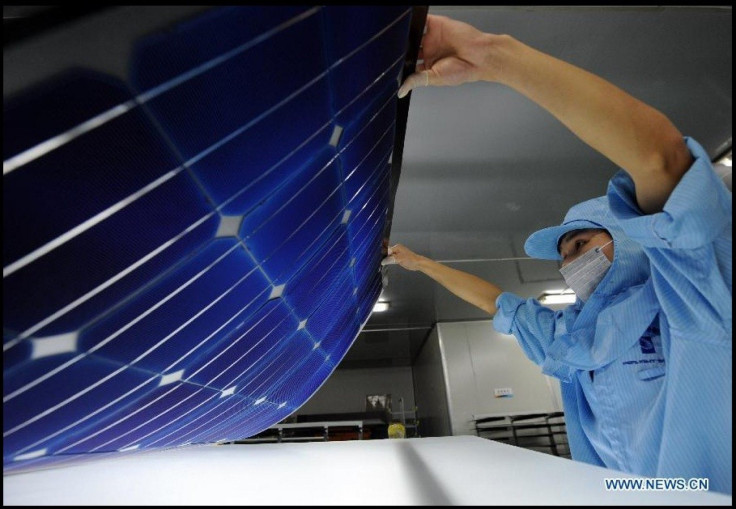

Is The Sun Setting on China's Solar Industry?

Tumbling prices, fraud and heavy debt loads will force a wave of mergers in the Chinese solar panel industry, a report has concluded.

Some of the country's largest manufacturers are facing huge debt liabilities with one company, Suntech Power Holdings [STP.N], potentially on the hook for hundreds of millions of dollars after it disclosed potential fraud by a partner, Reuters reported Tuesday.

As the price of solar panels continues to fall, many small operators have been forced to close, prompting a flight of investors which has sent the share price of U.S.-listed Chinese companies down by more than 85 percent since the start of 2011.

"Solar as an industry is going to continue to grow," Brian Salerno, portfolio manager for Huntington EcoLogical Strategy ETF (HECO.K), told Reuters.

"However, my belief is that for most of that time it's going to be profitless prosperity."

One of those with the most troubling balance sheets is LDK Solar, which holds debts of $6 billion against cash and other assets of just $244 million.

The news comes as The Wall Street Journal reported a shift in the clean technology investment strategies of private equity, noting a trend away from mainstream technologies such as wind and solar.

Instead, the money is moving to back downstream clean tech projects and products focused on energy storage and recycling.

"Clean technology is truly shifting from large, money-bleeding projects...to smaller, but profitable and scalable technological innovations applicable in clean-tech," Tony Luh, a general partner and greater China president at Westly Group, told the Journal.

© Copyright IBTimes 2024. All rights reserved.