Student Loan Debt May Not Be Why Home Ownership Among Younger Americans Is Declining

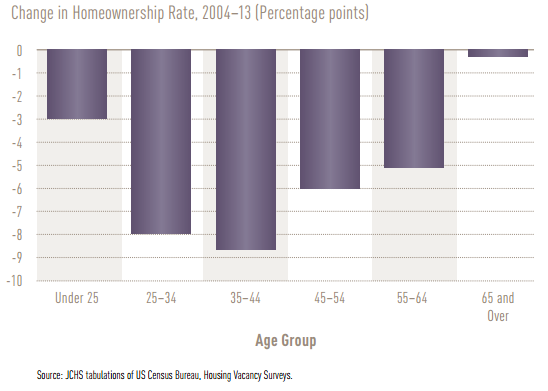

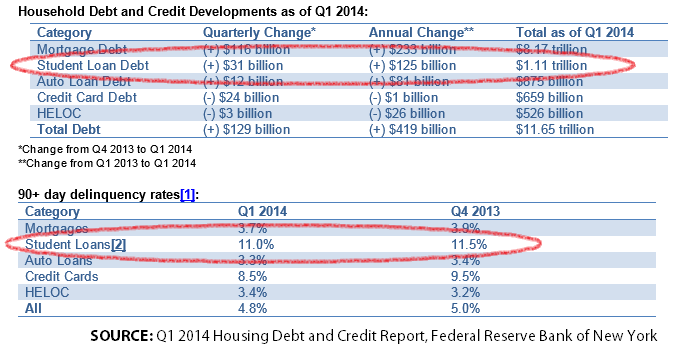

Ballooning education costs and a prolonged postrecession recovery have sent U.S. student loan debt to record highs, topping a trillion dollars earlier this year for the first time, and pushed home ownership down nearly 8 percentage points for Americans aged 25-34 in recent years, according to a recent Harvard study.

But one recent study said the correlation between this decline in home ownership and increase in student debt is misleading, which has elicited peals of dissent from those who question the study's findings.

“Despite the widely held belief that circumstances for borrowers with student loan debt are growing worse over time, our findings reveal no evidence in support of this narrative,” concluded the study in question, from the Brown Center on Education Policy at the Brookings Institution. “Furthermore, the incidence of burdensome monthly payments does not appear to have become more widespread over the last two decades.”

Nonsense, say the critics, who point to a 50 percent to 60 percent increase in debt since 2010, the year the data from the Brookings report was taken. "The average term of a student loan went from 7.5 years to 13.4 years during the study period's 18 years. That's nothing to brag about," writes Tom Blumer at Newsbusters, a website dedicated to "exposing and combating liberal media bias."

Brookings fellows and authors of the study Beth Akers and Matthew Chingos argue that rising tuition as well as a trend toward higher educational attainment “has played a large role” in the rise of student loan debt in recent years. The sluggish pace of postrecession recovery has also encouraged students to stay at university longer. Postgraduate-degree holders tend to earn more in their lifetimes, so they have a greater tolerance for student debt.

"So a large portion of the debt growth comes from more people getting graduate degrees, which is a good thing, but that doesn’t make that debt disappear," said June 24 opinion piece in the Los Angeles Times. "And loans are paid back over a longer period of time, which reduces the monthly outlay, which affects personal spending budgets."

The Federal Reserve Bank of New York said in a report last year that student loan debt was depressing home ownership among 30-year-olds. By 2012, Americans with student loan debt were less likely to own a home than those without the burden. Before 2009, it was the opposite, because young Americans with student loan debt were earning more than those without, a group that includes Americans who never went to college or dropped out before getting a degree.

But the Brookings report says that conditions today are similar to the way they were prior to 2004, in which young Americans without student loan debt were more likely to own homes by the time they turned 30 than those with the debt, and that more research is needed to make a definitive link between lower home ownership rates among young Americans and the rising cost of higher education.

Choire Sicha of the Awl blog slammed the report for citing student debt for households headed by anyone between 20 and 40 years old, which would exclude data for student-debt holders living at home whose parents would be over 40.

"One effect of this age spread sample is that it includes college graduates from up to almost 20 years ago," Sicha wrote. "This is literally not at all a study of college graduates of the last five years, or even 10 years. We're talking about people up to the age of 40, well into Gen X."

© Copyright IBTimes 2024. All rights reserved.