As European banks seek state help and U.S. lenders shore up shaky balance sheets, Canada's well-performing banks have stepped up their efforts to poach talent from rivals around the world.

South African government bonds and the rand currency ended firmer on Wednesday, boosted after a minister said the government would keep a lid on spending and tracking gains elsewhere as global risk appetite picked up.

Gold fell more than 1 percent on Wednesday, extending the previous day's hefty losses, as rising equities diverted some interest from the precious metal, and as investors remained wary of buying into the market after its recent sharp volatility.

South Africa's rand steadied against the rand on Tuesday and government bonds edged higher as tentative calm returned to the market although local assets are still vulnerable to contagion fears over Greece's heavy debt burden.

Gold prices turned lower on Tuesday, surrendering early gains as it was caught up in hefty losses across the financial markets due to heightened concerns over the prospect of a Greek default.

Anyone hoping that recent falls in commodity prices would provide a boost to powerhouse Asian economies and help lift the developed world out of recessionary danger will be disappointed. The region's focus remains firmly on inflation.

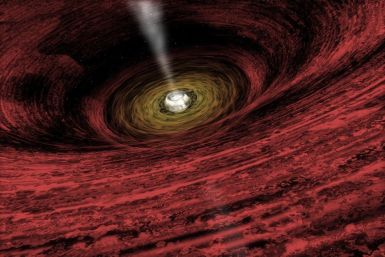

Signs of a U.S. recession, if not a global recession, are multiplying daily -- so much so that the cover on the latest issue of The Economist shows a black hole with the words, Be Afraid.

Greece's admission that it will miss its deficit targets this year and next despite harsh new austerity measures sent stock markets reeling on Monday and raised new doubts over a planned second international bailout.

September factory activity in some of Asia's biggest economies slumped to levels last seen during the depths of the financial crisis as export demand dropped, reinforcing fears that fading U.S. and European growth will spare no one.

Gold strengthened further on Monday as falling equities and lingering worries about a debt crisis in Europe drew investors to the precious metal, which posted its the biggest quarterly gain this year, but a firm U.S. dollar could still cap gains.

China's factory activity picked up in September for the second month in a row and export orders strengthened, offering some reassurance that the world's second-largest economy can weather the global economic turmoil.

Help could be on the way for the protestors, as New York City labor unions and community groups have thrown their support behind Occupy Wall Street and pledged to join in a massive rally on Wednesday, Oct. 5.

China's manufacturing sector contracted for a third consecutive month in September, suggesting that the world's second-largest economy is not immune to global headwinds, while factory inflation quickened.

Gold rose more than 1 percent on Friday but was on track for its biggest quarterly gain this year as concerns that the euro zone debt crisis was far from resolved weighed on stock markets and the euro, lifting interest in bullion as an alternative.

Russian precious metals miner Polymetal is seeking a premium listing on the London Stock Exchange, raising about $500 million in a move it hopes will catapult it into the FTSE 100 bluechip index and hand it currency for acquisitions.

European insurers Allianz

and AXA SA are among the potential bidders for HSBC Holdings Plc's sale of its general insurance business, which could fetch more than $1 billion, sources familiar with the matter told Reuters.Gold prices rose more than 3 percent on Tuesday as a drop in the dollar index helped the precious metal snap a four-day run of losses and after an early rout in the previous session tempted price-sensitive physical buyers back to the market.

EU antitrust regulators are investigating whether a group of banks, including Deutsche Bank, HSBC and Spain's BBVA, is blocking new players from entering the European online payments market.

An intensifying legal battle between Samsung Electronics Co and Apple Inc is expected to crimp growth at one of the fastest growing businesses of the Korean company, while threatening to worsen business ties with the firm's largest customer.

Douglas Flint, the chairman of European banking powerhouse HSBC , will take over as chairman of the Institute of International Finance next year, the global bank lobby's current chairman said on Saturday.

European shares fell on Friday after a fresh pledge of support from leading global economies to shore up the financial sector failed to placate markets, leaving them on course for a fifth straight month of losses.

Gold fell by more than 3 percent on Thursday, set for its largest monthly decline since January, after the Federal Reserve's move to boost U.S. growth lifted the dollar, which battered the commodities complex.