According to an internal memo, HSBC revealed that it will acknowledge and apologize to a U.S. Senate hearing next week for failing to spot money laundering that could have been used to finance terrorism and organized crime.

India's industrial output growth rose in May to 2.4 percent, exceeding analysts' expectation of 1.8 percent and as compared to a dismal growth of 0.1 percent registered in April.

Most European markets fell Thursday as investor sentiment continued to be negative over increasing concerns of the faltering global economic situation and deepening debt burden of the euro zone.

Most Asian markets rose this week as investor confidence was boosted by expectations of stimulus measures from central banks globally to regain the economic growth momentum.

While American politicians such as U.S. Sen. Kirsten Gillibrand, D-N.Y., are pushing to expand federal tax breaks for small businesses, the U.K. government has already announced a move to help early-stage businesses find new means of financing: tax relief for private investors.

Hopes that emerging markets will lead the world out of the global economic slowdown are beginning to dim.Christine Lagarde, managing director of the International Monetary Fund (IMF), voiced her concerns over the strength of the global economy, emphasizing that emerging markets, which currently account for two-thirds of global growth, were showing signs of weakening.

Asian stock markets declined Thursday as market participants remained cautious ahead of the European Central Bank (ECB) and Bank of England's (BOE) policy decision meetings later in the day.

Asian markets fell Thursday with the revival of investor concerns about the euro zone?s debt crisis intensifying and the economic downturn deepening.

Asian stock markets mostly advanced Wednesday on hopes that major central banks around the world would act to tackle the deteriorating global economic conditions.

Indian stock markets were trading slightly lower Wednesday as declines from oil & gas and IT sector shares outweighed the gains in metal and realty sectors.

European markets fell Wednesday, but investors continued to expect that the central banks would coordinate to announce stimulus measures to regain the growth momentum.

India's service sector continued its growth in June, though at a slightly slower rate than in May, according to the latest HSBC PMI data released Wednesday.

Though China's services activity grew in June, it declined to a ten-month low, according to the HSBC Purchasing Managers' Index (PMI) released Wednesday.

CEO Robert Diamond's ouster from Barclays (NYSE: BCS) raises questions about whether Wall Street's doyen, Jame Dimon, CEO of JPMorgan Chase (NYSE: JPM), might be next to go, especially as his bank's problems mount.

Asian stock markets advanced Tuesday as weak economic reports from around the world boosted hopes for stimulus measures from major central banks globally.

Barclays chief executive officer Bob Diamond Tuesday quit his post over the London Inter Bank Offered Rate (LIBOR) fixing scandal, in which the bank was fined £290 million ($450m) by the U.S. and UK regulators last week.

Asian markets rose Tuesday as investor confidence was boosted by expectation for stimulus measures from central banks globally.

Barclays Bank chairman Marcus Agius Tuesday confirmed that he had resigned over the Libor (London Inter Bank Offered Rate) inter-bank lending rate-fixing scandal.

Asian markets are expected to begin the week on the upswing gains after leaders of the European Union agreed on action to stem the region's debt crisis.

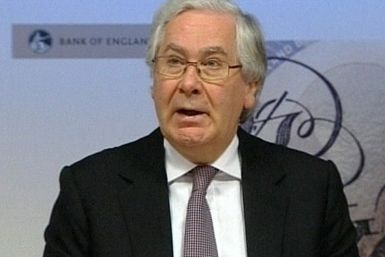

The Bank of England (BoE) is cracking down on large financial institutions to prevent them from cheating businesses and consumers worldwide -- a practice that has put a $360 trillion global financial market at serious risk for several years.

European markets rose Thursday following encouraging data from the U.S., but investors remain watchful ahead of the European Union summit in Brussels on Thursday and Friday, where leaders will discuss tackling the EU debt crisis with concrete measures

Most Asian markets fell this week as investors were worried after the U.S. Federal Reserve refused to announce a further round of quantitative easing and the HSBC Flash Purchasing Managers Index (PMI) indicated that China's manufacturing activity was faltering.