Supply Chain Woes Put Brakes On Europe's Top Cycle-makers In Portugal

Europe's leading cycle makers in Portugal are riding a pandemic-driven demand boom, but a supply chain crunch linked to Asia has put the brakes on.

InCycles Bike Group, a flagship in the country's successful export-led manufacturing cluster around the northern town of Agueda, is pushing hard to stay ahead of the peloton.

"We have orders through to mid-2023 but will we be able to meet them?", asks export manager Filipe Mota.

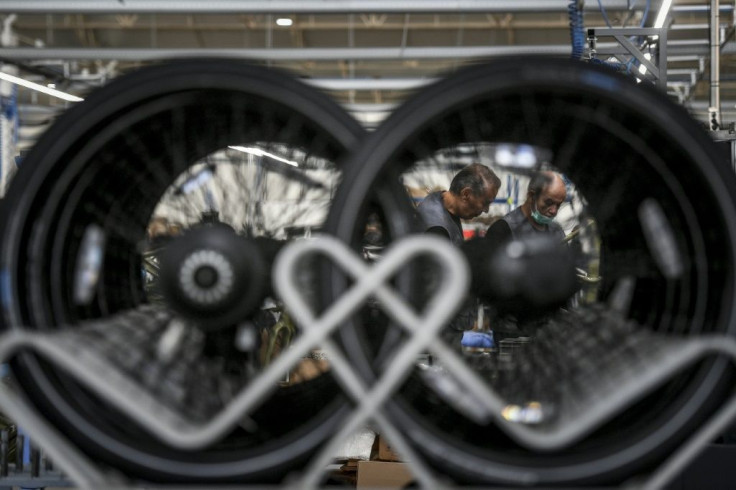

The coronavirus crisis saw people "fighting to get bikes, so we sold a lot," says Mota in the middle of the four assembly lines that employ nearly 200 workers supplying 40 brands.

But, he tells AFP, the "boom in orders" has led to "a shortage of very important spare parts".

Deliveries from mainly Asian suppliers can take up to two or three years, Mota says.

When the company started assembling bicycles for Uber, under the Jump brand which has since been snapped up by Lime, turnover soared from three million euros ($3.5 million) in 2018 to 50 million euros the following year.

The Covid-19 outbreak reduced sales to 37 million euros in 2020, as people initially stayed at home in lockdowns before venturing out and wanting bikes.

They are expected to remain around the same level this year, as the spike in demand led to the shortages.

"If we had the parts, we would easily have made 60 or 70 million euros," Mota boasts. The new factory opened last year with capacity to churn out 250,000 units a year, but expects to close 2021 with nearly 140,000.

The logistical nightmares are predicted to be over by 2023, which is encouraging Portugal's 8,000 employees in the sector to look forward with optimism.

Since the national association of two-wheel industries ABIMOTA launched an export drive in 2015, cycle sales abroad have almost doubled, hitting 425 millions euros last year.

And for 2021, despite the supply chain woes, they could rise by as much as 30 percent again, according to ABIMOTA general secretary Gil Nadais.

"We have several cutting-edge companies here, some of the best in Europe or the world," he says, citing the first non-Asian firm to manufacture carbon frames, the only factory in the world where robots turn out welded aluminium frames or the world leader in saddles for children.

Portugal produced 2.6 million bicycles last year and virtually all went to export. That puts the country alongside major powers Italy and Germany for cycle exports, according to Eurostat figures.

About half of the units came from the workshops of RTE, which supplies French sports giant Decathlon and is set to expand its Vila Nova de Gaia factory, close to Porto, and to open at a second site in Poland.

Beyond cheap labour and good traditional skills, the sector has benefited from customs tariffs the European Union has slapped on bikes imported from China.

"Without the anti-dumping measures our sector would not be where it is," says Gil Nadais. He acknowledges that production had begun to grow before the pandemic at a time when it was still falling in the rest of Europe.

According to Kevin Mayne, head of Cycling Industries Europe which represents the cycling industries on the continent, the market should continue to grow about 15 percent by 2030 -- or an extra 10 million units a year.

"The average price of a bicycle, the average use of a bicycle, the penetration of e-bikes... is better in Europe than anywhere else in the world," he says.

"So no matter where you make bikes, you have to be serious about Europe.

"The Portuguese industry and other European clusters should be winners because more companies will probably now decide Europe is a better long term investment."

© Copyright AFP 2024. All rights reserved.