Gold fell on Wednesday after a near 3 percent rally the day before sparked by Federal Reserve comments on possible measures to boost U.S. growth, and the bullion price is still set for its biggest monthly gain in nearly two years.

China's central bankers have found a new way of keeping banks from lending too much, a step Beijing hopes will help it tackle the country's persistent inflation woes.

Shares of large silver mining companies mostly rose Monday along with the broader stock market as investors ignored the falling price of the white metal on fresh optimism about the strength of the economy.

Shares of large gold mining companies fell Monday, along with the price of the yellow metal, in a sentiment shift away from precious metals and other safe havens toward riskier assets like stocks.

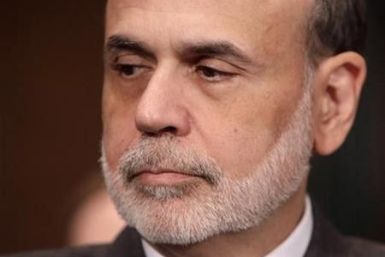

Brent crude oil rose slightly in choppy trade on Friday as Hurricane Irene barreled toward the U.S. East Coast and traders weighed comments by U.S. Federal Reserve Chairman Ben Bernanke on the economy.

Fed Chairman Ben Bernanke's much-anticipated speech Friday will likely disappoint investors and policy makers hoping for signs the central bank will try to rev up the weak economy, but the speech is likely to relieve gold investors who have booked big profits from that same economic malaise.

Steve Jobs resigned as Apple's Chief Executive on Wednesday and handed over the reins to Tim Cook, who was the company's Chief Operating Officer and had been assuming Jobs' role in his absence.

Shares of the parent of online job board Monster.com are down nearly 70 percent this year, with most of that loss coming since early July. A company that once boasted a multi-billion dollar market valuation is now worth less than $1 billion.

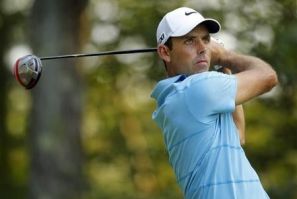

World number one Luke Donald is gearing up for a final 2011 push as the FedExCup playoffs begin Thursday at The Barclays with the Briton aiming to reign over both the U.S. and European tours.

Deutsche Bank AG knew in 2006 that a mortgage company it was preparing to buy lied to the U.S. government about its mortgages, yet went ahead with the purchase and should be held financially responsible, the Justice Department said on Monday.

South Korea's sovereign wealth fund said it had reinvested $78 million, around half the dividend it received from its $2 billion investment in Bank of America , back in the U.S. bank's shares this year.

Shares of Macau casino operators slumped on Monday on worries of weakening demand from wealthy Chinese consumers, the main players in the world's largest gambling market, leading investors to sell stocks that have hit record highs in the past few months.

Apple is leveraging a common user experience across its entire iOS ecosystem (iPod, iPhone & iPad) into significant product, branding and quality advantages.

Apple Inc, Nokia and Qualcomm Inc are among several technology companies pondering bids for InterDigital Inc, sources familiar with the situation said.

Chinese online video company Tudou Holdings Ltd (TUDO.O) priced shares in its initial public offering within the expected range on Tuesday, even though investor sentiment toward U.S.-listed Chinese stocks and the recent stock market turmoil had suggested it would be difficult.

As a U.S. economic rebound stalls and threatens to spiral into a new recession, oil demand in the world's top consumer may be slipping into an irreversible decline.

The crown may be slipping fast from billionaire trader John Paulson's head.

New China Life, the third-largest life insurance company in China, has filed its listing application with the Hong Kong stock exchange, setting the stage for a planned IPO of up to $4 billion in Hong Kong and Shanghai, sources with direct knowledge of the plans told Reuters on Thursday.

The crown may be slipping fast from billionaire trader John Paulson's head.

U.S. stocks tumbled more than 4 percent on Wednesday, almost wiping out gains from a relief rally the previous day, as rumors about the health of French banks sparked concern that the euro zone's debt crisis could claim new victims.

Gold is set to widen its premium over platinum after hitting parity for the first time in 2-1/2 years this week, with no end yet in sight to the potent cocktail of fear factors that are benefiting safe havens at the expense of cyclical assets.

U.S. stocks soared in turbulent trading Tuesday, coming off the worst three day selloff since the financial crisis, as investors took in stride the Federal Reserve's pledge to keep interest rates near zero at least through mid-2013.