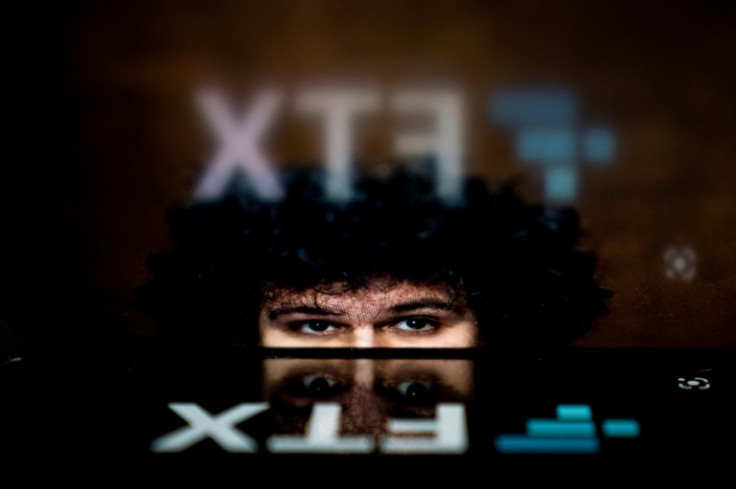

Surprise Arrest Snatches SBF From US Lawmakers Waiting To Sink Teeth Into Crypto Pariah at Hearing

KEY POINTS

- The Royal Bahamas Police Force arrested FTX founder and former CEO Sam Bankman-Fried after 6 p.m. ET at his apartment in Nassau

- He was arrested in "reference to various financial offenses against the laws of the United States, which are also offenses against laws of the Commonwealth of the Bahamas," the Royal Bahamas Police force said in a statement

- Bankman-Fried was taken into custody without incident and is set to appear in magistrates court in Nassau on Tuesday

The surprise arrest by the Royal Bahamas Police force of Sam Bankman-Fried on Monday evening nipped the crypto entrepreneur from testifying before the U.S. Congress, which is set to question him on matters surrounding the bankruptcy of his crypto empire FTX.

The Royal Bahamas Police Force arrested FTX founder and former CEO Sam Bankman-Fried after 6 p.m. ET at his apartment in Nassau, following formal notification from the United States government that it had filed criminal charges against him.

He was arrested in "reference to various financial offenses against the laws of the United States, which are also offenses against the laws of the Commonwealth of the Bahamas," the Royal Bahamas Police Force said in a statement.

Interestingly, the New York Times, citing a person with knowledge of the matter, said charges against Bankman-Fried include wire and securities fraud, conspiracy to commit wire and securities fraud and money laundering.

Bankman-Fried, colloquially called SBF in the crypto industry, was taken into custody without incident and is set to appear in magistrates court in Nassau on Tuesday.

The disgraced FTX CEO is reportedly considering whether to contest extradition, WSJ reported, citing a person familiar with SBF's thinking as a source.

The arrest took place a day before he was set to testify before the U.S. House Financial Services Committee in a hearing focused on the bankruptcy of Bankman-Fried's crypto empire.

Following news of Bankman-Fried's arrest in the Bahamas, Congresswoman Maxine Waters (D-CA), who chairs the House Financial Services Committee said she was surprised by the arrest.

"It's about time the process to bring Mr. Bankman-Fried to justice has begun," the U.S. lawmaker said.

"My staff and I have been working diligently for the past month to secure Mr. Bankman-Fried's testimony before our Committee tomorrow morning. We received confirmation this afternoon from Mr. Bankman-Fried and his lawyers that he was still planning to appear before the Committee tomorrow, but then he was arrested," Rep. Waters said.

"Although Mr. Bankman-Fried must be held accountable, the American public deserves to hear directly from Mr. Bankman-Fried about the actions that've harmed over one million people, and wiped out the hard-earned life savings of so many," the congresswoman said in an official statement.

Representative Waters also underlined that she was disappointed that the timing of Bankman-Fried's arrest denied the public the opportunity to get answers from the crypto pariah while testifying under oath.

"The public has been waiting eagerly to get these answers under oath before Congress, and the timing of this arrest denies the public this opportunity. While I am disappointed that we will not be able to hear from Mr. Bankman-Fried tomorrow, we remain committed to getting to the bottom of what happened, and the Committee looks forward to beginning our investigation by hearing from Mr. John Ray III tomorrow."

Ahead of the hearing, the court-appointed FTX CEO Ray III revealed in his prepared remarks the major reason for the controversial collapse of Bankman-Fried's crypto empire. "The absolute concentration of control in the hands of a very small group of grossly inexperienced and unsophisticated individuals," the written testimony read.

Ray also noted that FTX allowed the Bankman-Fried-founded crypto trading firm Alameda Research to borrow funds from the exchange "without any effective limits."

The new FTX CEO added that "the FTX Group went on a spending binge in late 2021 through 2022, during which approximately $5 billion was spent buying a myriad of businesses and investments, many of which may be worth only a fraction of what was paid for them."

© Copyright IBTimes 2024. All rights reserved.