Stocks of large financial companies, such as Bank of American and Goldman Sachs, have taken a pounding Friday over a likely lawsuit concerning mortgage sales.

The agency that oversees mortgage markets is preparing to file suit against more than a dozen big banks, accusing them of misrepresenting the quality of mortgages they packaged and sold during the housing bubble, The New York Times reported on Thursday.

Some of the nation's largest banks are under threat of a mortgage lawsuit from the federal agency that oversees the mortgage giants Fannie Mae and Freddie Mac.

European shares fell sharply on Friday, snapping a four-session rally, as traders feared U.S. non-farm payrolls numbers could signal a return to recession.

The Federal Reserve ordered Goldman Sachs Group Inc to hire a consultant to review practices of a former mortgage subsidiary on Thursday and said it plans to assess a monetary penalty for wrongful foreclosures.

Wall Street's four-day rally ground to a halt on Thursday, with major indexes falling 1 percent on caution ahead of a key labor market report expected to underscore fears the economy is headed for another recession.

Goldman Sachs Group Inc will compensate some home loan borrowers for wrongful foreclosures under an agreement reached with a New York state banking regulator.

A New York state banking regulator said on Thursday that it had reached a pact with Goldman Sachs Group Inc on foreclosure processes that will allow the planned sale of its Litton Loan Servicing LP to continue.

Goldman Sachs and two other firms have agreed with the New York banking regulator to end the practice known as robo-signing, in which bank employees signed foreclosure documents without reviewing case files as required by law, the Wall Street Journal said.

Stock index futures pointed to a weaker open on Wall Street on Thursday, with futures for the S&P 500, Dow Jones and Nasdaq 100 down 0.1 to 0.4 percent.

The Dow Jones Industrial Average Re-enters positive territory, although the Department of Justice's suit against AT&T could derail those gains.

Bank of America Corp's mortgage practices came under fresh fire as state and federal regulators questioned whether the largest U.S. bank is doing what it must to address perceived harm to homeowners and investors.

Top Bank of America Corp lawyers knew as early as January that American International Group Inc was prepared to sue the bank for more than $10 billion, seven months before the lawsuit was filed, according to sources familiar with the matter.

Stock index futures pointed to a weaker open for equities on Wall Street Tuesday after steep gains in the previous session, with futures for the S&P 500, for the Dow Jones and for the Nasdaq 100 down 0.2 to 0.3 percent.

Lehman Brothers Holdings Inc will ask a bankruptcy judge on Tuesday to let creditors vote on its $65 billion payout plan, a key step toward ending the biggest bankruptcy in U.S. history.

Switzerland's banking industry may have to slash 10,000 jobs by the end of next year, particularly at Swiss subsidiaries of big foreign banks, Swiss newspaper SonntagsZeitung reported.

Conventional wisdom in legal circles has long held that Goldman Sachs (GS.N) might escape further large fines or criminal charges for its role in the 2007-2009 financial crisis after reaching a $550 million settlement with securities regulators in July 2010.

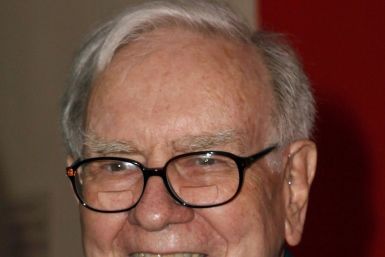

Billionaire Warren Buffett would invest $5 billion in Bank of America Corp. (NYSE:BAC), expressing his biggest vote of confidence in the banking giant.

Legendary investor Warren Buffett made a phone call to Bank of America CEO Brian T. Moynihan on Aug. 24 and offered to invest a staggering $5 billion in the bank. The Bank of America shares had been in doldrums amid questions over its liquidity situation and rumors that it would need a massive capital injection.

Warren Buffett showed again this week that his name and money is enough to give a struggling company instant credibility in the market. But the legendary investor also demonstrated his canny command of that reputation means that such deals can immediately generate profits.

Steve Jobs on Wednesday resigned as chief executive of Apple, marking an end to his 14-year reign at the consumer electronics giant he co-founded in a garage.