The Bank of Japan unexpectedly boosted its asset-buying program by ¥10 trillion ($126.7 billion), following similar easing steps by the U.S. Federal Reserve and the European Central Bank.

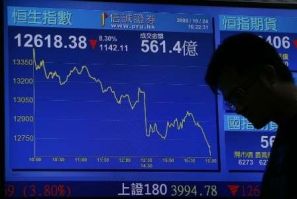

Asian markets fell Friday as investor confidence was weighed down amid increasing concerns about the global economy after data showed a fall in the industrial output of Japan and South Korea.

The U.S. stock index futures point to a slightly higher open Tuesday as investors follow a waiting strategy anticipating that the Federal Reserve will soon announce stimulus measures to rejuvenate the economic growth.

Most of the Asian markets fell Monday as investor concerns of the weakening global economic condition were revived as Japan's government lowered its assessment of the country's economy.

Investors feel that policy measures should be implemented to regain the growth momentum of the Japanese economy, which has been affected by the soft global demand and the worsening crisis in the euro zone.

U.S. stock index futures pointed to a lower open Wednesday as investor confidence was weighed down by the report that Japan returned to trade deficit in July indicating a soft global demand and weakening economic growth momentum.

Most of the Asian markets fell Wednesday as investor confidence was weighed down by the report that Japan's trade deficit increased in July, raising more concerns about the faltering global economy.

Most of the Asian markets rose Tuesday as investors maintained hopes about monetary easing measures from policymakers around the world to tackle the weakening of the global economic growth.

Asian stocks ended mixed last week as market players continued to wait for policy makers to come up with bold stimulus measures to boost the weakening global economy.

Asian markets were mixed Thursday as investors maintained a watchful mode awaiting monetary easing measures from policymakers around the world to tackle the weakening of the global economic growth.

U.S. stock index futures point to a higher open Tuesday amid hopes that central banks around the world will announce stimulus measures to boost the economy and regain the growth momentum.

Most of the Asian markets rose Tuesday amid hopes that the Bank of Japan will soon announce stimulus measures to regain the economic growth momentum.

Most of the European markets fell Monday as investors were disappointed to note that the economic growth slowed down in the second quarter in Japan indicating that the global economy continues to falter.

Japan's economic growth slowed down in the April-June quarter compared to the first three months of the year, indicating that the country is losing growth momentum affected by soft global demand and weak consumer spending.

Despite most central banks slashing interest rates in 2009, there is still room for central banks to maneuver and stimulate their sluggish economies.

Asian stock markets advanced for the fourth straight session Thursday after data showed that Chinese inflation continued to cool down in July, providing more room for further policy easing to boost growth.

European markets rose Thursday as investor confidence was lifted by hopes that China will announce stimulus measures to boost the economic condition and regain the growth momentum.

The Bank of Japan Thursday kept its key policy rate unchanged and refrained from announcing any monetary easing measures citing that the country's economy is picking up moderately.

Most of the Asian markets rose Thursday as hopes for monetary easing measures to be announced by China grew following reports that the country's inflation slowed down in July compared to the previous month.

Japan’s industrial output declined in June, which is the third consecutive month showing a fall, indicating that the weakening global demand and the debt burden faced by the euro zone are affecting the country’s economy.

Japan’s consumer prices declined in June indicating that the country’s economy continues to be affected by the soft global demand, the worsening crisis in the euro zone and the strengthening yen.

By taking policy rates to close to 0 percent and pushing deposit rates below zero, the move by Denmark may have opened the window for the ECB to take action at their meeting next week.