nearly $1 trillion in credit-card debt, it’s worth noting, makes up a sizeable slice.

Jill Gonzalez, a spokesperson for WalletHub, said that while more access to personal finance information is always a plus, a little wariness of the dangers of racking up credit card debt can go a long way, especially given the Federal Reserve’s plans to continue pushing up interest rates.

“I wouldn’t say we’re headed toward a recession just because we’re heading toward $1 trillion in credit card debt,” she said. “I would say this is not a good sign.”

The Fed’s rate hikes aside, consumers with credit card balances could be hurt in other ways, Gonzalez noted. Smartphone buyers, for instance, have begun factoring credit scores into their pricing. Still, although fintech isn’t exactly a remedy, she said, “digital tools and keeping track of your finances are always helpful.”

Olafsson echoed that notion, pointing out that the main issue with past credit collapses was often consumers’ inability to keep track of their expenditures — a problem that fintech apps can easily solve.

“A lot of people argue that people are so keen on credit card debt because they swipe it and then they never see [the purchase]. It’s not like cash,” she said. But with she app, she noted, “you can see what you are spending.”

© Copyright IBTimes 2024. All rights reserved.