Student Debt And Default Weighing On More Senior Citizens: GAO Report

More older Americans are grappling with debt from student loans, which can cut into Social Security payments and leave seniors more financially vulnerable during retirement, according to a Government Accountability Office report released Wednesday.

The percentage of seniors aged 65 to 74 who hold student debt is relatively small, but it increased fourfold in less than a decade -- from 1 percent of households in 2004 to 4 percent of households in 2010. Among all households headed by people aged 65 and up, about 3 percent, or 706,000, carry student debt, the GAO found.

Those aged 65 and older saw their outstanding federal student loan debt grow from $2.8 billion in 2005 to approximately $18.2 billion in 2013. Total student loan debt in the U.S. amounts to $1.2 trillion, the vast majority owing to federal loans.

"As the amount of student loan debt held by Americans age 65 and older increases, the prospect of default implies greater financial risk for those at or near retirement — especially for those dependent on Social Security," according to the GAO. The analysis will be highlighted today during a U.S. Senate hearing of the special committee on aging, "Indebted for Life: Older Americans and Student Loan Debt."

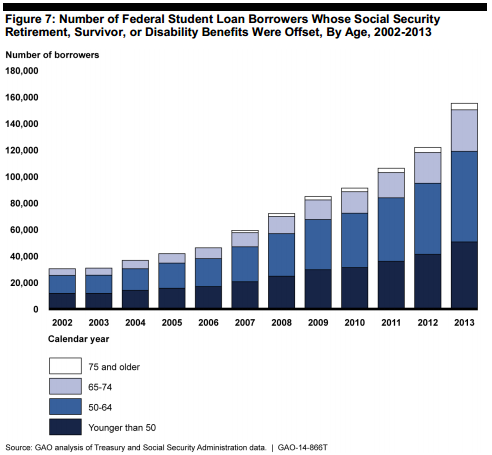

"From 2002 through 2013, the number of individuals whose Social Security benefits were offset to pay student loan debt increased about fivefold from about 31,000 to 155,000," the GAO states. "Among those 65 and older, the number of individuals whose benefits were offset grew from about 6,000 to about 36,000 over the same period, roughly a 500 percent increase."

Even though borrowers over the age of 65 held only 1 percent of all outstanding federal student loans (as of 2013), they defaulted at higher rates than younger borrowers.

The GAO report notes that 12 percent of the federal loans held by borrowers between the ages 25 and 49 were in default. By comparison, "27 percent of loans held by individuals 65 to 74 were in default, and more than half of loans held by individuals 75 or older were in default," the report says.

More than 80 percent of the outstanding student debt among seniors is for loans they took out for their own education, not for their children's education. The GAO said it did not have information on the age of the loans, and therefore could not determine how much of seniors' education debt stems from loans that were originated recently or loans that were originated many years ago.

© Copyright IBTimes 2024. All rights reserved.