Greece will need additional relief if it is to cut its debts to 120 percent of GDP by 2020 and if it doesn't follow through on structural reforms and other measures, its debt could hit 160 percent by 2020, a confidential analysis conducted by the IMF, European Central Bank and European Commission shows.

Eurozone finance ministers expected to approve second bailout for Greece to draw line under months of turmoil that has shaken the currency bloc.

Asian markets rose across the board Monday as policy easing by China and expectations that Greece will secure a second bailout buoyed investor appetite for riskier assets, sending U.S. crude up nearly 2 percent and copper nearly 3 percent higher.

Markets jumped Monday as policy easing by China and prospects for Greece to clinch a second bailout fund buoyed investor appetite for riskier assets, sending U.S. crude up nearly $2 a barrel and Asian shares up nearly 1 percent.

The European Central Bank would support the euro zone boosting its firewall by combining what remains in its temporary bailout facility with its permanent fund, ECB board member Joerg Asmussen was cited as saying by a German business daily.

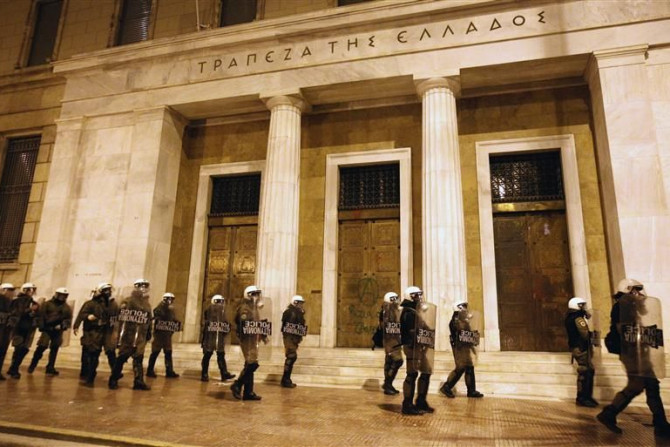

Riot police shielded Greece's national parliament Sunday as demonstrators gathered to protest against austerity measures on the eve of talks in Brussels on a 130 billion euro ($171 billion) bailout needed for the country to avert bankruptcy. (See Eurozone Crisis in Graphics and Interactive Timeline.)

Italy's central bank governor urged the government on Saturday to rapidly implement planned reforms and take further steps to support the Eurozone's third-biggest economy, which he said would shrink by about 1.5 percent this year.

European leaders expressed optimism on Friday that Greece would secure a new rescue package worth 130 billion euros though policymakers admitted urgent work was still needed to get its debt-cutting program back on track.

Masters of the Eurozone are considering tweaks to Greek debt restructuring in terms of its private-sector involvement among several options to further cut Greek debt toward the target of 120 percent of gross domestic product in 2020, officials said.

Some European leaders have expressed optimism that the next round of rescue financing for debt-scarred Greece will be approved by Eurozone finance ministers at a crucial meeting in Brussels on Monday.

The market capitalization of U.S. equity markets has increased by $3 trillion since last October.

Greece’s finance minister Evangelos Venizelos has suggested some countries in the bloc want Greece to leave the eurozone.

The eurozone finance ministers have demanded greater supervision and control of Greece's economy in return for the approval of bailout package.

China will continue to invest in euro zone government debt and it remains confident in the euro, the country's central bank governor said on Wednesday, while calling on Europeans to produce more attractive investment products for China.

French banks' liabilities with the Bank of France hit a record high of 218 billion euros in December, of which 119.6 billion was used for monetary policy, the central bank said on Tuesday.

Euro zone finance ministers dropped plans on Tuesday for a special face-to-face meeting on Greece's new international bailout, as the cabinet in Athens argued up to the last minute on plugging a 325 million euro ($427 million)gap in its austerity plan.

French banks' liabilities with the Bank of France hit a record high of 218 billion euros in December, of which 119.6 billion was used for monetary policy, the central bank said on Tuesday.

Italy's three-year borrowing costs hit their lowest since March at an auction on Tuesday, with an overnight sovereign rating cut having little impact as cheap ECB loans continued to support demand and ease its path towards an ambitious refinancing goal.

The European Central Bank's profits from Greek bonds could be used to help restructure Greece's debt, Executive Board member Benoit Coeure said, spelling out how the ECB's funds could play a role in Athens' debt deal.

The euro rose to a session high and shares reversed early losses after key German data bolstered hopes that Europe's largest economy was recovering and a strong Italian bond sale added to signs that financing pressures were being contained.

A European finance minister, in Washington for a panel on global business and economics, sent up a flare to U.S. officials Monday afternoon, saying he hoped the U.S. would be more involved in playing a key role to solving the ongoing sovereign debt crisis in Europe.

Japan's Nikkei share average slipped on Tuesday but still hovered near the 9,000 level, with non-life insurers underperforming after MS&AD Insurance Group Holdings (8725.T) cut guidance on heavy losses on the flooding in Thailand.