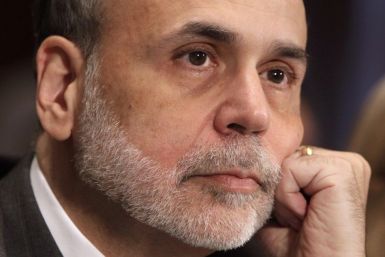

Federal Reserve Chairman Ben Bernanke said on Wednesday the central bank might need to ease monetary policy further if inflation or inflation expectations fall significantly.

Fannie Mae and Freddie Mac, the country's two largest mortgage finance providers, are expected to gradually increase the fees they charge lenders in the next year, their federal regulator said on Monday.

The regulator for Fannie Mae and Freddie Mac said on Monday he is considering some reform scenarios that include higher costs for mortgages backed by the government and sharing more risk with the private sector.

Redwood Trust, a California-based REIT, is about to launch its second private-label RMBS of the year, a US$375.2m prime-mortgage offering called Sequoia Mortgage Trust 2011-2 (SEMT 2011-2), according to a presale report released on Wednesday by Fitch Ratings.

Regulators are close to an agreement with Fannie Mae and Freddie Mac to settle a case over disclosing their exposure to risky subprime loans, The New York Times reported on Thursday.

President Barack Obama proposed a $447 billion package of tax cuts and spending measures on Thursday aimed at spurring growth and hiring.

A lawsuit accusing several mortgage lenders of fraud over home loans maintained within the industry's private electronic database cannot proceed, according to a U.S. appeals court ruling.

Bank of America Corp Chief Executive Brian Moynihan is running out of time to fix the largest U.S. bank.

General Electric Co said it would vigorously contest a lawsuit by the Federal Housing Finance Agency, which said the conglomerate's former WMC unit made inaccurate statements about the sale of two residential mortgage-backed securities.

JPMorgan Chase & Co and Bank of America led bank stocks lower on Tuesday after mortgage lawsuits filed late on Friday aggravated investor fears that the biggest banks could face massive legal liabilities.

JPMorgan Chase & Co, the second largest U.S. bank by assets, led a broader decline in bank share prices, as investors feared lenders face a growing list of lawsuits due to problem mortgages.

European stocks got hammered on Monday and the euro tumbled as well, as investors moved into safe assets. Rising fears over Europe's sovereign debt crisis and economic growth concerns in Europe and the U.S. is driving the move away from equities. The yield on the benchmark 10-year German government bond fell to well below two percent -- a new record. The Stoxx Europe 600 index fell 4.1 percent Monday, closing at 223.45.

A U.S. regulator will soon file lawsuits against major banks accusing them of bundling subprime home loans into bonds that never should have been sold to investors and causing mortgage giants Fannie Mae and Freddie Mac to lose billions, according to a source familiar with the matter.

Stocks of large financial companies, such as Bank of American and Goldman Sachs, have taken a pounding Friday over a likely lawsuit concerning mortgage sales.

Some of the nation's largest banks are under threat of a mortgage lawsuit from the federal agency that oversees the mortgage giants Fannie Mae and Freddie Mac.

The Obama administration is considering unveiling new plans next week to revive the ailing housing market and reduce foreclosures, including an effort to help troubled borrowers refinance their mortgages.

The Obama administration is considering unveiling new plans next week to revive the ailing housing market and reduce foreclosures, including an effort to help troubled borrowers refinance their mortgages.

The regulator for Fannie Mae and Freddie Mac, as well as dozens of investors, on Tuesday lodged objections to Bank of America Corp's proposed $8.5 billion mortgage-backed securities settlement.

Bank of America Corp's mortgage practices came under fresh fire as state and federal regulators questioned whether the largest U.S. bank is doing what it must to address perceived harm to homeowners and investors.

The Obama administration is considering plans to allow millions of homeowners with government-backed mortgages to refinance at current interest rates.

Central bankers and economists from around the globe will once again flock to the Federal Reserve's annual gathering in Wyoming this week, and once again will meet against the backdrop of volatile markets and the prospect of further Fed support for a struggling U.S. economy.