Stock index futures dipped on Wednesday, a day after major indexes hit a five-month high, with pressure on the euro testing the recent view that the U.S. market was decoupling from Europe.

Strong demand from China and India as well as short covering Wednesday extended a gold price rally that has lifted the yellow metal six percent since the end of last month.

Shares of silver mining companies rose on Tuesday as the price of the metal jumped, outperforming the rest of the market.

Bank of America Merril Lynch's (NYSE:BAC) move to fire one-fifth of the managing directors in its Asia operations, while significant, is only the latest sign foreign banks are jumping ship on investment banking opportunities within that market.

Stock index futures pointed to a stronger open for equities on Wall Street on Tuesday, with futures for the S&P 500, the Dow Jones and the Nasdaq 100 up 0.9-1.0 percent.

Gold prices rode a global stock market and commodities rally Tuesday break a two-day losing streak.

Bank of America-Merrill Lynch is cutting around a fifth of its managing directors across its Asia investment banking division, sources said Monday, in a bid to cut costs as the outlook sours in a once-booming region.

Alcoa Inc posted a fourth-quarter loss Monday due to a steep plunge in aluminum prices, but its revenue beat expectations and the company gave a positive outlook for global demand for the metal, especially in the aerospace and automotive markets.

Going on a short media blitz Monday afternoon, Wall Street power and JPMorgan Chase CEO Jamie Dimon sounded a highly optimistic note on the American economy, the housing market and even the chances of customers bilked by bankrupt broker-dealer MF Global getting their money back.

U.S. stocks ended slightly higher on Monday in a light-volume session, as investors stayed cautious ahead of corporate earnings and key auctions for European debt this week.

Stocks ended slightly higher on Monday in a light-volume session as investors stayed cautious ahead of corporate earnings and key auctions for European debt this week.

Silver for March delivery, the most actively traded contract on the Comex, was up 25 cents to $28.93 and spot silver was up 10 cents to $28.85.

China's growing demand for energy means oil should fundamentally have the most upside when compared to other publicly traded commodities, a Goldman Sachs analyst told a financial strategy conference in London Monday.

The application would allow FiOS subscribers to steam live television and certain video-on-demand programs through LG products.

Stock index futures edged higher on Monday as investors focused on a European meeting intended to find ways to boost the region's economies and tackle a debt crisis and prepared for the start of U.S. corporate earnings.

Stocks rose in the first week of this year, even though news that the U.S. jobless rate neared a three-year low did not whet interest in equities on Friday.

Has the U.S. stock market's gyrations left you feeling a little perplexed? Then consider the stocks of large-capitalization companies with demonstrated business models. And here are five.

Stocks were on track to post gains for the first week of 2012 on Friday as signs of a sustainable economic recovery overshadowed lingering concerns about the euro zone's debt crisis.

Silver mining company shares declined Friday as the price of the gray metal fell more than 2 percent. U.S. stock indexes mostly edged down, suggesting that investors are measuring the improvement in labor market against a declining euro.

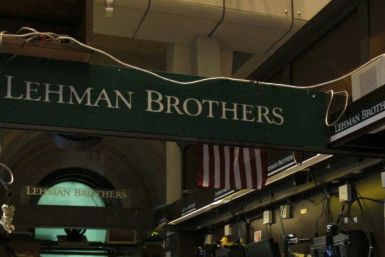

The estate of Lehman Brothers is battling Bank of America and Barclays in court over the sale of Archstone, the large multifamily housing landlord that real estate mogul Sam Zell's Equity Residential is seeking to buy.

Shares of companies that mine precious metals drifted lower Friday along with the broader equity market and the price of gold.

Gold prices rose Friday as concerns about the Eurozone's economy and the health of its banks offset the effect of a stronger dollar.