A series of technology companies, including security software maker Palo Alto Networks, are preparing to go public on the heels of Facebook's $5-billion filing, sensing a window of opportunity as the stock market rallies.

Goldman Sachs said fundraising across alternative asset classes, particularly credit and real estate, remains robust in a low-rate, low-risk world, and sees more value in the stocks of asset managers that have a diverse mix.

Gold prices retreated from an earlier two-week high in Europe on Wednesday as persistent concerns over Europe's finances hurt the euro and weighed on stock markets, while a supply upset in major producer South Africa lifted platinum to a five-month high.

Gary Cohn is currently the COO and President of Goldman Sachs. For a long time, he has been widely perceived as the likely successor of Goldman Sachs CEO Lloyd Blankfein.

After clamoring for the number one spot when it came to endorsing Facebook’s initial public offering in the beginning of the month, Goldman Sachs lost to Morgan Stanley, and placed fourth among U.S. financial rivals. Although it wasn’t chosen as the social-networking giant’s main supporter, Goldman Sachs and Facebook may have more in common than some think. In the past week, both companies claimed victories in intellectual property lawsuits, according to BusinessWeek.

Online review site Yelp gearing up for its IPO next week, but once the company hits the New York Stock Exchange on March 2, should consumers line up to buy the company's stock?

Millions of iPhones have been sold to date, and yet, no outsider knows that how these devices are made. Not until now, but things are going to change - the secret is going to be revealed on Tuesday edition of NightLine, a show on ABC News.

The Darlings tells a fictional tale about the downfall of a hedge fund and the wealthy family that owns it during Wall Street's 2008 meltdown, but many aspects of the novel are drawn straight from author Cristina Alger's reality.

TransUnion Corp., the third largest provider of credit information to banks and consumers, said Advent International Corp. and Goldman Sachs Group Inc.'s private equity arm agreed to buy the company from Chicago's billionaire Pritzker family and local private equity firm Madison Dearborn Partners LLC for over $3 billion.

Prompted by a delay in a big trade of a popular exchange-traded fund, the U.S. Securities and Exchange Commission is taking a closer look at a possible connection between high-frequency traders and hedge funds jumping in and out of ETFs, among other areas, according to a person familiar with the matter.

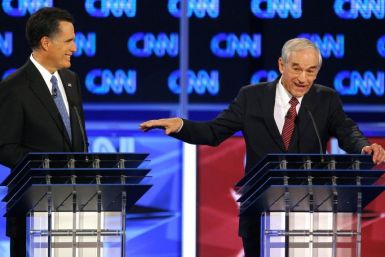

Mitt Romney and Ron Paul have proven their friendship on the campaign trail, but would Romney-Paul 2012 be a strong ticket?

Shares of Baidu, China’s equivalent of Google, fell as much as 5 percent early Friday after the company reported stronger-than-expected earnings.

Yelp, the San Francisco-based review website, could get a pop in its initial public offering if the overall market continues on a tear.

Exchange operator Nasdaq OMX is trying to gain support for a legislative proposal that would give it a competitive edge over both rival exchanges and banks that operate anonymous trading venues known as "dark pools."

Baidu, China’s equivalent of Google, reported fourth-quarter earnings rose more than expected due to heavier Internet use and sales.Baidu said net income rose 77 percent to $326.3

Generation Investment Management, the investment firm run by Al Gore and David Blood, released a white paper encouraging financial companies to adopt sustainable capitalism guidelines.

John Reed, who helped engineer the merger that led to the creation of Citigroup, told the SEC that the agency needs strengthen the rule to avoid the high-risk trading activities that helped cause the collapse of the world's financial system.

The Dow Jones Industrial Average rose 0.76 percent to 12,884.75 by early afternoon trading, while the Nasdaq rose 1.01 percent to 2,945.17. The S&P 500 rose 0.83 percent to 1,354.37.

Former U.S. vice president Al Gore wants to end quarterly reporting by companies and explore issuing loyalty-driven securities as part of an overhaul of capitalism that he says has turned many of the world's largest economies into hotbeds for irresponsible short-term investment.

Moody's Investors Service placed 114 financial firms , as well as 17 banks and securities firms with global capital markets operations, under ratings review due to the ongoing Eurozone crisis.

Wall Street stocks were set to open little changed on Thursday as concerns about a possible downgrade of global banks by Moody's were offset by upbeat U.S. data on the labor and housing sectors.

Stock index futures fell on Thursday after a Moody's warning of a possible downgrade of global banks and a further holdup in a bailout for debt-laden Greece.