U.S. carmakers met analyst expectations Thursday for December sales. Easier financing and recovering U.S. home prices released pent-up demand.

Why did cars fly out of showrooms in November? More confidence, more options, more incentives and more need.

Ford reported that consumers have continued to gravitate to the Dearborn-based company's fuel-efficient hybrid vehicles.

Despite Hurricane Sandy cutting October car sales, the industry posted a big improvement in October over last year's results.

Detroit automaker saw minor increase in sales last month. The news comes only two days after the company issued good 3Q earnings.

The No. 2 U.S. automaker posted an unexpected strong third-quarter as gains in its domestic business offset European losses.

The No. 2 U.S. automaker, which lost $553,000,000 in the first half of this year, aims to close a plant in Genk, Belgium.

Ford Motor Company (NYSE:F) reported flat sales in September despite robust gain in compacts.

Auto demand in global markets will continue its upward trend in 2012 and 2013 despite regional disparities. Nomura analysts forecast double-digit growth in the U.S. and Southeast Asia, but expect European demand to shrink 7 percent.

Volkswagen AG (PINK: VLKAY) cuts its internal European 2012 annual sales guidance by 150,000 vehicles, according to German news magazine Der Spiegel, Reuters reported.

General Motors Company (NYSE: GM) may be losing money on the Chevy Volt at present, but the long-term benefits of early R&D in electric vehicles, improvements to brand image and improving sales volumes should ultimately make it a wise decision for the company.

Ford Motor Co. has issued the third recall for its redesigned 2013 Ford Escape SUV on Wednesday. The Michigan based company cited an improperly installed part that could lead to a risk of fire on the SUV that went on sale in June.

General Motors Co began initial production of its first ever Chinese-designed car for the Indian market this week, a major step for the U.S. automaker as it tries to scale up in a market where foreign companies have struggled.

Global carmakers reported robust sales growth in August, indicating improving consumer sentiment and demand by small businesses and contractors. Companies including Ford Motor Company (NYSE: F), General Motors Company (NYSE: GM), Honda Motor Co. (NYSE: HMC) and Toyota Motor Corporation (NYSE: TM) all reported major gains.

Global automakers report August U.S. car sales, Tuesday. Follow the blog for the latest updates from Chrysler, Ford Motor Company (NYSE: F), General Motors Company (NYSE: GM), Nissan Motor Co. (Tokyo: 7201), Honda Motor Co. (NYSE: HMC), Volkswagen AG (Frankfurt: VOW) and Toyota Motor Corporation (NYSE: TM).

Ford's Lincoln brand hasn't done well in the U.S. but the nation's No. 2 automaker aims for better luck in China where archrival GM gets a big share of the luxury car market with its Cadillac line.

Rental-car company Hertz Global Holdings Inc. (NYSE:HTZ) is buying rival Dollar Thrify Automotive Group Inc. (NYSE:DTG) for about $2.3 billion in cash to increase its global reach.

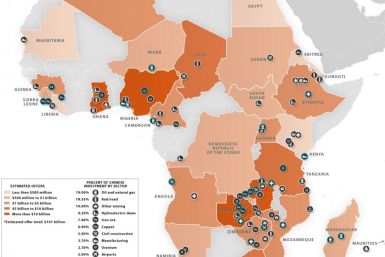

Global automakers from Renault SA (Paris: RNO) to Ford Motor Company (NYSE: F) to Chinese companies like Geely Automotive are all racing to get a piece of the long-term potential promised by Africa's burgeoning automotive market. The continent's economy is on the rise, and despite very real improvements in the quality of life and standards of living in many African countries, risks for multinational manufacturers remain.

The Canadian Auto Workers and the Detroit Three, General Motors Company (NYSE: GM), Ford Motor Company (NYSE: F) and Chrysler Group LLC, began preliminary contract negotiations on Tuesday, and the fate of Canadian auto manufacturing may hang on the talks.

Each week, we pick the biggest, most dramatic, or most captivating winners and losers in the world of money and business. Here are the winners and losers for July 29-Aug. 4.

Japan's big three, Nissan, Toyota and Honda gained big in sales while Ford and GM had lackluster showings.

General Motors Company (NYSE: GM) on Wednesday reported July U.S. car sales fell 6 percent compared with the year before as retail sales fell modestly and fleet sales plummeted.