Study Of Global Billionaires Suggests Americans Are Getting Fleeced By Rents

It should come as no surprise that the U.S. leads the world in the absolute number of billionaires in the country — 536 in 2015. But what those billionaires say about America is less obvious.

In a new study, researchers parsed the global list of billionaires maintained by Forbes magazine, examining trends across the world over the past two decades. America’s billionaires demonstrated three things: fewer heirs, more financiers and higher rents.

In other words, American billionaires show a country where more overall wealth accrues to the financial elite and other rent-seekers. (That’s not the rent you pay for an apartment, but rent you find in economics textbooks, referring to the extra price each of us pays companies that have a monopoly or other leg up on the broader market.)

Despite the high profile of billionaires like Donald Trump and the Walton family — whose wealth preceded their birth — the U.S. stands out worldwide for the comparatively low share of fortune inheritors. Just 29 percent of American billionaires grew their wealth from an inheritance, compared to 21 percent worldwide. And that share is falling.

Rising in the place of old money are all sorts of nouveau riche, from tech prodigies like Mark Zuckerberg to oil tycoons like the Koch brothers. But these fields are outpaced by Wall Street.

“In the U.S., extreme wealth is increasingly tied to finance,” study co-author Caroline Freund told ProMarket, a blog associated with the University of Chicago Booth School of Business. Financiers make up 27 percent of the mega-rich in the U.S., compared to 21 percent worldwide.

The biggest winners in the past 20 years: hedge funders. The U.S. stands head and shoulders above the rest of the world in the number of private investment professionals measuring their wealth in 10 digits, with names like George Soros and Carl Icahn near the top of the list. More than 80 percent of hedge fund billionaires in the world hail from the land of the free.

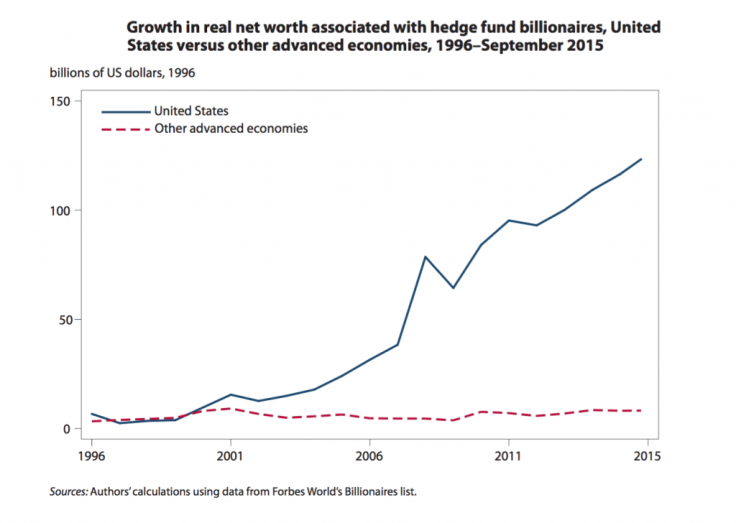

But it’s not just that there are more hedge funders in America. Comparing the overall intensity of billionaire wealth across the world — that is, how much each individual billionaire’s net worth has grown — researchers found that American hedge funders have seen a uniquely remunerative two decades of growth.

The hedge fund sector “hasn’t produced billionaires anywhere in the world like it has in the U.S.,” Freund said. “What we’re seeing in the US is not only there are more financial guys, but they’re getting richer on average.”

The total net worth of billionaires increased nearly fivefold between 1996 and 2015, rising from $25 billion to $120 billion.

It’s not just in the hedge fund world that individual billionaire wealth has ballooned. The U.S. also stands apart from the rest of the world in how intensive billionaire wealth growth has been. That is, it’s not just that there are more billionaires, but existing billionaires have grown even wealthier.

Freund and co-author Sarah Oliver, both of the Peterson Institute for International Economics, suggested this reflects rising rents. “Among the rich countries, only American billionaires are getting richer on average over time, potentially reflecting extreme rents in resources, finance and nontradables,” the authors wrote. (Nontradables comprise industries whose products can’t be exported, like healthcare and utilities.)

The apparent rise of rents has come as nearly every major U.S. industry has seen an increase in market concentration over the last 20 years, with more and more companies reaching monopoly-level size. The top 10 banks in the U.S., for instance, have increased their market share from 20 percent in 1980 to 50 percent today.

The winners in that trend: American billionaires. “There are more rents accruing to these individuals than in other countries,” Freund said.

The losers: everyone else.

© Copyright IBTimes 2024. All rights reserved.