Earnings from Wall Street heavyweights such as Pepsi and Kraft Foods, plus data on jobs and retail sales, should influence trading.

Markets seem upbeat after Janet Yellen’s speech Tuesday reassured investors there’d be no sudden course corrections in monetary policy.

A reading of Janet Yellen’s monetary policy testimony, which will be released before markets open, should provide further direction.

Monday may be a slow day, but the rest of the week -- with earnings, Janet Yellen's address and economic data -- could be anything but.

While the stage looks set for a higher open, jobs data for January will be key.

Investors attempt to pick up the pieces after Monday’s massive slump, which also triggered a sell-off in Asian markets.

The new year did not get off to a good start for the Dow Jones, S&P 500 and Nasdaq, all of which registered steep falls in January.

Earnings and economic data should influence investors at the end of a rocky week.

Data on GDP and jobless claims, along with earnings from corporate giants across a range of sectors, should influence markets.

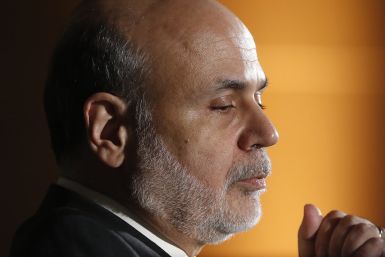

On a day marked by earnings announcements from Wall Street heavyweights, Ben Bernanke's last policy meeting could take precedence.

The earnings calendar is a busy one while data on durable goods orders, and indexes on housing and consumer sentiment, are also awaited.

It remains to be seen whether US stocks can put last week’s woes behind them or if they will go the way of European and Asian stocks.

The previous session's jitters seem set to continue into Friday's opening as earnings stay in focus on a day devoid of data releases.

Data on manufacturing PMI and existing home sales, along with quarterly earnings will have investors' attention.

Earnings will continue to be in focus as investors hope for a rebound from a sluggish start.

The New York area is set for another cold day weather-wise, but earnings ought to heat things up in the markets.

Earnings from GE and other majors, and numbers on housing starts, industrial production and consumer sentiment will influence investors.

Earnings of banking heavyweights, and data on jobs and inflation should provide direction to the markets.

The fourth-quarter earnings announcement from Bank of America and the Producer Price Index could influence markets.

It’s the beginning of a new quarter -- a time to assess how companies did in the previous one. In other words: earnings season.

The employment report for December will be watched keenly following a session of range-bound trading.

After an upbeat jobs report from ADP, investors will watch jobless claims data for further direction.