A Twitter-based hedge fund is making money.

Gold and silver prices rose Tuesday but companies that mine the precious metals fell as the broader market gave up recent in a clear signal that investors don't have much confidence in Europe's ability to solve its sovereign debt concerns.

Fitch Ratings announced on Tuesday it had reaffirmed the United States' long-term debt rating of AAA, despite Standard & Poor's downgrade. Here are the five things you need to know about its decision:

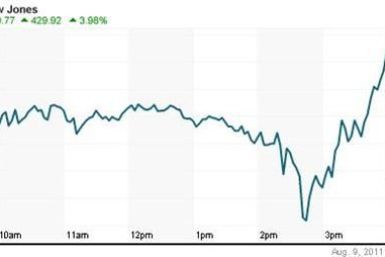

Debt concerns in Europe and a tepid U.S. economy have made for a bumpy stock market of late, to day the least. However, because one-day events can deceive, let's pull the lens back and do a condensed, cross-methodological analysis of the Dow Jones Industrial Average, to see if it reveals any long-term clues.

Premarket trading of gold and silver mining companies were mixed Tuesday in a tight range as stock index futures pointed to a lower open and commodities like crude oil and copper were down.

Shares on Wall Street rose with oil prices on Monday as acquisition news and stronger-than-expected economic data in Japan led markets to steadily forge ahead after last week's wild swings.

Does anyone recall last Monday's stock market panic?

Gold and silver prices rose Monday in early U.S. trading as Europeans bought unusually large volumes of the yellow metal.

Did last week?s wild stock market swings make you concerned that your 401K will soon turn into a ?201K? ? Then it sounds like it?s a good time to get an assessment of the U.S. economy from two respected economists, Paul Krugman and Irwin Kellner.

After a week of wild gyrations that saw the Dow Jones Industrial Average rise or fall 400 points on four consecutive days, there?s word that a major bank in France with a funny-sounding name may be in trouble. Further, if you think a possible problem at France's Societe Generale won?t affect the value of the U.S. stocks you own, think again.

A spree of bad news -- market gyrations, fears of a double-dip recession, stubborn unemployment and fallout from a debt deal -- has shaken confidence in President Barack Obama's leadership and could cloud his chances for winning re-election.

Gold and silver prices retreated Friday as investors shrugged off weak consumer sentiment data to step back into stocks and give the S&P 500 a two-day winning streak for the first time since mid-July.

After one of the most volatile weeks in memory, U.S. stocks ended higher on Friday in a tentative sign that the worst of the selling may be over.

House Minority Leader Nancy Pelosi, D-Calif., rounded out the super committee by announcing her three House Democratic members for the special bipartisan board. Now the tough work begins: reducing the deficit by at least another $1.5 trillion over 10 years, and as far as the financial markets are concerned, the sooner the reduction is announced, the better.

Gold and silver mining company stocks fell Friday as the broader equity markets posted gains, extending for a second day their rebound from this month's horrendous downdraft.

After a week of gyrations that's seen the Dow Jones Industrial Average rise or fall 400 points for four straight days, it's understandable if U.S. investors are bewildered. Given the tumult, what stance should investors adopt now?

The Dow Jones industrial average rebounded on Thursday soaring 423.37 points, or 3.95 percent, to 11143.31, after a disappointing 520-point loss on Wednesday, the ninth-largest point drop ever, because of growing fears about the health of Europe's banks and the probabilities of a global economic recession. Meanwhile, the Nasdaq gained 111.63 points, or 4.69 per cent, to 2,492.68.

Gold and silver settled lower Thursday after investors returned to stocks amid encouraging news from the Labor Department and stricter margin requirements from the CME Group Inc., which runs US futures markets.

Firmer U.S. stocks pulled world shares higher on Thursday as strong U.S. jobs data took some of the focus away from renewed fears about the health of the euro zone banking system.

With the appointment of nine of 12 members, the "super committee" charged with reducing the budget deficit by at least another $1.5 trillion is taking shape. The body could help stabilize the financial markets by announcing a ?quick-start? agreement on additional debt reduction.

The Dow registered another volatile day Wednesday, plunging 520 points to 10,720 on chatter of additional banking sector concerns in Europe. Further, until investors can sort out which debt concerns are real, and which are not, look for choppy trading conditions to continue.

The stock market spent Wednesday tormenting investors, knocking the Dow Jones Industrial Average down 519.83 points and slamming media stocks.