ECB President Jean-Claude Trichet stepped up warnings over Italy's strained public finances on Saturday, telling the struggling center-right government it must act quickly to reassure nervous markets.

Central banks from around the world are placing record sums of money into the Fed as a safe haven, at amounts even higher than during the Lehman Brothers meltdown.

Europe's most indebted nations are under heavy pressure from their richer neighbors to sort out their finances, but they are unlikely to mimic the impoverished gentlefolk of old by selling off the family silver -- or in their case, gold -- to do so.

The problems of liquidity and confidence in Europe are not as severe as during post-Lehman crash, but are heading in that direction, ECB Governing Council member Luc Coene said in an interview published on Friday.

Financial markets kicked off September in a cautious mood Thursday with European stocks lower and world equities struggling to keep up what would be a five-day winning streak.

The hedge fund's chief economist will speak at FINforums Conference on three game-changing events that could unwind the European economy.

Gold and gold receivables held by euro zone central banks fell by 4 million euros to 363.248 billion euros in the week ending Aug. 26, the European Central Bank said Tuesday.

Stock index futures fell on Tuesday after equities rose nearly 8 percent in the past five sessions as investors cautiously awaited a batch of data for a better assessment on the state of the economy.

Gold edged higher on Tuesday, following its worst weekly performance in two months last week, supported by improving physical demand and some investor uncertainty ahead of minutes from the U.S. Federal Reserve's recent policy meeting.

Global stocks rose to their highest levels in nearly two weeks Tuesday, while safe haven assets like the Swiss franc and German Bunds were subdued, encouraged by signs that the U.S. economy may avoid recession.

The new head of the IMF on Saturday called on global policymakers to pursue urgent action, including forcing European banks to bulk up their capital, to prevent a descent into a renewed world recession.

Following are comments by European Central Bank President Jean-Claude Trichet and IMF Managing Director Christine Lagarde at a Federal Reserve conference on Saturday:

The new head of the IMF on Saturday called on global policymakers to pursue urgent action, including forcing European banks to bulk up their capital, to prevent a descent into a renewed world recession.

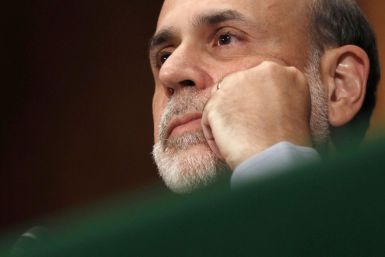

Investors are agonizing over the prospect of another round of quantitative easing that could come from the Fed chairman Ben Bernanke’s Jackson Hole summit later this week.

Asian stocks turned positive on Monday, recovering a small portion of last week's steep losses, while gold shot to new highs as investors worried about the sluggish U.S. economic outlook and Europe's debt crisis.

With the global economy sputtering and financial markets on the rocks, the world needs reassurance the U.S. central bank stands ready to save the day.

The euro rebounded on Friday as an early sell-off lost steam on central bank demand and technical buying, although the currency was vulnerable due to fears about euro-zone banks and a gloomy global outlook.

Gold charged to a record high early Friday in electronic trading as a host of bad economic news from around the world drove investors away from stocks for the safety of the yellow metal.

Robert Gibbs, a former spokesman for President Barack Obama, on Wednesday sought to clarify the role in public policy the Tea Party faction of the Republican Party is playing: counter-productive, to put it diplomatically.

Sarkozy and Merkel Face Ever Grimmer Choices to Save Euro

The World Bank chief Tuesday called for national governments to seek long-term debt curbs to solve the current sovereign debt crises in Europe and the United States, but said it was too early for special action by the Group of 20 nations.

No euro zone member states will be allowed to quit the currency bloc, European Central Bank Governing Council member Yves Mersch said in an interview published on Monday in the China Business News.